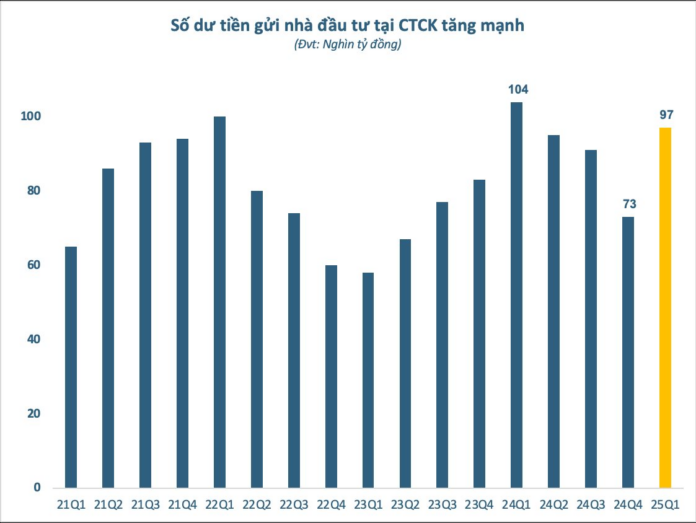

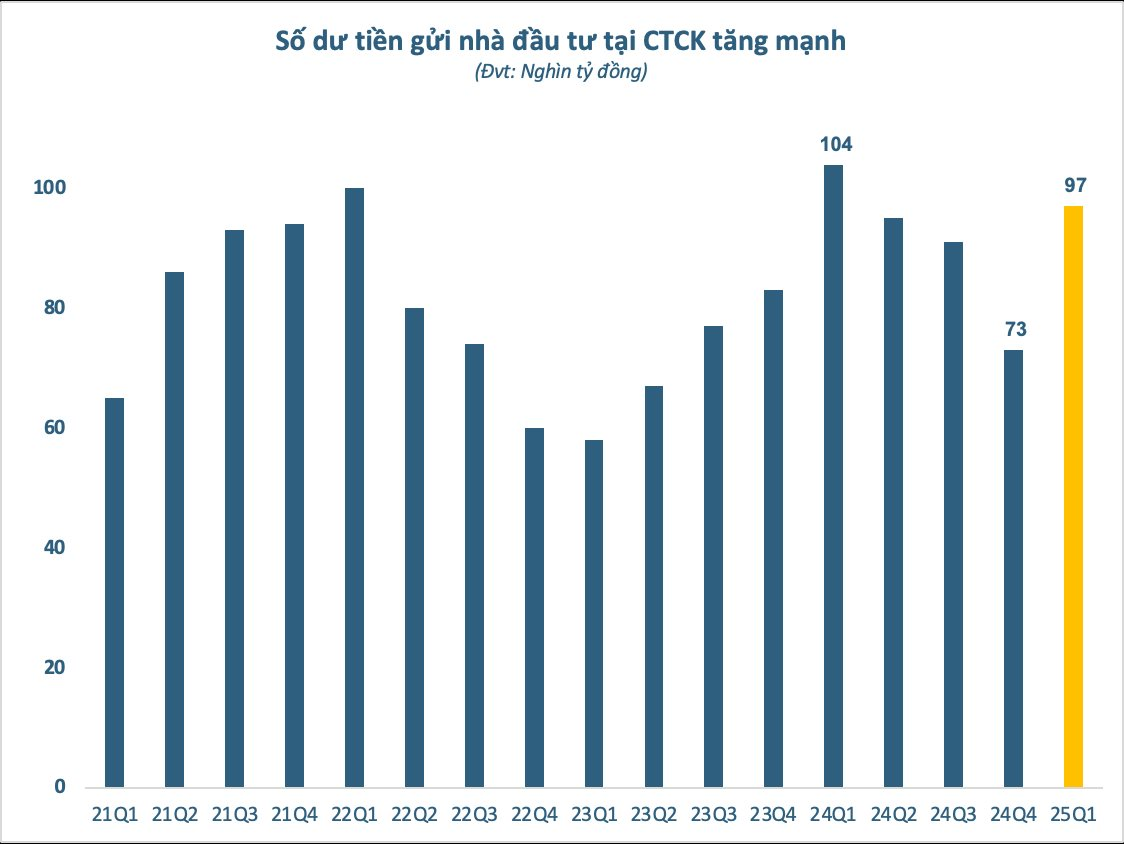

According to financial report statistics, the client deposit balance at securities companies at the end of Q1/2025 reached approximately VND 97,000 billion. This is mainly the money of investors trading securities in the form of securities company management. This amount of money is already in the investors’ accounts and has not been disbursed as of January 31, 2025.

