State Budget Revenue Reaches Nearly VND 1 Quadrillion in First Four Months

According to the Ministry of Finance, state budget revenue in the first four months of this year reached over VND 944 trillion, a more than 26% increase compared to the same period last year. The budget revenue estimate for the whole year is over VND 1.9 quadrillion, meaning that after just four months, the revenue has already reached nearly 50% of the plan. Notably, domestic revenue increased by nearly 30% (reaching over VND 827 trillion). Stable import-export activities also contributed significantly to the budget.

State budget revenue reached 48% of the estimate in four months.

According to statistics from local authorities, Hanoi continues to lead the country in budget revenue, reaching over VND 310 trillion, accounting for 61% of the estimate, and a 59% increase compared to the same period last year. In 2024, Ho Chi Minh City lost its top position in budget revenue to Hanoi for the first time. In recent years, domestic revenue has continued to account for a large proportion, especially from foreign-invested enterprises (FIEs), non-state sectors, and personal income tax. A positive signal indicates that the source of revenue is shifting from a dependence on land to production and business activities.

In the first four months, Ho Chi Minh City collected more than VND 200 trillion, equivalent to nearly 39% of the estimate, ranking second in the country. The slight increase of just over 3% compared to the same period in 2024 has caused the former “locomotive” to lag behind Hanoi. Hai Phong ranked third in the country, with a budget revenue of nearly VND 58 trillion.

The leading group in budget revenue also includes familiar names such as Ba Ria-Vung Tau, Binh Duong, Dong Nai, Bac Ninh, and Quang Ninh. The geographical advantages, infrastructure, seaports, industrial parks, and location at the gateway for import-export activities of these provinces have created a stable and consistently growing source of revenue over the years.

Meanwhile, regions in highland and border areas, where economic activities have not developed strongly, have limited revenue. There is a gap of up to tens of times when comparing the revenue of leading cities such as Hanoi and Ho Chi Minh City with low-revenue localities such as Bac Kan, Dien Bien, Lai Chau, and Cao Bang.

2024 was the last year of budget revenue statistics from 63 localities, with Bac Kan being the only province with revenue below VND 1,000 billion. Dien Bien collected over VND 1,500 billion, while Cao Bang and Lai Chau were just over VND 2,000 billion.

A “Measure” of Reform Effectiveness

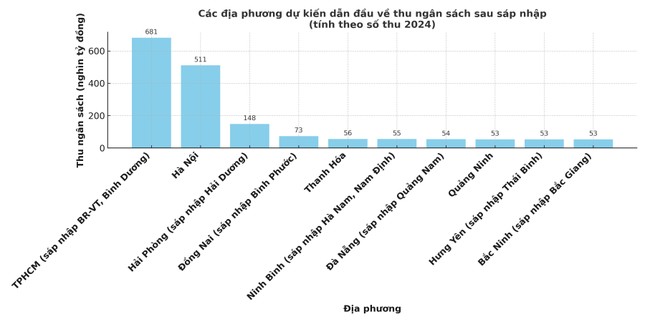

According to the list of 34 provinces and cities after the merger, some provinces with high revenue will be merged with provinces with low revenue, and the picture of budget revenue of localities will change. Based on the 2024 budget revenue figures, it is expected that after the merger of 10 provinces and cities, the budget revenue will exceed VND 50,000 billion.

Ho Chi Minh City is expected to regain its top position in the country, with the merger of Ba Ria-Vung Tau and Binh Duong, which are also among the leading provinces in terms of budget revenue. In 2024, the total budget revenue of Ho Chi Minh City, Ba Ria-Vung Tau, and Binh Duong reached nearly VND 682 trillion. Hanoi ranked second with more than VND 511 trillion.

Hai Phong (merged with Hai Duong) will rank third with VND 148 trillion. Dong Nai (merged with Binh Phuoc) will rank fourth with VND 73 trillion.

Provinces and cities expected to lead in budget revenue after the merger (based on 2024 revenue figures).

