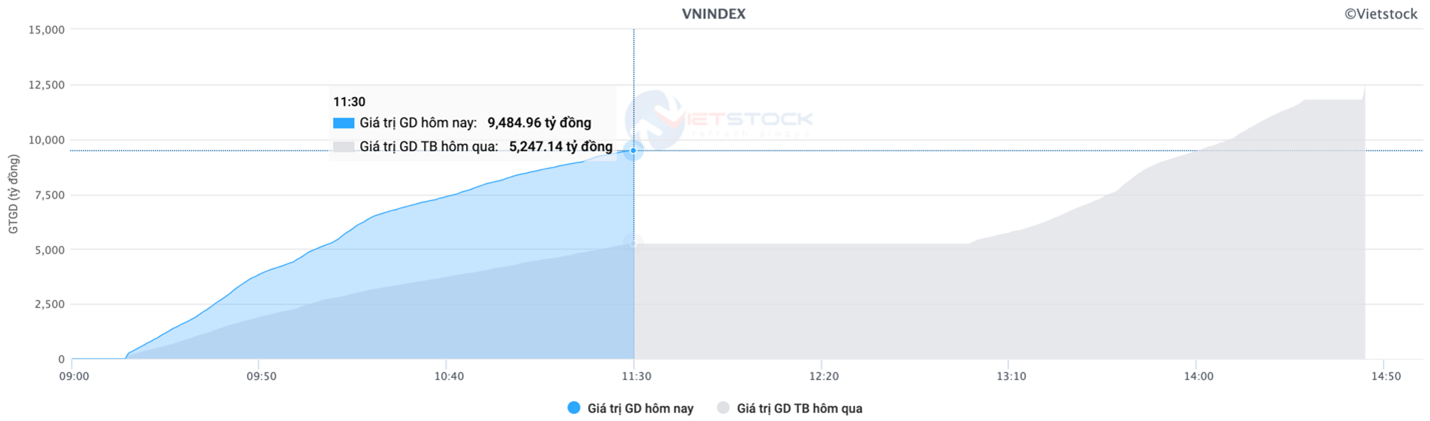

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 722 million shares, equivalent to a value of more than 17.2 trillion VND; HNX-Index reached over 61.8 million shares, equivalent to a value of more than 949 billion VND.

VN-Index opened the afternoon session with increased selling pressure, causing the index to plunge and close in pessimistic red. In terms of impact, HPG, FPT, VCB, and VHM were the most negative stocks, taking away more than 5.2 points from the index. On the other hand, STB, MSN, BCM, and MBB were the stocks that managed to stay in the green and contributed over 1.3 points to the overall index.

As of the close on 10/02, shares of leading steel companies in Vietnam such as HPG decreased by 4.7%, HSG fell by 4.5%, NKG decreased by 3.6%, and GDA dropped by 4.8%. Even the shares of steel companies that mainly operate in the domestic market plummeted, such as SMC, which fell close to the floor, and TLH, which went down by 2.7%.

On 09/02 (US time), President Donald Trump, speaking to reporters aboard Air Force One en route to the Super Bowl in New Orleans, said he would announce new tariffs on metal imports on Monday (10/02 US time). Although the details of this new move have not been officially announced, Trump’s statement on steel tariffs immediately hurt stock prices.

Steel stocks plunge as President Trump threatens tariffs

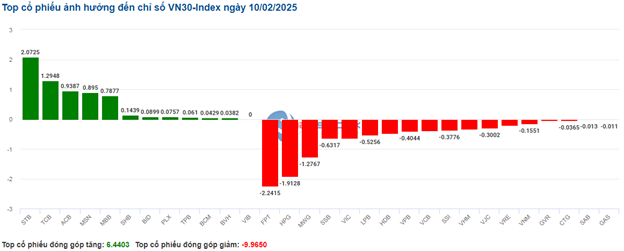

| Top 10 stocks with the most significant impact on VN-Index on 10/02/2025 |

Similarly, HNX-Index also witnessed an unoptimistic performance, negatively impacted by stocks such as IDC (-2.01%), VCS (-3.03%), CEO (-3.01%), and CDN (-5.13%)…

|

Source: VietstockFinance

|

The telecommunications sector experienced the most significant decline in the market, with a drop of -4.74%, mainly attributed to VGI (-5.43%), FOX (-3.24%), CTR (-3.49%), and ELC (-2.06%). Following closely were the industrial and information technology sectors, with decreases of 2.75% and 2.55%, respectively. On the contrary, the energy sector demonstrated a modest recovery of 0.21%, with green signals observed in TMB (+5.08%), PVC (+0.92%), PVB (+3.35%), CLM (+4%), and NBC (+9.43%)

