On February 5, 2025 (the 8th day of the first lunar month of the Year of the Dragon), the Ho Chi Minh City Stock Exchange (HOSE) hosted a bell-ringing ceremony to inaugurate the Spring Dragon 2025 stock trading.

Speaking at the ceremony, Deputy Minister of Finance Nguyen Duc Chi commended the positive results of 2024. Overall, the market operated safely and stably, with improved discipline, transparency, and sustainability.

However, the securities industry still needs to accelerate administrative reforms, implement new information technology systems, and continue to address challenges related to market upgrades.

SUSTAINING GROWTH, AIMING FOR UPGRADE

According to Nguyen Viet Ha, Acting Chairwoman of HOSE, in 2024, despite complex global macroeconomic fluctuations, the Vietnamese economy grew positively thanks to the government’s close management and the recovery of business production and operations. Consequently, the Vietnamese stock market maintained its stable, safe, and smooth operation and achieved growth.

“In 2025, the securities industry pledges to exert utmost efforts and determination to effectively implement solutions and action plans, thereby maximizing opportunities for enterprises to raise capital and investors to participate in the market according to legal regulations. Simultaneously, we will work on completing the criteria for market upgrade as planned by the government… to ensure the stock market continues to affirm its position as a crucial medium and long-term capital mobilization channel for the economy.”

In this context, the VN-Index ended 2024 at 1266.78 points, a 12.1% increase compared to the end of 2023. The market capitalization of stocks reached VND 5,210 trillion, a 14.3% rise from the previous year.

Additionally, the average trading value in 2024 reached VND 18,685 billion per day, a 22.4% increase compared to 2023. By the end of 2024, the liquidity of the Vietnamese stock market ranked third in Southeast Asia, only after Thailand and Singapore.

Ha shared that this year, HOSE aims to deploy a new information technology system to introduce new products and services to the market and enhance the system’s processing capacity to accommodate the growth associated with the market upgrade.

Commenting on the market, Vu Thi Chan Phuong, Chairwoman of the State Securities Commission (SSC), stated that 2025 would witness many unpredictable unstable factors. However, Vietnam still has numerous opportunities to achieve the GDP growth target set by the government. These positive factors will continue to underpin the stability and growth of the Vietnamese stock market in terms of both scale and quality.

A YEAR OF CHANGE AND BREAKTHROUGH

According to Deputy Minister of Finance Nguyen Duc Chi, 2025 is a year of high expectations and changes for the country and the economy. The government is also formulating and implementing solutions to strive for higher economic growth rates than planned, laying the groundwork for a double-digit GDP growth target in the 2026-2030 period.

To achieve these goals, the securities industry needs to step up its efforts and focus on implementing robust solutions to ensure the market’s stable and sustainable development and reinforce its role as a crucial medium and long-term capital channel for the economy.

Meanwhile, the Ministry of Finance has directed the State Securities Commission, stock exchanges, the Vietnam Securities Depository, and market members to vigorously pursue market development measures in 2025. This includes promptly completing the legal framework and guidelines for new provisions in the amended Securities Law, which was passed in 2024.

Deputy Minister Nguyen Duc Chi emphasized: “This is very important because the old regulations are no longer applicable, and new guidelines are necessary to ensure that there are no complaints from businesses, organizations, and individuals participating in the securities market in 2025. Administrative procedure reform should clearly define the responsibilities of specific management agencies, based on the early publication of new regulations in the market.”

Concurrently, the Ministry of Finance has also assigned the market management agencies the task of creating high-quality commodities to attract investors in 2025.

In addition to the mission of ensuring the smooth and safe operation of the market and maintaining market discipline, the regulatory agency is committed to implementing a new information technology system to enhance quality. Similarly, market upgrade is a crucial goal for the securities industry this year. According to Deputy Minister Nguyen Duc Chi, the upgrade of the stock market can no longer be delayed.

“This year, we must meet the conditions to elevate the stock market to a new level, creating momentum for its growth in the future. An upgrade will bring numerous benefits to various parties, including Vietnam and foreign investors, thereby increasing the participation of foreign capital in the Vietnamese stock market,” concluded the Deputy Minister of Finance.

What Does the Sudden Drop in Individual Investors’ Cash Holdings Mean?

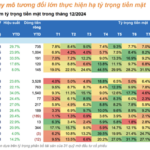

As investor cash reserves held by securities firms hit a six-quarter low, investment funds have been consistently pouring money into equities, significantly reducing their cash holdings.

The Price of Gold Plummets as Investors Rush to Cover Stock Market Losses

The US dollar index and Treasury yields fell during the session, but failed to buoy the precious metals market.