Compared to the beginning of the year, investors’ deposits at securities companies have increased by about VND 24,000 billion, and the deposit balance at the end of Q1 is the second highest in history, only lower than the record set in Q1/2024 (about VND 104,000 billion).

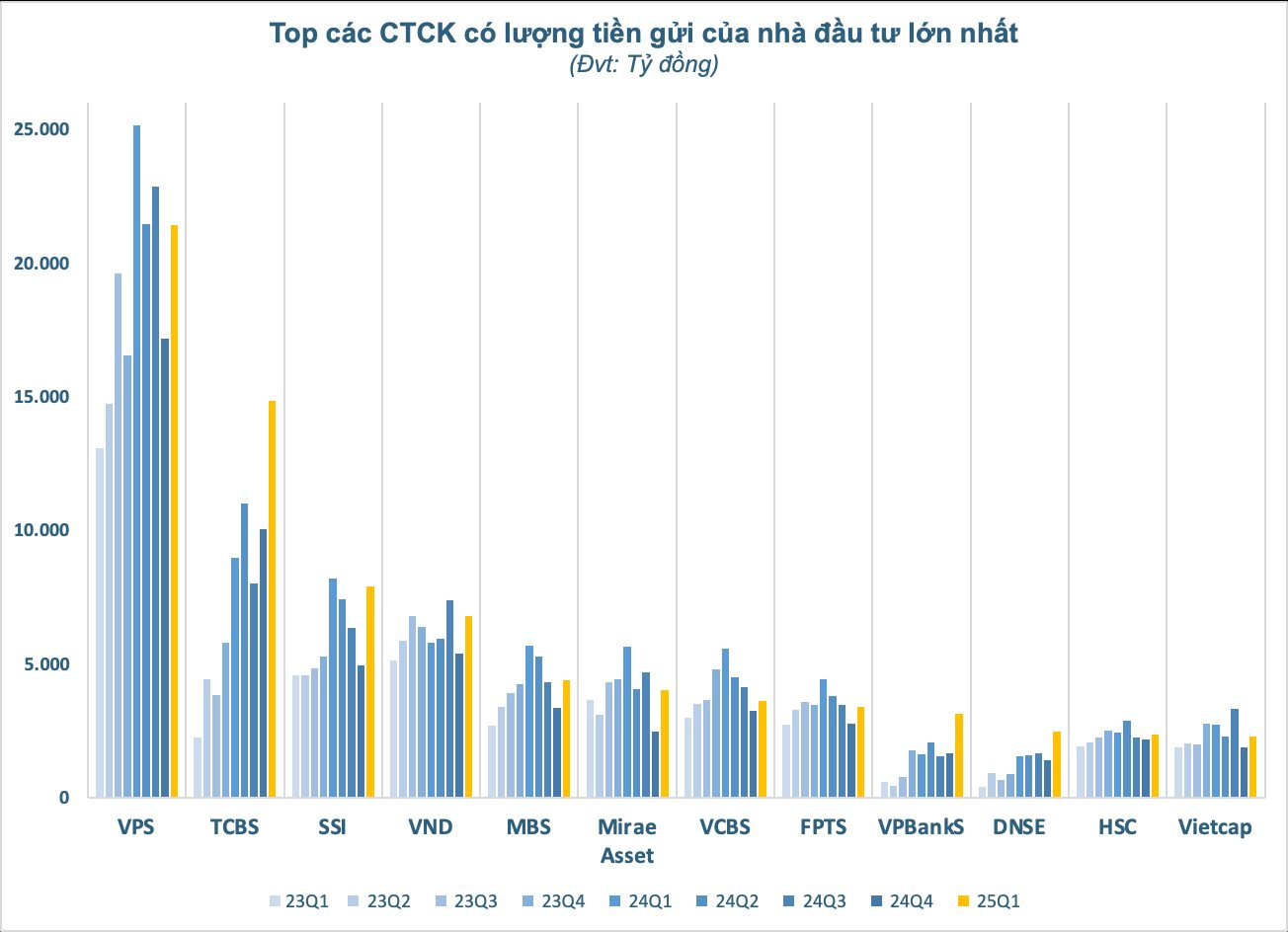

VPS remains the securities company with the largest client deposit balance, with more than VND 21,400 billion as of March 31, an increase of nearly VND 4,300 billion from the beginning of the year. VPS is currently the securities company with the largest brokerage market share on the three exchanges HoSE, HNX, and UpCOM, as well as derivatives, far surpassing the names behind. Therefore, it is not surprising that it has a superior amount of investors’ money in its accounts.

