I. MARKET ANALYSIS OF STOCKS ON NOVEMBER 21, 2024

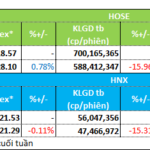

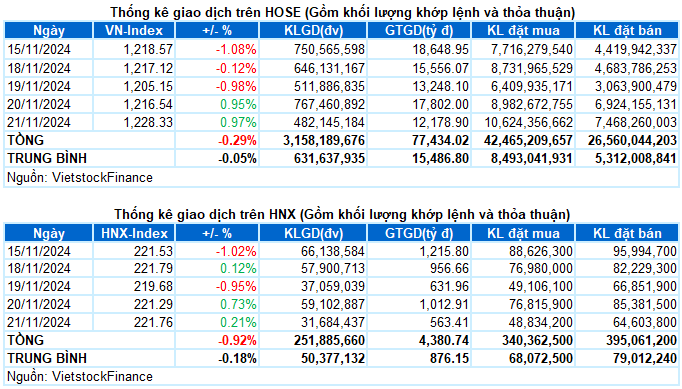

– The main indices continued to gain points during the November 21 trading session. VN-Index closed up 0.97%, reaching 1,228.33 points; HNX-Index ended at 221.76 points, up 0.21% from the previous session.

– Matching volume on HOSE reached just over 427 million units, down 34.2% from the previous session. Matching volume on HNX decreased by 50.7%, reaching over 25 million units.

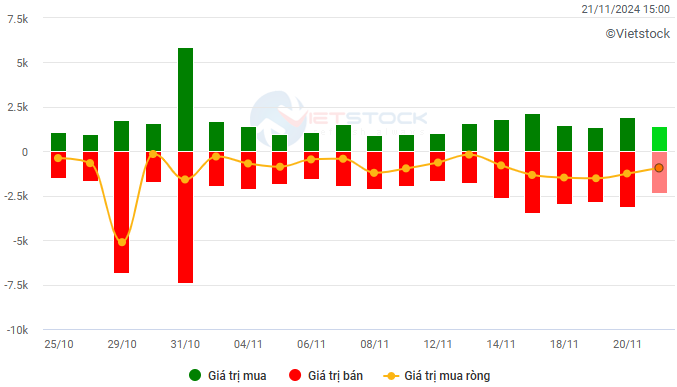

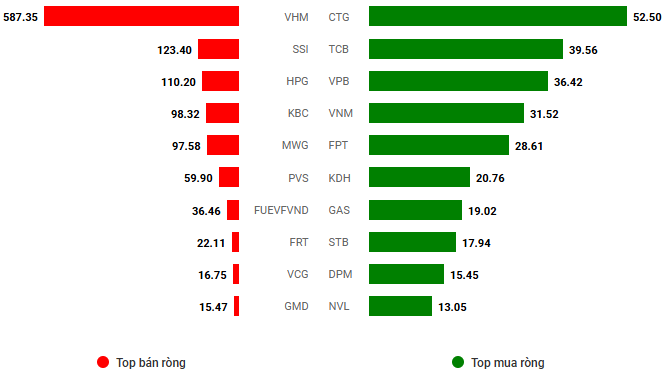

– Foreign investors continued to net sell on the HOSE with a value of more than 866 billion VND and net sold more than 60 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The market traded very cautiously on the futures expiration day. The index mostly hovered around the reference level during the morning session with low liquidity. Buyers started to accelerate in the afternoon session, led by pillar stocks, and green quickly spread across all sectors. However, the net selling of foreign investors has not shown any signs of stopping. At the close of November 21, the VN-Index increased by 11.79 points, or 0.97%, to 1,228.33 points.

– In terms of impact, the top 10 stocks contributed positively to the VN-Index, adding more than 6 points, led by CTG, VPB, and MWG with more than 3 points. In contrast, the top 10 stocks with the most negative impact today took only more than 0.2 points from the overall index, reflecting the dominance of buyers.

