Post-2023, credit growth surged to 13.79%, and 2024’s expected credit growth of 15% will further support the economy’s recovery. This presents both opportunities and challenges for the banking system. Banks with strong credit growth will have the opportunity to relax their credit policies, while those that fail to meet targets may need to adjust their strategies. Credit growth is not merely a number but a reflection of each bank’s opportunities and challenges.

Macroeconomic data for the first eight months of 2024 showed that the industrial production index (IIP) grew by 8.6%, with a PMI of 52.4 points. The industry’s GDP in Q2 2024 grew by 7.4% year-on-year. These positive results in the manufacturing sector were both a driver and a consequence of promoting corporate credit. Meanwhile, the growth in retail sales of goods and services—indicative of consumer spending—increased only from 8% to 9% since the beginning of the year, lower than the expected 10% to 12% in a normal growth period. Corresponding to this low consumer spending, retail credit faced growth challenges, prompting retail banks to adjust their loan portfolios to adapt to market demands.

Retail banks lose momentum in core credit segment

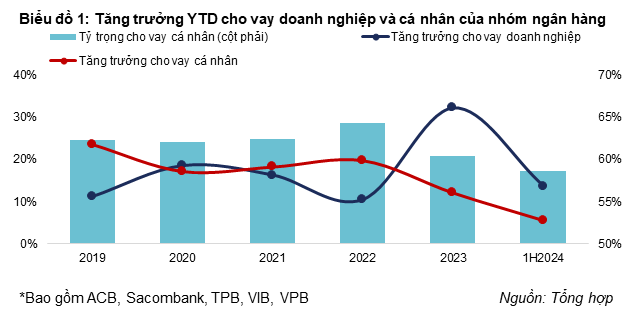

The proportion of personal loans from retail banks has significantly decreased, reaching its lowest point in five years, dropping from nearly 65% in 2022 to just 58.7% in the first half of 2024. This fluctuation in the loan portfolio structure of retail banks indicates that consumer credit no longer has much room for growth as in the previous period. Retail sales growth figures also show weaker consumer spending in 2024, with growth ranging only from 8% to 9%, much lower than in previous favorable economic periods.

Meanwhile, this group of banks’ corporate credit growth hit a new peak in 2023, reaching 32.3%, double that of personal credit, which stood at 12.1%. This differentiation is particularly evident, with the gap between corporate and personal credit growth reaching 20%, the first time in the last five years that such a large disparity has been observed. This reflects the increased credit demand from businesses, especially in a favorable macroeconomic context, as companies expand their production and business operations.

2024 continues this trend. Corporate credit for this group of banks grew by 13.69% in the first six months, while personal credit growth lagged, reaching only 5.48%. Macroeconomic data, including the PMI and industrial production index, indicate the robust development of businesses, and retail banks have had to adjust their strategies to keep up with the credit demands from this sector. This year’s trend continues to show that corporate credit plays a crucial role in ensuring credit growth targets and is a focus for many retail banks to compensate for the decline in personal credit.

Low credit growth and declining NIM become common at retail banks

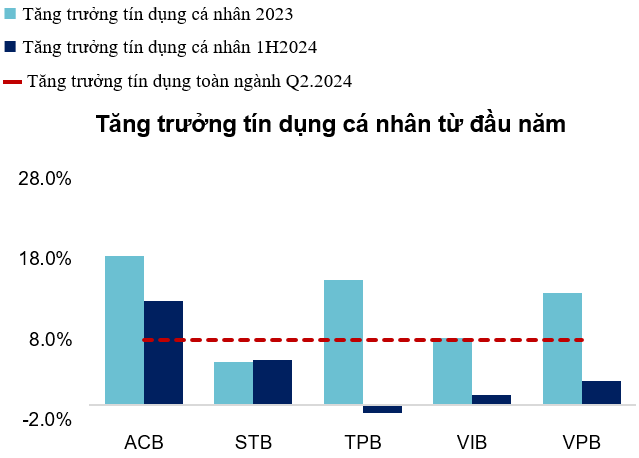

The differentiation in credit growth rates during 2023-2024 led to inevitable lending strategy adjustments for retail banks. In 2023, there were significant differences in credit growth rates and performance among retail banks. Banks like TPBank (TPB) and VPBank (VPB) significantly reduced the proportion of personal loans, shifting their focus to corporate lending, achieving the highest credit growth for the year within this group. This indicates that their strategy of focusing on corporate credit helped them navigate the slow growth phase of consumer credit.

In contrast, banks like ACB, Sacombank, and VIB recorded lower credit growth due to their high proportion of personal loans. These banks were heavily impacted by the declining consumption trend in 2023-2024, particularly as weak purchasing power diminished the growth momentum of personal credit demand.

|

Chart 2: Year-to-Date Personal Credit Growth of Retail Banks

|

Source: Consolidated

By the first half of 2024, ACB and Sacombank had made significant improvements. At ACB, personal loans still accounted for over 65% of the credit portfolio, mainly focused on the trading and manufacturing industries. Sacombank also recorded positive credit growth by concentrating on lending to the manufacturing and real estate sectors while maintaining a stable personal loan ratio of nearly 55%. VPBank maintained its credit growth at 10.24% in the first half of 2024, primarily driven by increased corporate lending, as personal credit grew by only 2.93%. With over 20% of VPBank’s portfolio dedicated to real estate lending, the bank achieved a stable net interest margin (NIM) by reducing its consumer lending ratio, but the potential risks in the real estate sector will require attention.

In contrast, VIB and TPBank experienced low credit growth. Focusing on personal credit and significantly lowering lending rates to stimulate consumer demand had a negative impact on their NIM. However, this reduction was insufficient to boost personal credit growth, leaving VIB facing pressure to further lower rates while maintaining operational efficiency.

At TPBank, personal credit remained negative compared to the end of 2023, with personal loans, mainly consumer credit, accounting for over 50%, resulting in TPBank’s overall credit growth reaching just under 4%. Nonetheless, its retail lending portfolio provides TPBank with the opportunity to maintain a higher NIM than the industry average, but the bank also faces the challenge of weak consumer spending in the current economic climate.

Credit growth in the first half of 2024 indicates that retail banks are adapting to the weak consumer environment. The shift from personal to corporate lending has become a common strategy to sustain overall growth and performance. However, banks still face significant challenges in boosting their core credit segments and will need time for the consumer sector to fully recover.

Le Hoai An, CFA – Nguyen Thi Ngoc An – HUB

The Central Bank Will Continue to Lower Lending Rates

The State Bank is implementing a range of solutions to boost credit growth, with a key focus on reducing lending rates.

The Art of Compounding: Maximizing Your Savings with Rising Interest Rates

As we move into September, banks continue to favor the upward trend in savings interest rates, with increments ranging from 0.1% to 0.8%. According to analysts, the deposit rates offered by major commercial banks could witness a slight increase during the final quarter of the year.