Alongside the 1.3% dip in the VN-Index in January, market liquidity took a significant hit. However, this isn’t cause for concern as buying demand remains relatively strong. Mirae Asset predicts that the VN-Index still has the potential to reach 1,340 points in July.

LOW LIQUIDITY BUT STRONG BUYING DEMAND

Despite notable profit-taking pressure in June, Mirae Asset believes that buying demand is gradually gaining the upper hand as the average matching trading value per session increased by 5% from the previous month to VND19.79 trillion, while the total trading volume decreased by 8.7% month-on-month. This reflects that most of the selling pressure has been relatively well absorbed.

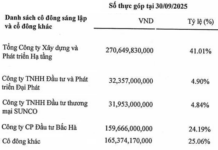

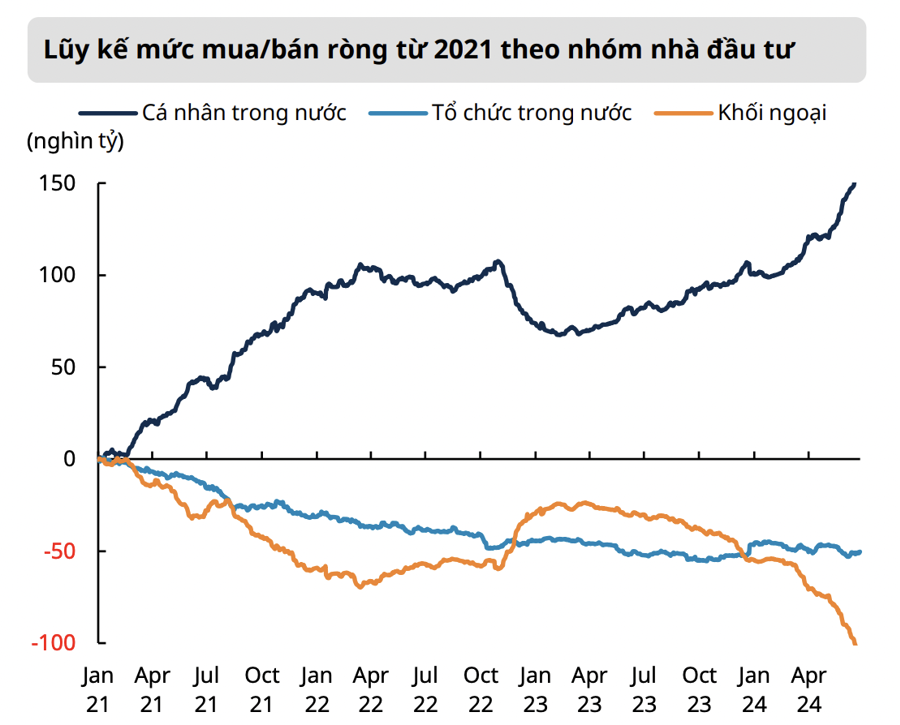

Domestic institutional investors returned to net buying with VND1,001 billion in June, partly reversing the net selling position since the beginning of the year of VND3,910 billion. Notably, this group net bought in the second and fourth weeks of June when the VN-Index recorded a three-week losing streak.

In addition, the main force in curbing the decline continues to come from the strong buying demand of domestic individual investors, with this group net buying VND15,580 billion in the previous month, accumulating a net buy of VND55,950 billion since the beginning of the year.

This continues to contrast with foreign investors’ continued net selling streak, offloading VND16,590 billion in June and a total of VND52,040 billion since the beginning of the year, extending the net selling streak to 15 consecutive months, except for a small net buy of VND185 billion in January 2024.

On another note, ETFs withdrew for the eighth consecutive month, with a total withdrawal of -$105.1 million in May, bringing the net withdrawal since the beginning of the year to -$569.4 million as of June 28. Most of this withdrawal was recorded from Fubon FTSE (-$44.9 million), DCVFMVN Diamond (-$42.2 million), Xtrackers FTSE Vietnam (-$7.2 million), VanEck Vietnam (-$5.2 million), and SSIAM VNFinLead (-$4.6 million), far outweighing the inflows from Kim Growth VN30 (+$5.1 million) – notably, this ETF has been net buying for three consecutive months.