– VN30-Index closed up 1.17%, reaching 1,286.67 points. The breadth was overwhelmingly positive, recording 24 gainers, 3 losers, and 3 unchanged stocks. Among them, MWG, CTG, and VPB surged the most, rising 3.3%, 2.9%, and 2.7%, respectively. On the other hand, SAB, VJC, and BCM were the 3 remaining stocks that closed in the red, but the decline was insignificant, less than 0.5%.

In terms of sectors, telecommunications led the board with a remarkable gain of nearly 6%. This was thanks to the strong performance of large-cap stocks in the industry, including VGI (+7.16%), FOX (+2.45%), CTR (+2.66%), and VNZ (+2.9%).

Following were the non-essential consumer and energy groups, which recovered notably after recent negative movements. Many stocks rebounded impressively, such as MWG (+3.35%), FRT (+2.97%), GEX (+3.72%), PLX (+1.17%), PNJ (+1.29%), VGT (+2.24%), TLG (+2.44%), DRC (+2.43%); BSR (+1.04%), PVS (+1.51%), and PVD (+1.72%).

With their large market capitalization, financial stocks contributed significantly to the overall market gain today. Notable performers in this group included CTG (+2.94%), VPB (+2.67%), STB (+2.01%), MBB (+1.91%), MSB (+1.77%), SSI (+1.23%), and VCI (+1.53%), among others. Meanwhile, the real estate group was relatively quiet after a strong gain in the previous session. Most stocks fluctuated slightly around the reference level.

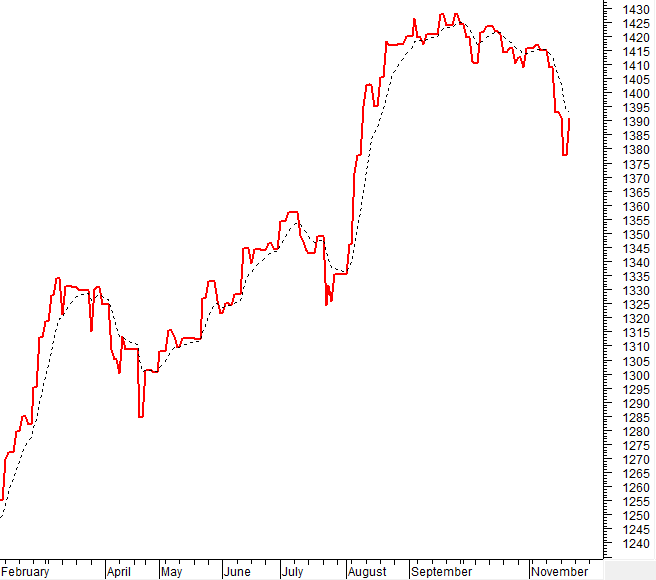

VN-Index continued its upward momentum after the strong gain in the previous session. However, the trading volume needs to surpass the 20-day average to reinforce the sustainability of the uptrend. Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the near future, the MACD indicator also gives a similar signal, the short-term outlook will become even more optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator indicator has given a buy signal in the oversold region

VN-Index continued its upward momentum after the strong gain in the previous session. However, the trading volume needs to surpass the 20-day average to reinforce the sustainability of the uptrend.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the near future, the MACD indicator also gives a similar signal, the short-term outlook will become even more optimistic.