In terms of foreign investors’ activities, they continued to net sell over 420 billion VND on the HOSE exchange, focusing on stocks such as HPG (194.15 billion), MWG (117.77 billion), VCB (74.42 billion), and CTG (55.12 billion). On the HNX exchange, foreign investors net bought over 710 million VND, mainly investing in SHS (12.31 billion), MBS (3.14 billion), VGS (2.95 billion), and TVC (1.32 billion)

| Foreign investors’ buying and selling activities |

Morning session: Sea of Red

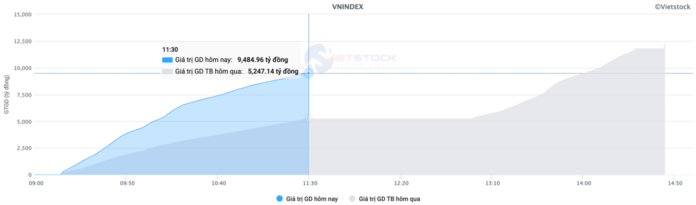

The market was engulfed in red throughout the morning session of the first trading day of the week, following a four-day winning streak the previous week. At the midday break, the VN-Index temporarily retreated to 1,269.88 points, a decline of 0.42%; HNX-Index decreased by 0.35%, settling at 228.69 points. The selling side dominated with 422 declining stocks versus 263 advancing stocks.

Liquidity surged by more than 80% compared to the previous Friday morning session, reaching a value of nearly 9.5 trillion VND on the HOSE exchange during the morning session alone.

Source: VietstockFinance

|

A few bright spots among the “blue-chip” stocks were striving to hold the market amid strong selling pressure from the rest. 7 out of 10 stocks with the most positive impact on the VN-Index belonged to the banking group, with BID, STB, and TCB taking the lead, contributing a total of 1.5 points to the index’s gain. However, this was not enough to curb the red trend as, on the opposite side, FPT, HPG, and VCB exerted significant pressure, taking away 2.6 points from the index.

Most industry groups were overshadowed by the red trend. Notably, the telecommunications group ranked at the bottom of the market, plunging by 4.27% in the morning session. Many large-cap stocks in this sector declined by more than 3%, including VGI, CTR, FOX, YEG, and TTN.

The industrial sector, which had witnessed the most positive index performance since the beginning of 2025, was also experiencing a significant decline of nearly 2%. Stocks that witnessed notable selling pressure included VTP (-6.11%), HAH (-2.96%), ACV (-2.76%), SCS (-2.75%), PHP (-4.24%), and VSC (-2.22%)… Similarly, the information technology sector faced a downturn as the two heavyweight stocks in this sector, FPT and CMG, decreased by 1.92% and 1.56%, respectively.

On the flip side, a few sectors managed to maintain a slight gain, including essential consumer goods, healthcare, energy, and finance. However, this positivity was largely driven by a handful of standout stocks such as MSN (+2.07%), MML (+7.03%); DVN (+4.92%), TNH (+0.76%), DAN (+14.69%); TMB (+1.34%), PVC (+3.67%), PVB (+3.05%); STB (+2.8%), MBB (+1.1%), BID (+0.99%), TCB (+0.97%), and NAB (+1.75%). The majority of the remaining stocks in these groups could not escape the overall downward adjustment.

Foreign investors maintained their net selling trend, with a value of more than 277 billion VND on the HOSE exchange during the morning session. The stocks experiencing the most substantial net selling pressure were MWG (63.7 billion), HPG (53.5 billion), and VCB (45.9 billion). Conversely, FPT and STB attracted notable buying interest from foreign investors, with net buying values of around 73 billion VND each.