The localities with revenue of over VND 50,000 billion also include Thanh Hoa and Ninh Binh (merged with Ha Nam and Nam Dinh); Da Nang (merged with Quang Nam); Quang Ninh and Bac Ninh (merged with Bac Giang); and Hung Yen (merged with Thai Binh).

However, there are still some provinces in the country with a budget revenue of less than VND 10,000 billion, including Dien Bien, Cao Bang, Lai Chau, Son La, and Tuyen Quang (merged with Ha Giang), according to the 2024 figures.

Among the 34 new provinces and cities, there are localities with high revenue merging with localities with low revenue, and the total revenue will increase. However, according to experts, challenges may also arise in allocating resources reasonably and avoiding concentrating them in developed areas. The effectiveness of budget revenue after the merger depends largely on the management and resource allocation capacity of each locality.

An Important Indicator Emerges

In an interview with Tien Phong newspaper, PGS, TS. Nguyen Thuong Lang of the National Economics University stated that the merger would “expand the development space.” However, he did not rule out the possibility of some units falling into difficulties and being unable to catch up with the potential of the merged unit, leading to a relatively “disadvantaged” state in terms of investment and trade. As a result, there may be an increasing gap in development levels.

“This phenomenon is common in many countries. There needs to be a mechanism for redistributing and reallocating resources among units reasonably, adjusting the economic structure, and reducing dependence on traditional resources to narrow the gap in budget revenue and development levels between units,” emphasized Mr. Lang.

According to experts, the disposal of redundant assets can contribute to budget revenue.

According to the expert, after the merger of provinces and cities, and the rearrangement of the apparatus, the state budget will generally have more room to increase. By streamlining the apparatus, reducing the number of units and personnel, and decreasing the number of people in the apparatus, regular expenditures tend to decrease. In terms of revenue, apart from expectations from thriving production and business activities, PGS, TS. Nguyen Thuong Lang also forecasts a possible surge in revenue from the disposal of redundant assets.

“The rearrangement process will result in various types of redundant assets that need to be disposed of, such as the land-use rights value of 29 provincial-level administrative headquarters and thousands of district- and commune-level ones. If the land-use rights of these plots of land, which are in extremely favorable locations, are auctioned for the development of high-tech industrial parks, high-end urban areas, commercial centers, and high-end business and service areas, it can lead to a sudden increase in revenue.

Other types of assets, such as official residences, infrastructure works, unused cars, and means of transport, can be transferred to units in need or auctioned, thus increasing the budget of both the central and local governments in the second half of the year,” said Mr. Lang.

The role of the economic “locomotives” needs to be promoted.

Economist PGS, TS. Ngo Tri Long stated that the growth in budget revenue is an important indicator reflecting the effectiveness of reform measures, especially in the context of the administrative apparatus having been rearranged and streamlined after the merger. To ensure “sustainable budget revenue”, Mr. Long emphasized the need to expand the tax base to include areas with potential, such as the digital economy, services, and new industries; strengthen inspection and control to prevent revenue loss and tax evasion, especially in new areas such as e-commerce and digital platform-based businesses.

Regarding the role of the two economic “locomotives” of the country, Mr. Long said that Ho Chi Minh City and Hanoi need to nurture and expand their revenue sources by supporting businesses, reforming the tax system, attracting investment, and developing the private sector.

In addition, public investment is also a key driver to stimulate growth and create sustainable revenue. In this regard, Hanoi aims to disburse about VND 87 trillion in 2025, focusing on major transport infrastructure projects such as bridges and urban railways. Ho Chi Minh City is also aggressively implementing public investment projects from the beginning of 2025 to address bottlenecks in transport infrastructure.

Unveiling the Real Estate Hotspots in the Newly Merged Province-City

The Capital Region is experiencing a significant real estate investment boom, particularly in its satellite towns. The anticipated provincial and municipal mergers are expected to catalyze unprecedented market growth, presenting lucrative opportunities for investors and developers alike.