This time, Dong Nai Water’s payout ratio is 12%, equivalent to VND 1,200 per share. With 120 million shares outstanding, the company is estimated to pay out VND 144 billion.

Previously, in late 2023, DNW made an initial payment of a 4% dividend to shareholders, worth VND 48 billion. Thus, the total dividend payout ratio for the two periods in 2023 was 16%, valued at VND 192 billion.

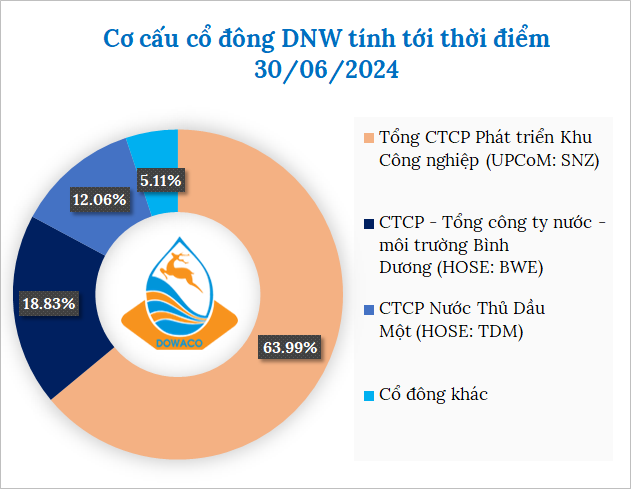

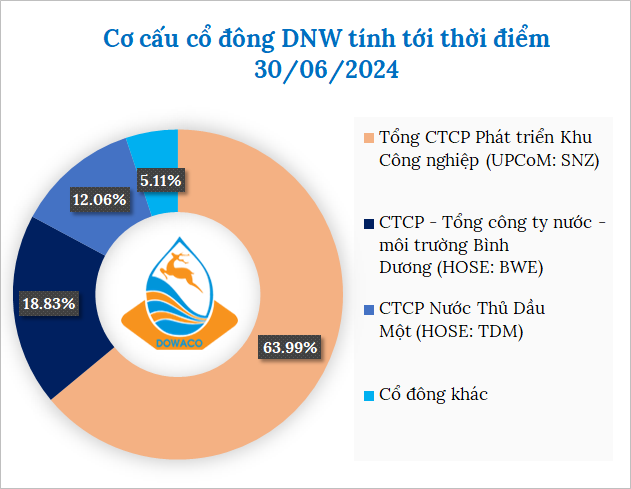

The company has a concentrated shareholder structure, with the top three largest shareholders holding nearly 95% of its capital. As of June 30, its parent company, Industrial Park Development Corporation (UPCoM: SNZ), owned nearly 64%, followed by Binh Duong Water – Environment Joint Stock Company (HOSE: BWE), which held 18.83%, and Thu Dau Mot Water Joint Stock Company (HOSE: TDM), which contributed 12.06%. With this dividend payout, the above major shareholders received VND 92 billion, VND 27 billion, and VND 17 billion, respectively.

Source: VietstockFinance

|

Historically, DNW has consistently paid cash dividends to shareholders since its listing on the UPCoM in 2016, with payout ratios ranging from 4-16%. 2023 was the second consecutive year that the company paid out the highest dividend (16%). In 2024, Dong Nai Water plans to distribute a 12% dividend.

|

Dividend History of DNW

Source: VietstockFinance

|

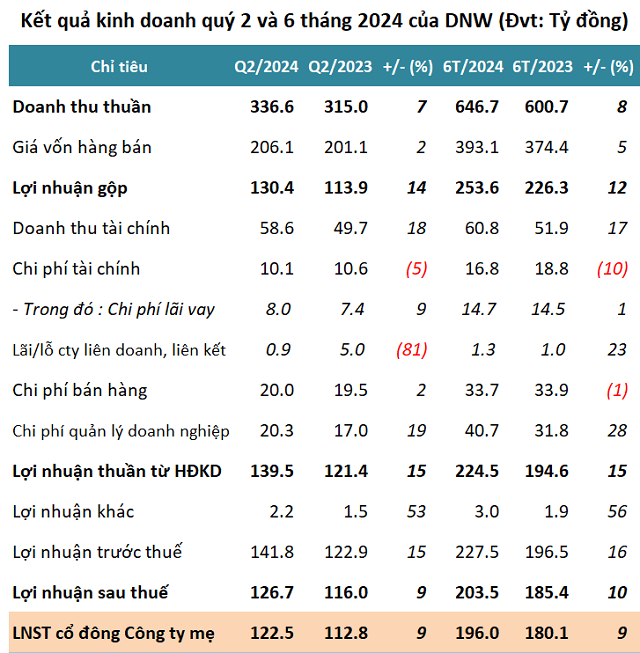

In terms of business performance, in the first half of 2024, DNW recorded revenue of nearly VND 337 billion and a net profit of over VND 122 billion, up 7% and 9% year-on-year, respectively. Its core business remains water supply.

On a cumulative basis for the six months, Dong Nai Water’s revenue was nearly VND 647 billion, up 8%, and its net profit was VND 196 billion, up 9% compared to the first half of 2023.

Source: VietstockFinance

|

For the full year 2024, DNW targets revenue of VND 1,100 billion and net profit after tax of VND 248 billion. With the results achieved in the first half, the company has accomplished 65% and 51% of these targets, respectively.

As of the end of the second quarter, the company’s total assets stood at VND 3,590 billion, up 2% from the beginning of the year. Nearly VND 724 billion was in bank deposits, accounting for 20% of total capital. Payable debt decreased by 8% from the beginning of the year to nearly VND 1,134 billion, as financial debt decreased by 9% to nearly VND 880 billion.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.