Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 1.03 billion shares, equivalent to a value of more than 20.8 trillion dong; HNX-Index reached over 92.1 million shares, equivalent to a value of more than 1.49 trillion dong.

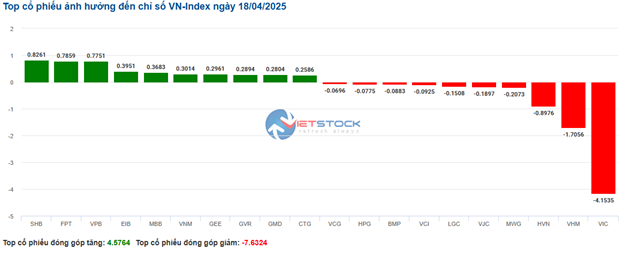

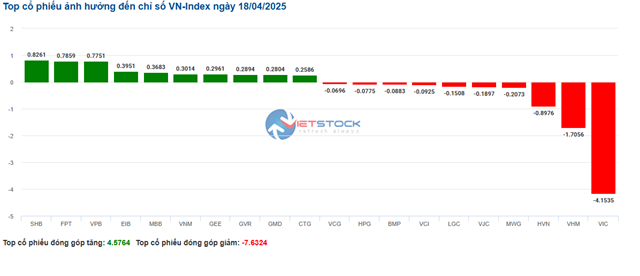

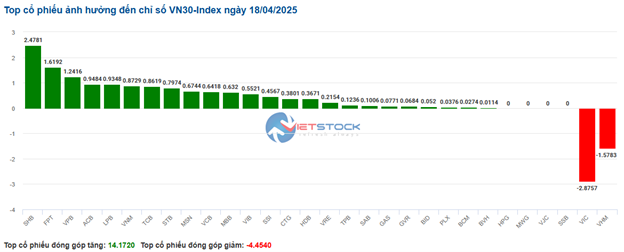

VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, but towards the end of the session, sudden selling pressure caused the index to decline and fall back to the reference level at the close. In terms of impact, SHB, FPT, VPB, and EIB were the most positive influences on the VN-Index, contributing over 2.8 points. On the other hand, VIC, VHM, HVN, and MWG had the most negative impact, taking away more than 6.95 points from the overall index.

Source: VietstockFinance

|

Similarly, the HNX-Index also had a positive performance, with the index positively influenced by the codes KSF (+5.91%), SHS (+4.26%), HGM (+8.33%), NVB (+2.97%)…

Source: VietstockFinance

|

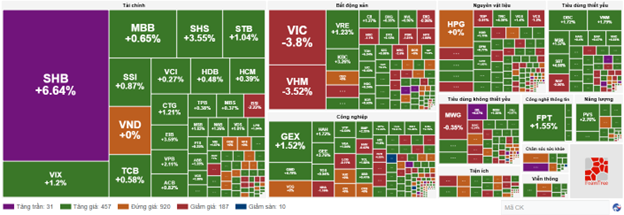

At the close, the market was up 0.15%. The information technology sector was the group with the most positive impact on the market, rising 2.08%, mainly driven by FPT (+2.01%), CMG (+3.83%), ITD (+3.45%),… Following was the telecommunications services group, with most of the stocks in the sector maintaining a positive green color, such as VGI up 2.99%, CTR up 3.62%, ELC up 2.69%, FOC up 0.29%,…

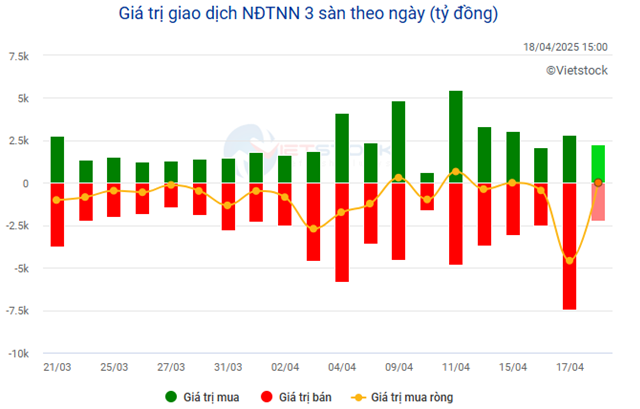

In terms of foreign trading, they returned to net buying over 19 billion dong on the HOSE exchange, focusing on FPT (266.63 billion), SHB (76.09 billion), HPG (67.35 billion), and MBB (48.98 billion). On the HNX exchange, foreigners net bought over 32 billion dong, focusing on CEO (13.56 billion), NTP (11.72 billion), SHS (7.36 billion), and PVS (4.93 billion).

12:00 pm: Maintaining a Broad-Based Uptrend

The buying interest was not overly confident to push prices higher, but the positive momentum from the start of the session was maintained until the end of the morning session. At the midday break, the VN-Index rose 8.95 points (+0.74%) to 1,226.2 points; HNX-Index gained 1.43% to reach 212.58 points. The buyers continued to consolidate their advantage, with 474 stocks advancing and 204 declining at the end of the morning session.

Today, the Vingroup’s heavyweights took a back seat as the “king stocks” took center stage. Bank stocks accounted for more than half of the top 10 contributors, with VCB, SHB, and CTG adding 4 points to the index. Additionally, FPT also made a significant contribution, boosting the VN-Index by 1.7 points as it attracted strong buying interest from foreign investors. Meanwhile, the duo of VIC and VHM exerted the most negative pressure, taking away more than 4 points from the overall index.