TCBS Securities ranked second with nearly VND 15,000 billion in deposits, an increase of more than VND 4,800 billion in just one quarter. This is also the strongest growth in investors’ deposits in the first quarter of the year.

Most of the top securities companies have also experienced strong growth in this item compared to the beginning of the year. Two big names, SSI and VNDirect, had investor deposit balances of VND 7,900 billion and VND 6,800 billion, respectively. There were also nearly VND 4,400 billion in investor deposits at MBS and more than VND 4,000 billion in investor money “waiting” at Mirae Asset.

Meanwhile, outstanding loans at securities companies continued to hit a new record of about VND 280,000 billion (~USD 11 billion) at the end of Q1, a sharp increase of VND 35,000 billion in the first 3 months of the year. Of which, margin debt was estimated at VND 273,000 billion, also the highest in the history of Vietnam’s securities market. Moreover, the number of domestic investor accounts has also been continuously increasing. As of March 31, 2025, domestic individual investors had a total of more than 9.6 million accounts, equivalent to about 9.6% of the population.

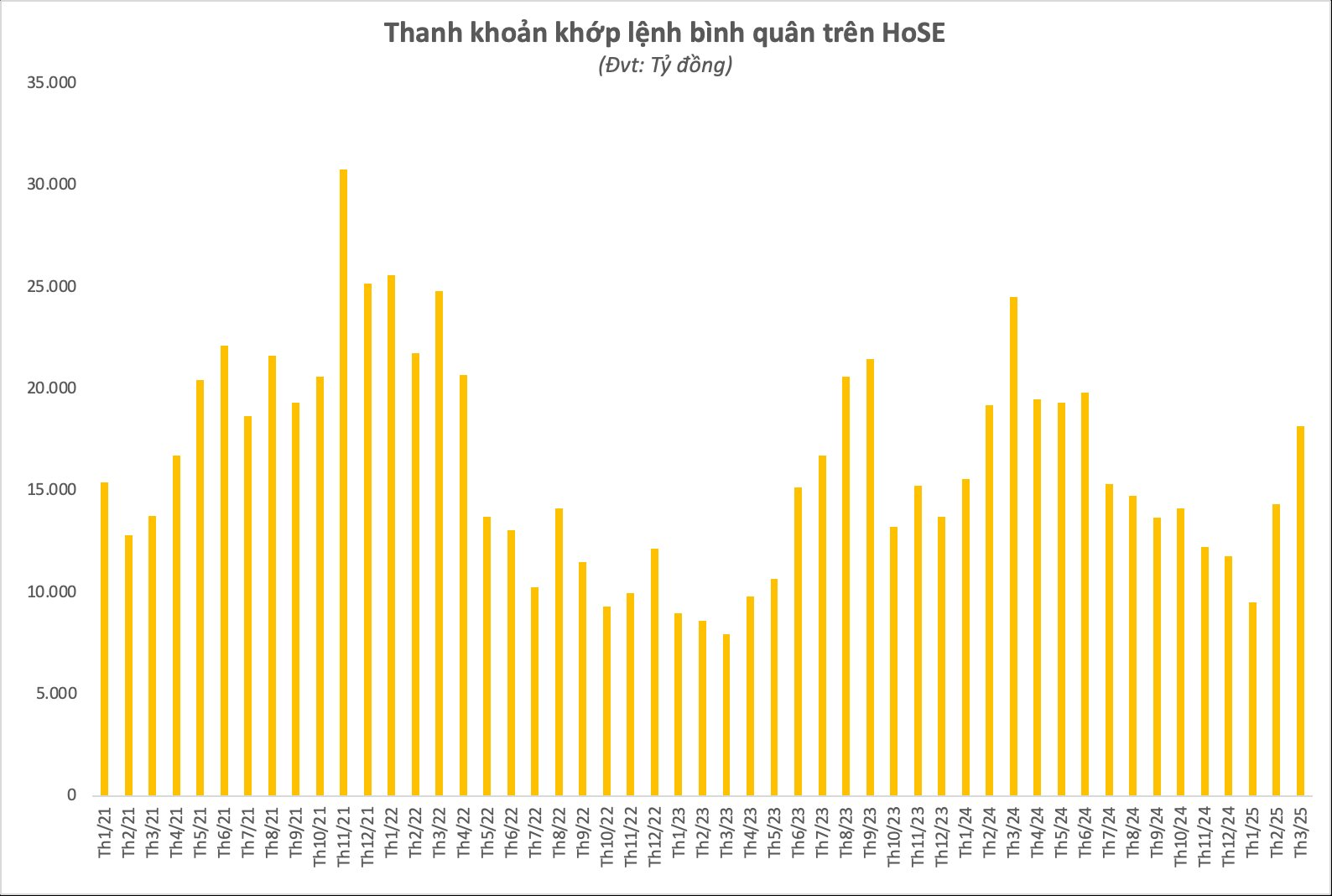

In fact, the context of the securities market in the first quarter of 2025 was quite vibrant. Trading liquidity continuously improved after a gloomy period at the end of the previous year, with the average matching value increasing for three consecutive months despite the Tet holiday, reaching more than VND 18,000 billion/session in March.

Overall, the securities market is expected to grow strongly in 2025 with many supportive factors. In 2025, the goal has been set very clearly with a determination to upgrade Vietnam’s stock market from a frontier market to an emerging market according to the Strategy for Developing the Securities Market by 2030, which has been approved by the Prime Minister. Upgrading the stock market from a frontier market to an emerging market will not only bring many opportunities for Vietnam’s stock market and market participants but also contribute to enhancing the country’s image and investment environment, promoting economic development in general, and is expected to improve investor sentiment and attract more foreign capital inflows.

In addition, despite many fluctuations due to the impact of the world economic, trade, and geopolitical situation, the Vietnamese government still maintains an economic growth target of 8% for 2025 and double digits for the following years. With the solutions and strong participation of ministries, sectors, and localities, Vietnam has many opportunities to achieve the set growth targets. Along with this, with the government’s reform and innovation solutions, the investment, production, and business environment will continue to improve, positively supporting the development of enterprises in the coming years.