19:40: Intense tug-of-war

Investors’ indecision caused the market’s main indices to fluctuate below the reference level continuously. As of 10:40 am, the VN-Index decreased by 4.92 points, hovering around 1,270 points. The HNX-Index dropped by 0.83 points, trading around 228 points.

The breadth of the stocks within the VN30-Index basket was slightly tilted towards the red side. Specifically, STB, TCB, ACB, and MSN contributed 2.07 points, 1.29 points, 0.94 points, and 0.9 points to the overall index, respectively. Conversely, FPT, HPG, MWG, and SSB encountered strong selling pressure, deducting nearly 10 points from the VN30-Index.

Source: VietstockFinance

|

The energy sector recorded the strongest recovery in the market this morning. Notably, stocks such as PVB rose by 4.27%, PVC increased by 1.83%, PVS climbed by 0.59%, PSB advanced by 3.33%, and TVD surged by 5.26%,…

Meanwhile, the telecommunications services sector continued to lead the group of stocks with the most negative impact on the market, declining by more than 3%. This was mainly driven by stocks such as VGI, which fell by 3.44%, CTR decreased by 2.86%, FOX dropped by 3.04%, and YEG slid by 3.09%,…

The red trend swiftly spread to the stocks in the industrial sector. Notably, VTP declined by 5.74%, ACV fell by 2.35%, HAH decreased by 1.85%, VJC dropped by 1.12%, and GMD slipped by 1.28%,…

Compared to the opening, buying and selling forces were relatively balanced, accompanied by ongoing differentiation, with a significant number of stocks (more than 960) standing still. There were 246 advancing stocks and 368 declining stocks.

Source: VietstockFinance

|

Opening: Broad-based decline

The market opened the morning session on a negative note, with most industry groups trading in the red. Notably, the VN30 index had the most significant negative impact as almost all the stocks within this group decreased.

Large-cap stocks were exerting strong downward pressure on the market. HPG, SSB, VJC, FPT, and MWG led the market decline. On the other hand, stocks such as BCM, PLX, MSN, and ACB managed to maintain their green status right from the opening.

The telecommunications services sector experienced the most negative impact at the beginning of the session, falling by 1.57%. Specifically, stocks such as VGI decreased by 2.11%, CTR fell by 2.06%, YEG dropped by 2.41%, and FOX slid by 2.23%,…

Following closely was the information technology sector, which also witnessed a pessimistic performance. This was mainly driven by heavyweight stocks in the sector, such as FPT, which declined by 0.89%, and CMG, which fell by 0.56%. The remaining stocks in this sector mostly stood still or traded slightly in the green.

– 09:40 10/02/2025

The Cash Flow Comeback Before the Holiday Break

The VN-Index soared by over 17 points, surging past the 200-day SMA. This rally was accompanied by a spike in trading volume above the 20-day average, indicating a resurgence of active participation by investors. The Stochastic Oscillator and MACD both flashed bullish signals, with the latter crossing above the Signal Line. If this momentum persists, the outlook for the market is exceedingly positive.

The Vietstock Daily: A Tentative Rise?

The VN-Index’s consecutive gains, coupled with below-average trading volumes, reflect investors’ cautious sentiment. This dynamic needs to change in upcoming sessions to sustain the upward trajectory. Notably, the Stochastic Oscillator has signaled a buy in the oversold region. If this buying signal persists and the index moves out of this region, the short-term outlook will turn even more positive.

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.

The Market Beat: Foreigners Buy for Two Straight Sessions, VN-Index Responds Positively

The market ended the session on a positive note, with the VN-Index climbing 5.42 points (+0.43%) to reach 1,265.05, while the HNX-Index gained 0.34 points (+0.15%), closing at 223.01. The market breadth tilted in favor of advancers, with 432 tickers in the green and 301 in the red. The large-cap sector mirrored the broader market’s sentiment, as evidenced by the VN30 basket, which saw 20 constituents advance, 5 decline, and 5 remain unchanged, resulting in a sea of green.