Sabeco has announced a dividend payout ratio of 30% (equivalent to VND 3,000 per share). With approximately 1.3 billion shares in circulation, the total payout is estimated to be nearly VND 3,848 billion. The payment is expected to be made by July 31.

Earlier in late January 2025, Sabeco had paid an interim dividend of 20% (VND 2,000 per share). With the completion of this final dividend distribution, the company will have fulfilled its 2024 dividend plan with a total ratio of 50%, amounting to nearly VND 6,413 billion.

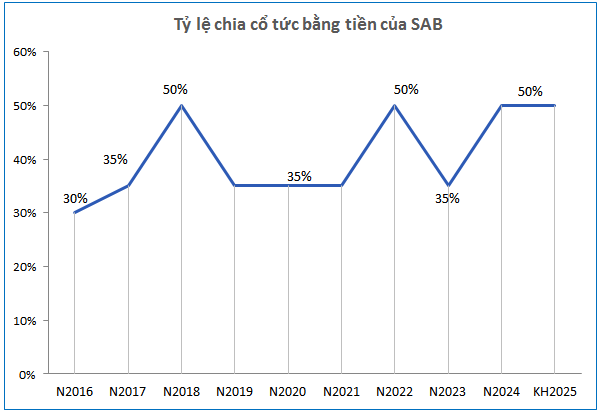

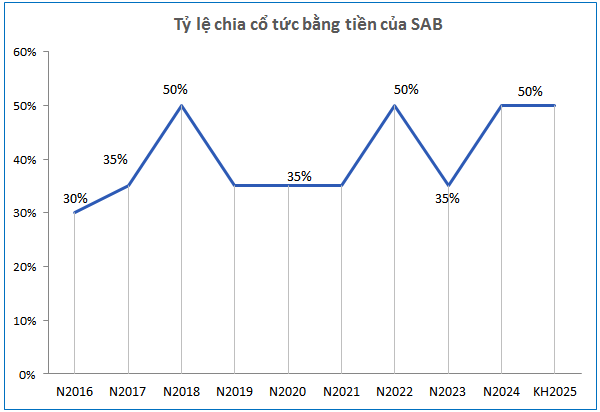

Source: VietstockFinance

|

High cash dividend payouts are not uncommon for Sabeco. In 2018 and 2022, the company distributed dividends at a rate of 50%, while in other years, it typically maintained a payout ratio of 35%.

Source: VietstockFinance

|

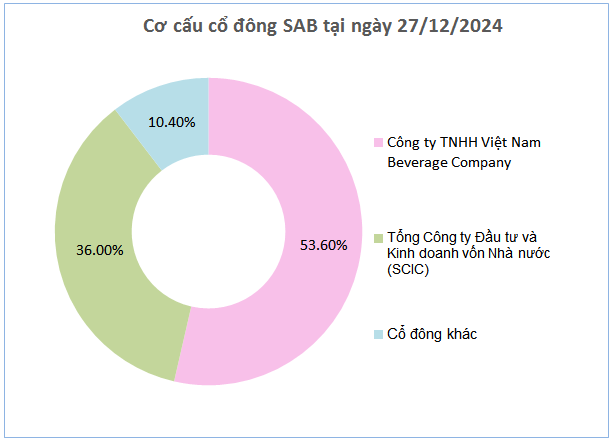

As of December 27, 2024, Vietnam Beverage, Sabeco’s parent company, held a 53.6% stake and is expected to receive over VND 3,436 billion in dividends. In contrast, SCIC, with a 36% stake, is estimated to receive more than VND 2,300 billion in 2024 dividends.

For 2025, Sabeco has set a revenue target of VND 44.8 trillion, a slight decrease of 1% from the previous year, while net profit is expected to reach VND 4.84 trillion, an increase of 8%.

| Sabeco’s First-Quarter Financial Results Over the Years |

In the first quarter, the company behind the Saigon Beer brand recorded a revenue of VND 5.81 trillion and a net profit of VND 800 billion, representing a 19% and 22% decrease, respectively, compared to the same period last year. With these results, Sabeco has achieved 13% and 17% of its annual plan.

– 11:11 07/05/2025

The Ultimate Guide to Dividends: Unlocking the Secrets to Massive Payouts

Unlike previous weeks, the period from April 21–25, 2025, saw a higher number of businesses finalizing dividend payouts. A total of 14 companies finalized dividend payments, with the highest being 30%, meaning shareholders received 3,000 VND for every share owned.