METRO LINE 1: OPEN-LOOP PAYMENT TECHNOLOGY AND SACOMBANK’S FOOTPRINT

In your opinion, what does the collaboration between Sacombank, HURC1, card organizations, and technology companies to implement an electronic ticketing system based on Open-loop technology for Metro Line 1 (Bến Thành – Suối Tiên) mean for public transportation in Ho Chi Minh City and Vietnam as a whole?

The Open-loop public transport payment model has witnessed significant growth worldwide, especially post-COVID-19, as contactless payments become a necessity. This system offers commuters various payment options, including bank cards, Apple Pay, Google Pay, CCCD, or QR code scanning with mobile phones and smartwatches, eliminating the need for traditional paper tickets.

Ho Chi Minh City’s decision to adopt Open-loop technology for the Metro Line 1 (Bến Thành – Suối Tiên) from the outset demonstrates its strategic vision, enabling the city to keep pace with global smart transportation trends. This solution not only enhances the travel experience for commuters but also affirms the city’s status as a modern and progressive metropolis.

Could you elaborate on Sacombank’s role in the electronic ticketing payment process for Metro Line 1 (Bến Thành – Suối Tiên)? Can you also share some insights into the project’s execution with your partners?

We are responsible for providing payment acceptance services, integrating card readers into the ticketing gates, and establishing payment flows and transaction reconciliation processes between issuing banks and card organizations such as Mastercard, Visa, JCB, UnionPay, American Express, and Napas. This system ensures swift transaction processing while adhering to the highest security standards, allowing commuters to use their bank cards, mobile phones, or smartwatches for safe and seamless payments when using public transportation.

While we have been nurturing this project for an extended period, the focused implementation phase lasted approximately three months before its operational launch. Through the close collaboration of our experienced project team in the payments domain, leading technology partners, and the invaluable advisory role played by Mastercard, the electronic ticketing payment system has been operating smoothly since the metro line commenced operations.

Apart from the evident benefits of the electronic ticketing system for commuters, what advantages does it offer to managing and operating agencies like HURC1?

Undoubtedly, this electronic ticketing system not only enhances convenience for passengers but also yields substantial benefits for managing and operating agencies such as HURC1. Firstly, it optimizes financial management by promoting cashless payments, enhancing transparency, and reducing the risks of cash leakage and errors associated with manual cash handling. Additionally, automated transaction reconciliation streamlines processes and significantly saves time and resources compared to manual recording and counting methods.

Secondly, it considerably reduces operational costs by lowering staffing expenses for ticket booth personnel, minimizing paper ticket printing and automatic ticket machine maintenance costs, and ultimately enhancing operational efficiency. This initiative also contributes to the development of green transportation, reducing paper ticket waste, and fostering environmental protection.

Furthermore, the digital payment system provides real-time passenger data for metro rides, enabling managers to analyze passenger volume and travel patterns to optimize routes and service frequencies. Thus, the electronic ticketing system is not merely a convenient payment method but also a vital tool for modernizing the management and operation of urban transportation.

SACOMBANK’S VISION: PARTNERING FOR GREEN AND SMART TRANSPORTATION DEVELOPMENT

What is your assessment of the status of electronic payments in the transportation sector in Vietnam? What role do banks, including Sacombank, play in this digital transformation journey?

In reality, the digitization of payment processes in Vietnam’s transportation sector is still in its early stages and faces considerable challenges. Beyond the implementation of non-stop electronic toll collection (ETC) on expressways and the adoption of cashless payment projects for public transportation in major cities like Ho Chi Minh City and Hanoi, other provinces and cities have limited opportunities and face obstacles in embracing this digital shift.

Therefore, despite significant progress, we must continue to upgrade infrastructure, harmonize systems, and accelerate the digitization of more processes to align transportation nationwide with the digital economy vision set forth by the government. This underscores the crucial role of banks in providing connectivity, consulting, and supporting the deployment of digital payment solutions for each locality. With its experience, modern technological foundation, continuous investment, and willingness to pioneer new technologies, Sacombank is committed to collaborating with provinces and cities to research and implement smart payment systems suited to their specific contexts.

I firmly believe that with strong support from the government, ministries, local authorities, and the dedication of banks and technology companies, we will soon realize the goal of smart transportation, delivering tangible benefits to the people and society.

Apart from Metro Line 1, what other projects is Sacombank involved in to support Ho Chi Minh City’s development of green, sustainable, and environmentally friendly transportation?

Sacombank is collaborating with the Ho Chi Minh City Department of Transport and partners to implement an electronic ticketing payment system for buses, river buses, and electric buggies. Over 2,200 buses across the city will be equipped with a unified payment system, enabling commuters to use bank cards or e-wallets instead of paper tickets. Currently, more than 510 buses have integrated this new payment system, aiming for a 100% completion rate by the end of June 2025.

This initiative will also pave the way for the city to interconnect the electronic ticketing system, creating a diverse and interconnected public transportation ecosystem. It will offer commuters a seamless and swift travel experience without the hassle of payment concerns. Notably, the city targets a full transition to electric and green energy buses by 2030, and Sacombank pledges to continue its partnership and provide state-of-the-art electronic payment solutions to support the sustainable development of urban transportation.