VN-INDEX STILL HAS POTENTIAL TO REACH 1,340 POINTS DESPITE BANKS’ UNDERPERFORMANCE

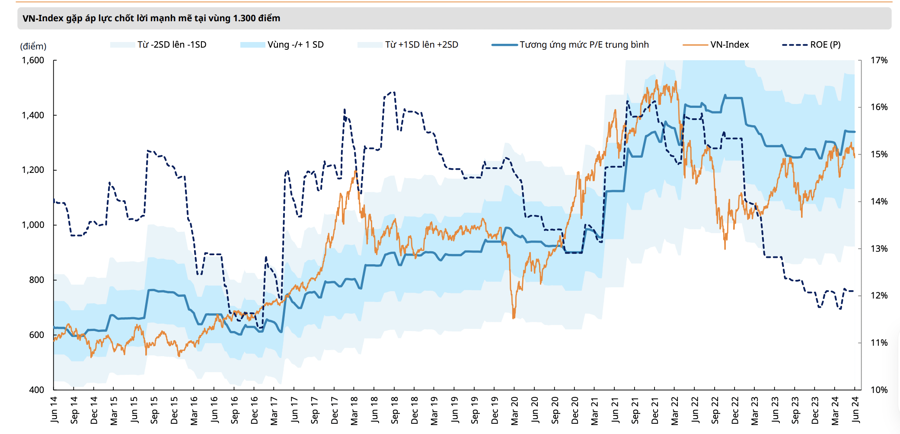

The VN-Index is currently trading below the 10-year average P/E ratio, creating more room for growth in the second half of 2024. However, the market will need new catalysts to realize this target price range.

Nevertheless, the VN-Index is likely to maintain its uptrend, targeting the 1,320–1,340 range, corresponding to the 10-year average P/E ratio. While the growth drivers are expected to be less robust, price actions are likely to fluctuate within a large range, leading to a sideways cycle and accumulation.

This trend is predicted to last until mid-July, as the market enters a quiet period with a cautious trading sentiment ahead of the Q2 earnings season.

The market’s lack of strong upward momentum is largely influenced by the weak trading of large-cap stocks in the Banking and Real Estate sectors.

Although other sectors may show more positive prospects, their overall impact is still limited compared to the Banking and Real Estate sectors’ 51% market capitalization. Specifically, the Banking sector, despite accelerated credit growth in the first half of June to 3.79% from the end of 2023, improved from 2.41% at the end of May, is unlikely to reflect this in Q2 profits.

On the other hand, the outlook for the Real Estate sector remains subdued while awaiting clearer information on the early application of three critical laws: the 2024 Land Law, the 2023 Housing Law, and the 2023 Real Estate Business Law. Therefore, the Q2 earnings picture poses a significant challenge for the VN-Index in the next two months.

POSITIVE SIGNALS FROM CREDIT

Key factors to monitor in the second half of 2024 include credit growth. The current lending rates are not the main barrier to credit growth in the first half of 2024.

Instead, the more challenging issue is credit demand, as banks face a dilemma: consumers and businesses feel that the economy is not strong enough to guarantee new loans for consumption and investment, and commercial banks are under pressure from rising bad debts, making it difficult to ease lending conditions.

However, credit growth is expected to accelerate in the second half of 2024, driven by positive signals in the manufacturing sector, reflected in increased imports of raw materials since May, and Vietnam’s continued monetary and credit policy easing to support economic recovery.

Additionally, some positive signals come from commercial banks actively raising capital through corporate bonds in the first half of 2024, with the total capital raised through bonds by banks exceeding VND100 trillion out of the total VND140 trillion of the whole market. Meanwhile, medium and small-sized commercial banks have increased deposit interest rates since the beginning of May, reflecting a more positive outlook for the second half of 2024.

Although the Big4 banks have not significantly increased deposit interest rates, the State Bank’s OMO and RRP rate hikes are gradually affecting Vietnam’s interest rate landscape.

Short-term capital mobilization through certificates of deposit or long-term capital through bonds will provide an appropriate buffer to raise the necessary capital for upcoming lending activities and reduce the ratio of short-term capital for medium and long-term loans (SFL ratio), which remained above 40% in April 2024, compared to the 30% ceiling effective from October 1, 2023, for the SFL ratio.

However, the SFL ratio at large banks outside the Big4 has fallen below 30%, such as TCB recording 25% in Q1 2024 compared to 33.5% in Q1 2023, and preparing to implement the Basel III standards to enhance capital and risk management.

Exports and imports: The main driver of GDP growth in 2024, exports are expected to regain momentum in the coming months, driven by increased imports of raw materials since May (with a growth rate of 17.3% over the same period last year in the first half of 2024), which is likely to boost exports in the following months.

Public investment: Despite a slow start in the first half, with investment from the state budget reaching only 27.51% of the overall plan and 29.39% of the Prime Minister’s allocation plan for 2024, Mirae Asset predicts that the disbursement of public investment will accelerate significantly in the coming months.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.