VPBank Leads in Growth

VPBank is expected to lead the pack with an impressive 60% growth in profit for the second quarter of 2024, according to SSI forecasts. The bank is projected to record a profit of 4.2 trillion VND, attributed to the potential break-even point reached by FE Credit.

Earlier, at the General Meeting of Shareholders, Mr. Nguyen Duc Vinh, CEO of VPBank, stated, “We have planned to compensate for the losses of FE Credit. This year, the company is expected to make a profit of over 1,200 billion VND. For the following years, from 2025 onwards, profits could reach the range of 3,000-4,000 billion VND.”

Following VPBank, Techcombank is anticipated to achieve growth of over 30% this quarter. SSI analysts expect Techcombank to maintain its positive momentum, with a 10-11% increase compared to the beginning of the year. NIM and non-performing loan ratios are projected to remain relatively stable compared to the previous quarter.

In terms of profitability, non-interest income is forecast to remain stable. Meanwhile, activities related to guarantees and bond issuances, as well as extraordinary profits from government bond trading, may not be as significant as in the first quarter.

Consequently, Techcombank’s pre-tax profit is estimated to reach 7 trillion VND, a 31% increase year-on-year, but a 5% decrease compared to the previous quarter.

Coming in third is HDBank. For the second quarter of 2024, the bank is expected to achieve a profit of 3,500-3,600 billion VND, representing a 28-31% increase year-on-year, driven by credit growth. However, NIM for the second quarter of 2024 may witness a decline compared to the first quarter.

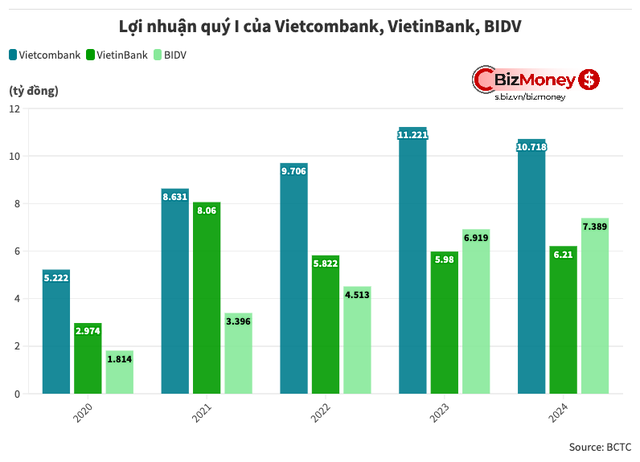

Among the state-owned banks, SSI Research predicts that the three giants, Vietcombank, BIDV, and VietinBank, will achieve profit growth of 8-10%, 12%, and 15% year-on-year, respectively.

Profit of the Big 4 in the first quarter

Specifically, for Vietcombank, with a credit growth of around 4% compared to the beginning of the year as of the end of June, and a decrease in deposits, the bank’s NIM is expected to remain stable in the second quarter. Asset quality will also be maintained stable. Vietcombank’s pre-tax profit for the second quarter is projected to reach approximately 10,000-10,300 billion VND, representing an increase of 8-10%.

On the other hand, BIDV is expected to achieve a 12% growth in profit due to an improvement in NIM compared to the previous quarter. The bank’s pre-tax profit is estimated to reach 7,800 billion VND.

Among the “Big 3,” Vietinbank is anticipated to record the most impressive profit growth.

“CTG maintained a stable growth trajectory in the first half of 2024, helping NIM remain stable compared to the previous quarter. We believe that the bank will continue to aggressively handle bad debts in the second quarter of 2024, resulting in a projected pre-tax profit increase of 15% year-on-year, reaching 7,500 billion VND,” stated the SSI Research report.

VIB and OCB Projected to Experience Profit Decline

In contrast to the positive performance of VPBank and Techcombank, two banks that may record less favorable profit growth in the second quarter of 2024 are VIB and OCB.

At VIB, the reduction in interest rates to stimulate credit demand could result in a 3% credit growth compared to the beginning of the year. However, this move may also lead to a decrease in NIM during the second quarter of 2024 due to high credit costs.

“We estimate that pre-tax profit will reach 2,100-2,200 billion VND, a decrease of 25-28% year-on-year,” the SSI report stated.

For OCB, NIM and non-performing loan ratios are expected to remain stable compared to the previous quarter, with credit growth reaching 7-8% compared to the beginning of the year. However, according to the analysts, provisioning costs may increase significantly in the second quarter of 2024, resulting in a 5-14% decline in pre-tax profit year-on-year, reaching 1,350-1,500 billion VND.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.