In tandem with payment infrastructure investments, Sacombank has also pioneered the development of green card lines to encourage the use of public transportation and promote sustainable consumption. Specifically:

Sacombank Mastercard Metro Pass and Sacombank Mastercard MultiPass card lines offer numerous benefits tailored to customers who frequently use public transportation such as buses and metros. For instance, MultiPass cardholders can ride buses at a flat rate of 5,000 VND, while the maximum fare for Metro Line 1 is 10,000 VND, resulting in savings of up to 50% compared to regular fares.

Additionally, when purchasing bus passes with the MultiPass card, customers enjoy a further 5% discount. These practical incentives aim to encourage a shift towards green, cost-effective, and safe mobility options.

Sacombank Visa Platinum O₂ and Sacombank Mastercard Debit Eco Green card lines: These pioneering credit cards feature a transaction-based carbon emissions measurement function, raising customers’ awareness of their environmental impact through spending habits.

Moreover, attractive cashback incentives are offered to customers who consume green and environmentally friendly products and services. Notably, for each new card opened, Sacombank contributes 10,000 VND to the “Live Healthy” Community Development Fund, established in collaboration with the Ho Chi Minh City Youth Union and the Vietnam Student Union.

Sacombank is committed to continuing its research and development of innovative digital financial solutions, partnering with the government and the community to build a smart, modern, and environmentally friendly urban area.

“GREEN COMMITMENT”: SACOMBANK’S EFFORTS TOWARD A SUSTAINABLE FUTURE

Currently, ESG practices, green growth, and sustainable development have become inevitable trends and goals that many countries, including Vietnam, are pursuing. The financial and banking sector plays a crucial role in this journey. How does Sacombank view ESG, and are the bank’s efforts to promote cashless payments in transportation aligned with ESG goals?

Absolutely! We consider ESG not merely as a trend but as an integral part of our long-term strategic development. Our commitment to ESG is not new; for over 33 years, Sacombank has always placed social responsibility on par with business objectives, striving for shared prosperity for the economy and the community.

Undeniably, the financial and banking sector plays a pivotal role in supporting businesses and society in transitioning to sustainable growth models. Sacombank has been focusing its lending activities on green sectors such as sustainable agriculture and forestry, renewable energy, and clean industries. Various preferential lending programs have been implemented to support businesses and individuals engaged in environmentally friendly practices.

The digitization of transportation payment processes is just one aspect of Sacombank’s ESG strategy, which aims to foster the digital economy and Vietnam’s green transformation. We are also researching and applying interconnected financial solutions, including digital payment systems, digital partnerships, and financing, in other critical sectors like education and healthcare.

We believe that through close collaboration among banks, government agencies, and enterprises, ESG will not only be a goal but will become a core value in all socio-economic activities, paving the way for a more sustainable future for Vietnam.

Thank you for your insights!

|

On the occasion of the 50th anniversary of the Liberation of the South (April 30, 1975 – April 30, 2025) and marking a new milestone in Ho Chi Minh City’s public transportation development, Sacombank proudly partners with the exhibition of beautiful images depicting the city’s growth journey at the Metro Bến Thành Station. Beyond retracing the city’s remarkable development over the past five decades, the exhibition also showcases modern payment solutions for public transportation, such as the Sacombank Mastercard Metro Pass and Sacombank Mastercard MultiPass cards, promoting cashless transactions and the utilization of the smart transportation ecosystem. To celebrate this occasion, Sacombank introduces attractive promotions for MetroPass and MultiPass cardholders, supporting Ho Chi Minh City’s “Free Bus Ride on April 30” program. Specifically, from April 25, 2025, to May 30, 2025, for MetroPass cards, and from April 11, 2025, to May 30, 2025, for MultiPass cards, cardholders will enjoy a 100% refund for tap-to-pay transactions on the metro, buses, and other public transport means within the MultiPass ecosystem. |

– 13:22 29/04/2025

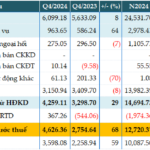

Unlocking Sacombank’s Record-Breaking Success: A Dive into the Bank’s Impressive Q4 Performance and Annual Profits Surpassing 12,000 Billion VND

The bank’s estimated pre-tax profit for Q4 2024 stood at over VND 4,600 billion, a remarkable 68% increase compared to the same period last year. For the full year of 2024, the bank’s pre-tax profit is estimated to exceed VND 12,700 billion, the highest in its history and surpassing the target set by the Annual General Meeting of Shareholders.

Revolutionizing Urban Transportation: Sacombank’s Cashless Payment Solutions for a Greener Ho Chi Minh City

On December 22, the long-awaited Metro Line 1, connecting Ben Thanh and Suoi Tien, will officially open for commercial operations. This marks a significant step forward in the city’s transportation system, offering a fast and efficient way to travel. What’s truly remarkable is that passengers can now enjoy a seamless, cashless payment experience for their tickets through an innovative electronic ticketing system, powered by HURC1, Mastercard, and Sacombank. This cutting-edge Open-loop technology promises a convenient and secure journey for all commuters and tourists alike.

The Great Bank Clearance Sale: Offloading a Thousand Billion Debt, Including Nearly 6,000 Taels of SJC Gold.

Sacombank continues to slash prices on its long-standing debt, which includes a substantial cash loan and nearly 6,000 taels of SJC gold. Despite previous price cuts, this debt has remained stubbornly persistent over the years.