Most recently, the Ministry of Finance and the State Securities Commission (SSC) announced that they are finalizing the draft Circular amending and supplementing a number of articles of Circular No. 119/2020/TT-BTC and Circular No. 96/2020/TT-BTC, which was previously amended and supplemented according to Circular No. 68/2021/TT-BTC. The draft has amended and supplemented a number of new provisions to ensure the smooth operation of securities registration, depository, clearing, and settlement activities, which are suitable for the functions of the KRX system and meet the criteria for market upgrading.

It is expected that this Circular will soon be submitted to the Ministry of Finance for consideration and issuance following a shortened procedure. Issuing the Circular following a shortened procedure is necessary to meet the expected official operation timeline of the KRX system in early May, as this system has many new features compared to the current system.

VCBS Ranks in the Top 10 Brokerage Firms by Market Share in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) unveiled the top 10 securities companies with the largest brokerage market share in Vietnam. This list showcases the leading firms in the industry, commanding a significant portion of the market and playing a pivotal role in shaping Vietnam’s burgeoning investment landscape.

Tomorrow’s Stock Market Outlook, November 29: Will Profit-Taking Pressure Subside?

In the November 28 stock session, profit-taking selling pressure on stocks eased. Investors hope that this signal will persist into the next session.

Unveiling a New Policy: Welcoming the Wave of Foreign Investment to Vietnam’s Stock Market

Vice President of the SSC shared that Circular No. 68/2024/TT-BTC is a result of an expedited and transparent regulatory process, showcasing the strong collaboration between regulatory bodies, operators, and market participants. This collaborative effort is aimed at upgrading and building a securities market that is safe, comprehensive, robust, integrated, and sustainably developed.

The Profit Plunge: Unraveling the Sequential Decline in Vietnam’s Securities Industry

In Q3, the combined pre-tax profits of securities firms reached an impressive VND 6,900 billion, matching the same period in 2023 but falling just shy of the preceding quarter by nearly 7%.