24 out of 28 banks have a narrow NIM in 2023

NIM (Net Interest Margin) is the difference between the interest rate of deposit activities and lending activities of banks.

Therefore, despite being influenced by many factors such as scale, business model, brand, customers, changes in market interest rates are one of the factors that directly impact a bank’s NIM.

When interest rates are high, prioritizing savings will cause NIM to decrease. Conversely, when interest rates are low, stimulating borrowing will cause the NIM ratio to increase.

In 2023, when difficulties overshadowed all aspects of the economy, the government and the State Bank of Vietnam (SBV) implemented many interest rate reduction policies to support businesses, people, and stimulate economic growth. However, the demand for borrowing was not high, credit growth slowed down, while investment channels stagnated or almost froze, making the attractive savings deposit channel still, even with interest rates at historical lows. When the demand for savings deposits from individuals is higher than borrowing, it will put pressure to decrease NIM.

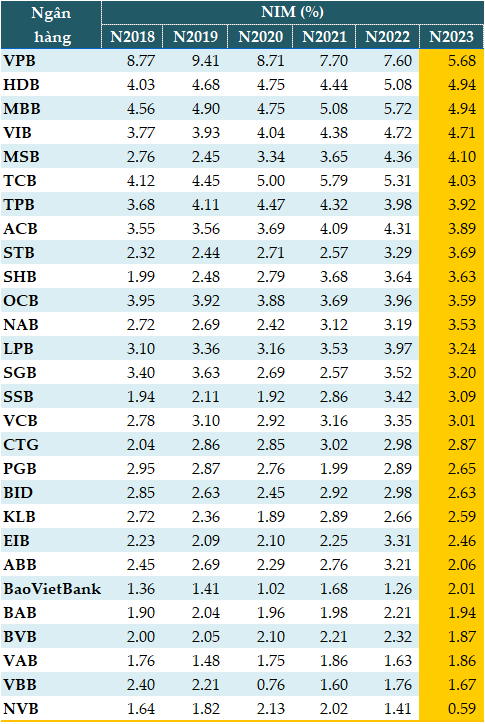

Therefore, in 2023, 24 out of 28 banks had a decrease in NIM compared to the previous year, according to data from VietstockFinance.

VPBank is the bank with the highest NIM ratio at 5.68% despite a 1.92 percentage point decrease from the previous year. Next are HDBank (HDB) and MB (MBB) with a NIM ratio of 4.94%, VIB is 4.72%, and MSB is 4.1%.

There are 4 scarce banks that improved their NIM in 2023 compared to the previous year: Sacombank (STB), Nam A Bank (NAB), BaoVietBank, and VietABank (VAB). With a 29% improvement in net interest income for the whole year, it helped Sacombank‘s NIM in 2023 continue to increase thanks to a high profitable asset ratio (9.6%).

|

NIM of banks in the last 5 years (Unit: %)

Source: VietstockFinance

|

Improving NIM immediately is difficult

Assoc. Prof. Dr.. Dinh Trong Thinh – Economic expert, assessed that NIM decreasing is a common situation throughout the banking system. Because of the decrease in profit, both the planned profit for lending and the reserve for provisioning are reduced.

“It is difficult to improve NIM in 2024. The issue is how to accurately estimate loans, debt collection, reserve formation, and debt write-offs,” said Thinh.

Assoc. Prof. Dr. Nguyen Huu Huan – Lecturer of Ho Chi Minh City University of Economics, said that banks wanting to improve NIM can only apply technology, which banks are still moving towards, optimizing costs to improve NIM.

In addition, NIM is the interest rate difference between lending and mobilization. While banks can improve NIM, it is not beneficial for the economy.

Currently, lending rates are already very low, it is likely that banks’ NIM in 2024 will increase. However, the SBV also encourages commercial banks to reduce lending rates to support businesses, which will result in a decrease in NIM. Instead of improving NIM, banks should focus on cost optimization. This means that NIM remains the same but the bank saves more on operating costs, thereby increasing the bank’s profitability, and it is clear that this is the current trend of banks.

In addition to interest income, banks also develop other sources of income that are not affected by credit growth. Banks apply technology (such as artificial intelligence) to optimize operating costs, saving many costs, including costs like opening branches, renting premises, electricity, personnel…

Recently, the trend of banks is shifting to focus on digital transformation rather than traditional banking services. This also helps improve banks’ operating costs and optimize bank profitability.

Ms. Le Thanh Hang – Advisor Investor Relations at Techcombank said that NIM of banks can improve in 2024, but only slightly compared to 2023 because Techcombank can continue to apply support programs for customers facing cash flow difficulties.

KB Securities Vietnam (KBSV) forecasts that in 2024, the low interest rate environment will be fully reflected in the cost of capital while lending rates will decrease slowly and with a delay. Based on that, NIM in 2024 of the banking industry will have a more significant improvement but cannot return to the high level like 2022.

In the updated banking industry report at the end of 2023, MB Securities (MBS) believes that in the context of the solutions of the Government and the SBV all revolving around removing cash flow difficulties, to help the economy have access to credit loans, the low interest rate level must be maintained for at least 6-9 months. This will be an opportunity for banks to increase NIM. However, with the orientation of supporting the economy, reducing lending rates will also be a key factor to help commercial banks receive high credit limits from the SBV and increase competitiveness when credit demand has not clearly recovered. Therefore, MBS expects the NIM for 2024 of most banks to only slightly increase compared to 2023 and will not be as high as in 2022. Especially, state-owned commercial banks are expected to not have a good NIM increase like joint-stock banks in 2024 due to activities under the role of regulatory tools.

Meanwhile, Shinhan Securities Vietnam (SSV) predicts that NIM in 2024 can only improve slightly to 3.9% in 2024 from 3.75% in 2023. Along with assumptions of credit growth, net interest income growth of banks for 2023 and 2024 may reach 6.5% and 17.3%, respectively.