Vincom Retail’s Strategic Expansion: A Deep Dive

As per SSI Research’s analysis, Vincom Retail (code: VRE) made a significant move by depositing VND 5,480 billion with Vinhomes and Vingroup to acquire commercial land plots in the Vinhomes Royal Island and Vinhomes Golden Avenue projects. These plots boast a total net floor area of 109,800 m2, translating to approximately 1,200 new shophouses. The company plans to launch these shophouses in 2025, with revenue recognition commencing in 2026.

A closer look at Vincom Retail’s balance sheet as of the end of 2024 reveals ongoing deposits with Vingroup-related parties for two new shophouse projects and investments in new shopping malls, totaling VND 19,680 billion, a notable increase of VND 7,800 billion from 2023.

SSI Research forecasts that in 2025, Vincom Retail is poised to debut three new shopping malls in the cities of Haiphong, Hung Yen, and Nghe An, collectively spanning a retail floor area of roughly 117,000 m2.

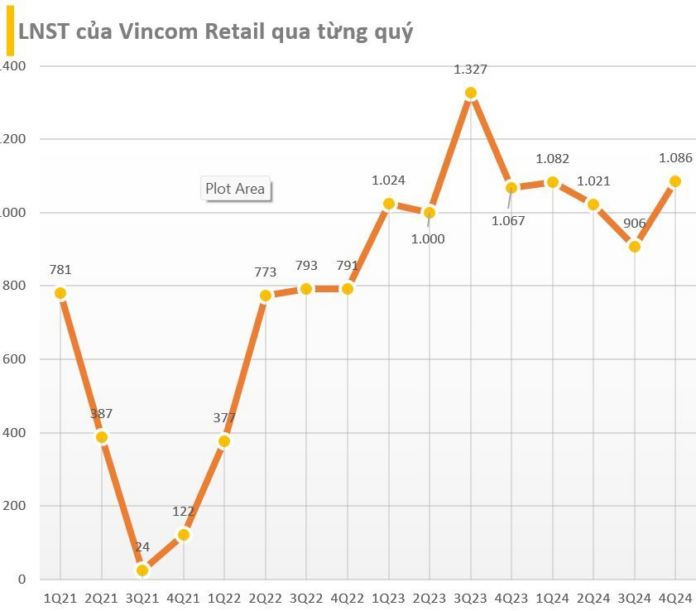

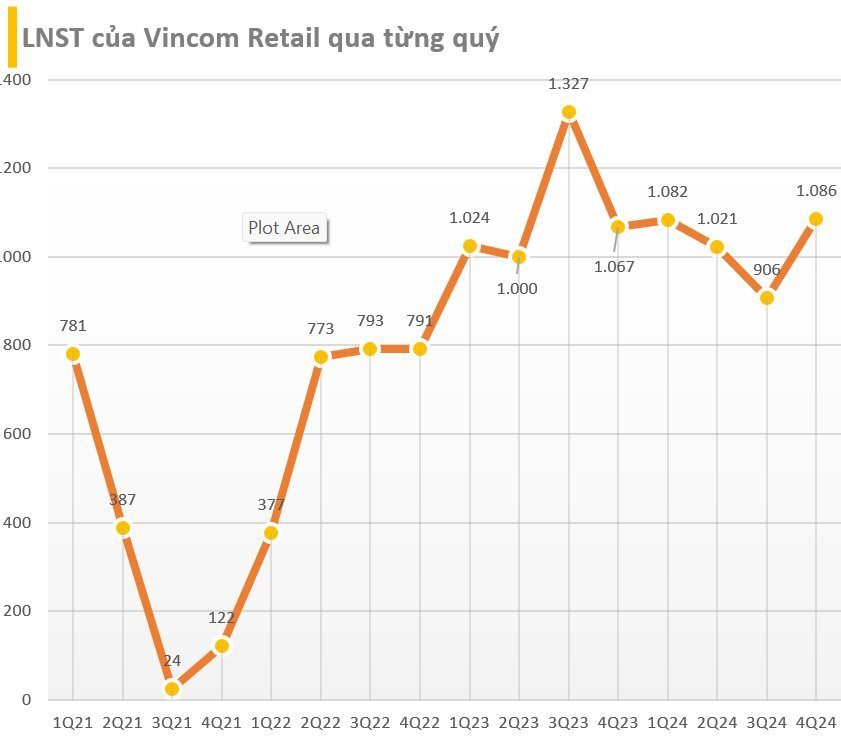

Delving into the company’s financial performance, Vincom Retail posted consolidated net revenue of VND 8,939 billion and net profit of VND 4,096 billion for 2024, marking decreases of 8.7% and 7%, respectively, compared to the previous year. Specifically, in Q4/2024, Vincom Retail recorded a slight increase in net profit, reaching VND 1,086 billion.

Over the past year, the company inaugurated five new shopping malls, adding a substantial 94,700 m2 to its retail floor area (GFA). These included Vincom Mega Mall Grand Park, Vincom Plaza Ha Giang, Vincom Plaza Dien Bien Phu, Vincom Plaza Bac Giang, and Vincom Plaza Dong Ha Quang Tri, bringing its nationwide presence to 88 shopping malls across 48 out of 63 provinces, with an impressive total retail floor area exceeding 1.84 million m2.

In tandem with this expansion, Vincom Retail remains committed to enhancing the quality of its existing malls. Notably, in June 2024, the company reopened Vincom Plaza 3/2 in District 10, Ho Chi Minh City, following a comprehensive renovation. Additionally, the company successfully repositioned Vincom Plaza Imperia Hai Phong, introducing trendy brands and elevating the overall customer experience.

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

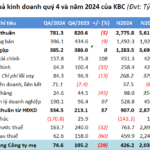

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.