In the midst of these market shifts, Right Property, a line of standardized real estate products, has emerged as a top choice for investors due to its array of superior advantages, especially its liquidity even amidst market fluctuations.

Right Property Line “Tunes In” to Investors

The trio of Land Law, Housing Law, and Business Law, which came into effect on August 1, 2024, is expected by experts to remove legal barriers and invigorate the market. Additionally, the macroeconomy has shown positive signs with a 6.82% GDP growth in the first nine months, an 8.9% increase in FDI, lower interest rates, and accelerated public investment disbursement. These favorable factors are fueling the market’s recovery in the final months of the year. According to the Vietnam Real Estate Brokers Association (VARS), the market will continue its slow but steady recovery and is expected to make significant progress by the end of 2024.

The real estate market is entering a selective phase, requiring investors to be more discerning and prudent than ever. Observing the market’s ups and downs, investors are becoming more meticulous in their investment choices. Industry experts assert that a standardized product (Right Property) with proper legal standing, growth potential, and market appeal, prioritizing safety, efficiency, and sustainability, will be the criteria for investors’ decisions.

Firstly, proper legal standing refers to red-booked properties, auctioned properties, and those eligible for business operations. Secondly, growth potential pertains to well-priced properties in locations with robust economic growth and future infrastructure plans. Thirdly, market appeal involves well-planned real estate with comprehensive amenities and aesthetic value. This trend of investing in standardized and transparent real estate is contributing to a healthy and sustainable market development, laying a strong foundation for future growth.

CityMark Residence Exemplifies Right Property

A recent notable representative of the Right Property line is CityMark Residence, a project that encompasses all the elements of a standardized, safe, and profitable real estate venture, offering high liquidity.

Developed by Tumys Homes, a reputable investor with strong financial capabilities, CityMark Residence is anticipated to be in high demand due to its solid legal foundation and fulfillment of investors’ needs in the current phase.

Strategically located in the heart of Phu My, Ba Ria – Vung Tau, CityMark Residence is in an area with rapid economic growth and well-developed transportation infrastructure. Residents can easily commute to Ho Chi Minh City, Long Thanh International Airport, and nearby industrial parks.

CityMark Residence offers a modern living space with exceptional quality of life

The presence of Cai Mep port, the deepest port in Vietnam, has made Phu My a desirable destination for international experts. With approximately 15,000 specialists, engineers, and staff from economic powerhouses such as Japan, South Korea, China, Taiwan, and the EU working in the nearby industrial zones, Phu My boasts a substantial demand for high-end real estate. This serves as a solid assurance of CityMark Residence’s profitability, liquidity, and sustainable investment potential.

CityMark Residence also captivates customers with its neo-classical architectural design, rich in artistic value. The project introduces a luxurious and convenient living space with a diverse ecosystem of high-end amenities, including a green park, swimming pool, modern gym, spa, children’s playground, elegant business lounge, romantic walking street, and a vibrant culinary and shopping district…

At the recent PropertyGuru Vietnam Property Awards 2024, CityMark Residence excelled by winning the “Best Condominium in Southern Vietnam” award due to its robust legal framework, rapid construction progress, refined architectural design, and world-class amenities. This event garnered significant attention from industry professionals and solidified CityMark Residence’s leading position in the real estate market.

The strategic collaboration with BHS Group, a seasoned entity in the real estate field, further underscores the developer’s commitment to crafting a quality product that meets customer needs and enhances their investment value.

With a scale of 2 towers, 25 stories high, encompassing 1,248 luxury apartments, and 55 commercial shophouses, CityMark Residence presents an attractive investment opportunity with sustainable liquidity, catering to investors’ preferences in all market conditions.

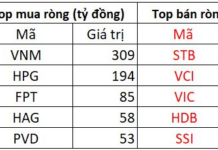

The Foreign Block: Investing Inflows and the Liquidity Conundrum

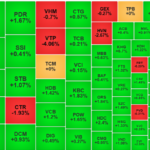

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.

The New Trendsetter: Breaking the Mold with an Unexpected Move

“With a nudge upwards, savings deposit interest rates are responding to the short-term liquidity challenges faced by the system during the peak credit growth season towards the year-end.”

Is a V-Shaped Recovery in the Cards for the Market Post-Deep Pullback?

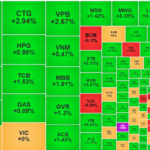

The afternoon session witnessed a surge in trading activities, with momentum picking up towards the end. The depletion of selling pressure from the morning session triggered a rapid upward swing in prices. As buying momentum improved, sellers became imbalanced, leading to a dominant wave of rising prices across the board. The HoSE trading volume soared by 130% in the afternoon session compared to the morning.

The Market Climbs Higher Amid Uncertainty: Foreign Investors Ease Off Selling Spree

The T+ profit-taking volume remained but did not put much pressure on the first trading session of the week. The slow upward trend, with low liquidity and gradually improving breadth, reflected a doubtful sentiment, yet there was still money flow willing to push the prices higher.