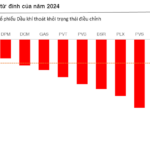

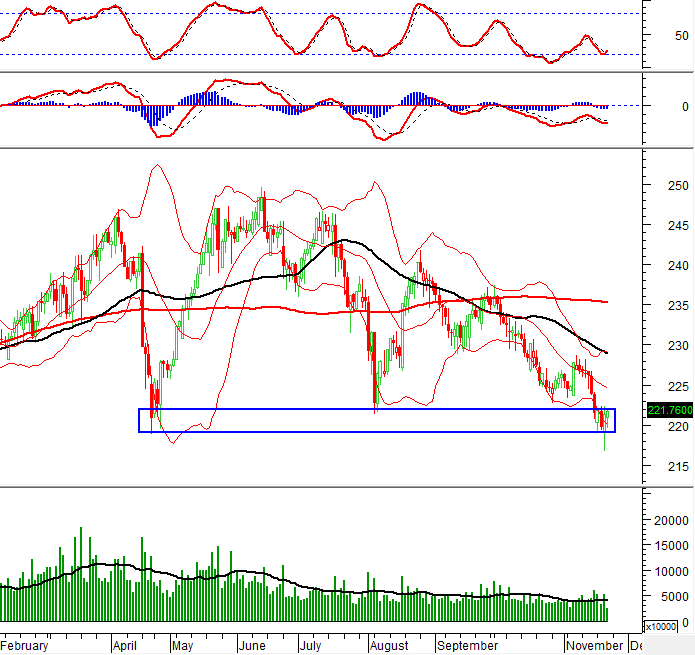

HNX-Index – Testing the old April 2024 low

HNX-Index surged strongly and retested the old low of April 2024 (corresponding to the 219-222 range). In the near future, the index needs to surpass this threshold, accompanied by trading volume above the 20-day average, to continue maintaining the uptrend.

Currently, the Stochastic Oscillator indicator has given a buy signal again and exited the oversold region. If this signal is maintained, the short-term uptrend will continue in the coming sessions.

Analysis of Money Flow

Movement of smart money: The Negative Volume Index indicator of VN-Index is currently below the EMA 20-day moving average. If this condition persists in the next session, the risk of a sudden drop (thrust down) will increase.

Foreign capital flow: Foreign investors continued to net sell in the November 21, 2024, trading session. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

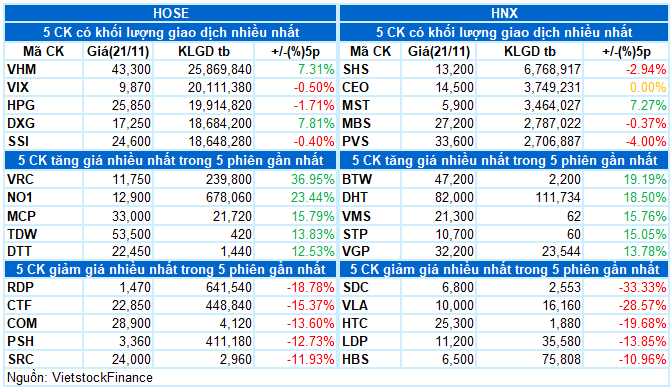

III. MARKET STATISTICS ON NOVEMBER 21, 2024

Economic and Market Strategy Division, Vietstock Consulting Department

The Perfect Headline: “The Looming Correction”

The VN-Index witnessed a significant decline, closely hugging the lower boundary of the expanding Bollinger Bands, painting a rather pessimistic picture. Accompanying this downturn was a dip in trading volume, falling below the 20-day average, indicative of investors’ cautious sentiment. As the Stochastic Oscillator continues its southward journey, foreign investors’ net selling reinforces the ongoing corrective pressure in the foreseeable future.

The Market Beat, November 18th: A Tug of War Persists, VN-Index Stuck in the Red

The market closed with the VN-Index down 1.45 points (-0.12%) to 1,217.12, while the HNX-Index climbed 0.26 points (+0.12%) to 221.79. The market breadth tilted in favor of gainers with 368 advancing stocks against 340 declining ones. Meanwhile, the VN30-Index presented a relatively balanced picture, with 14 decliners, 12 advancers, and 4 unchanged stocks.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.

The Liquidity Crunch: Capital Flow Conundrum for Real Estate Players

After a week of recovery, fueled by bottom-fishing funds, the market’s liquidity took a turn for the worse. Many groups witnessed a decline in their trading volumes. Amidst this downturn, real estate emerged as a sector with a distinct divergence in fund flows.