The green color is spreading well across most sectors. Information technology and telecommunications are the two groups currently leading the market thanks to the strong breakthroughs of FPT (+4.39%), CMG (+4.79%); VGI (+4.09%), CTR (+3.38%), SGT (+1.88%), FOC (+1.31%), and TTN (+3.85%).

The financial group contributed significantly to the market’s rise due to their large market capitalization. In addition to the purple color of SHB, many stocks also surged more than 2%, including VCB, VPB, EIB, BVB, VAB, SHS, PTI,…

Stocks related to exports, such as seafood and textiles (VHC, ANV, IDI, FMC; GIL, TNG, MSH, VGT,…), are recovering well after facing deep correction pressures in the previous phase.

Additionally, industrial real estate stocks were also actively traded as buying interest improved in KBC, IDC, SIP, BCM, NTC, LHG, SZC,… However, the adjustments of the “big boys” like VIC (-4.23%), VHM (-3.7%), PDR (-1.81%), DIG (-0.64%),… continued to weigh on the real estate sector as a whole, making it the only group dominated by red at the end of the morning session, losing 1.71%.

10:40 am: Green Prevails, SHB Continues to Surge

The prevailing sentiment among investors is one of caution, which has caused the main indices to shift from a positive start to a tug-of-war around the reference level. As of 10:30 am, the VN-Index rose 6.81 points to trade around 1,224 points. The HNX-Index gained 3.13 points to trade around 212 points.

Most of the stocks in the VN30 basket were in positive territory. Specifically, SHB, FPT, VPB, and ACB contributed 2.47 points, 1.61 points, 1.24 points, and 0.94 points to the index, respectively. On the other hand, only two stocks, VIC and VHM, faced selling pressure, taking away more than 4.4 points from the VN30-Index.

Source: VietstockFinance

|

The energy group is performing well in the market, although there is still some differentiation among the stocks. Notably, PVS rose 2.76%, PVD gained 1.4%, PVB increased 1.16%, and PVC climbed 1.12%… Meanwhile, stocks like TMB, CLM, CST, POS, etc., remained unchanged.

Following closely, the financial sector also attracted attention, with SHB surging to the ceiling price, VCB rising 1.89%, BID up 0.42%, and CTG climbing 1.21%… On the downside, stocks like PVI, BSI, and BAB… also appeared in the red, but the declines were not significant.

In contrast, the real estate sector witnessed differentiation, with the red color slightly dominating as selling pressure concentrated on VIC, which fell 3.66%, and VHM, which lost 3.35%, causing these two heavyweights to remain in the red. Conversely, the green color was well maintained in several stocks, including BCM (+1.31%), VRE (+1.23%), SSH (+0.86%), KSF (+7.83%),…

Compared to the opening, buyers continued to hold the upper hand. There were 457 gainers and 187 decliners.

Source: VietstockFinance

|

Opening: Continuing the Recovery Trend

At the start of the April 18 session, as of 9:30 am, the VN-Index surged, reaching 1,225.88 points. Meanwhile, the HNX-Index also edged higher, climbing to 212.02 points.

Amid concerns about escalating global trade tensions, the European Central Bank (ECB) decided to cut interest rates for the seventh time since June last year to protect the region’s economy from the risk of recession.

According to the latest announcement, the ECB reduced interest rates by 0.25 percentage points to 2.25%, in line with the expectations of most analysts polled by Bloomberg. Notably, policymakers removed the word “restrictive” when referring to their monetary policy stance, signaling a significant shift in their perception of the current economic situation.

The green color temporarily prevailed in the VN30 basket, with 26 gainers, 2 decliners, and 2 unchanged stocks. Among them, VIC and VHM were the stocks that fell the most. On the upside, SHB, BCM, VNM, and FPT were the stocks that posted the strongest gains.

As of 9:30 am, the energy sector was the group with the most positive impact on the market this morning, with stocks in the sector rising sharply from the start of the session, such as PVD (+1.97%), PVS (+2.36%), PVC (+2.25%), PVB (+0.39%),…

In contrast, the real estate sector was the only group in the red, with the heavyweights in this sector falling sharply from the start of the session, including VIC (-2.96%), VHM (-3.17%), PDR (-0.6%). The remaining stocks in the sector managed to maintain their gains, such as BCM, KDH, KBC, DXG, IDC,…

– 11:50 18/04/2025

The Stock Market Week of April 14-18, 2025: Wide-Ranging Sell-Off Pressure

The VN-Index concluded the session with a surprisingly narrowed advance, while the trading volume surpassed the 20-day average. This development underscores the persistent selling pressure that emerged as the index approached the January 2025 resistance zone (equivalent to 1,220-1,235 points). If the VN-Index fails to successfully breach this threshold in the upcoming period, the risk of a correction will become more apparent as profit-taking selling pressure tends to expand.

The Tiring Index

The VN-Index kicked off the week on a strong note, surging by almost 19 points. However, this was short-lived as the market witnessed two consecutive days of sharp declines. Although the index rebounded in the last two sessions, it still ended the week 2 points lower than Monday’s open, closing at 1,219.12.

The Hunt for Shark Money: Proprietary and Foreign Institutions Unite in Buying Spree, but Diverge on VIX

The April 18th session concluded with a net buying consensus from both proprietary securities companies and foreign investors, with respective figures of over VND 261 billion and VND 11 billion. VIX attracted attention as it was the top net buying stock for proprietary firms but led in foreign net selling.

The Expert’s View: A Market for the Patient, Not the Impatient.

The second quarter will be a true test of the market’s mettle, according to experts. It is not a time to expect skyrocketing profits but rather to assess businesses’ adaptability and resilience in a potentially volatile environment.