Abundant Supply, Yet Auto Market Sales Still Decline

According to statistics from the Vietnam Automobile Manufacturers’ Association (VAMA), with 29,585 cars sold, the sales of its members in April 2025 decreased by 7% compared to March 2025.

However, the cumulative four-month period of 2025 saw a total market consumption of 101,834 units, a 23% increase compared to the same period in 2024.

Of this total, the sales of passenger cars and commercial vehicles reached 20,766 and 8,619 units, respectively, both down 7% from the previous month. Conversely, the group of specialized vehicles showed growth with 200 units sold, up 11%.

In terms of origin, domestically produced and assembled cars sold 13,890 units, down 7% from the previous month. Similarly, imported cars also decreased by 7% with 15,695 units sold.

Despite the decline in sales, the supply of new cars in the market showed significant growth.

The latest data from the General Statistics Office shows that in April, the Vietnamese car market received 56,563 new cars, including domestically assembled and imported cars. This figure represents a slight increase of 4.8% compared to March (53,960 units).

Notably, the output of domestically produced and assembled cars reached 39,500 units, a remarkable growth of 3.7% compared to the previous month and a 60% increase compared to the same period in 2024.

This is the highest output in the first four months of 2025, indicating that domestic manufacturers are still making efforts to boost production to meet the potential market demand or clear existing inventory.

Why is the Vietnamese Auto Market Stagnating?

The auto market in the past month showed signs of stagnation due to several notable factors.

Accordingly, the unprecedented price reduction at the beginning of 2025, when manufacturers and dealers simultaneously launched huge promotions to clear inventory from 2024, triggered a wave of strong shopping demand. However, this boom in demand quickly led to market saturation, resulting in a significant decline in current purchases.

Another factor worth mentioning is that April coincided with two long holiday periods – the Hung King’s Commemoration Day and the Liberation Day and International Workers’ Day holidays. The extended breaks encouraged people to prioritize spending on travel and entertainment, temporarily setting aside large-value purchases like automobiles.

Additionally, a significant portion of customers are awaiting more attractive promotions or the launch of new car models in the coming months, especially during the summer. The combination of these factors contributed to the significant decline in auto sales last month.

Moreover, the Vietnamese auto market is witnessing intensified competition among brands. On the other hand, the slow sales pace could lead to an increased risk of inventory accumulation.

With more and more new car brands entering the Vietnamese market and many upcoming models hinted at a summer launch, the heightened competition will drive all brands to devise different strategies to boost sales.

To stimulate purchasing demand, car manufacturers and dealers will likely need to offer deeper discounts and more appealing promotions.

In the context of excess supply over demand, the flexibility and effective marketing strategies of manufacturers will play a pivotal role in shaping market trends in the remaining months of 2025.

VinFast Remains the Market Leader

The sales report and ranking of the best-selling models in April 2025 revealed an interesting trend in the Vietnamese auto market.

The dominance of VinFast electric vehicles in the top three positions reflects a new consumption trend in Vietnam, where consumers are increasingly favoring environmentally friendly vehicles and prioritizing high-quality domestic products.

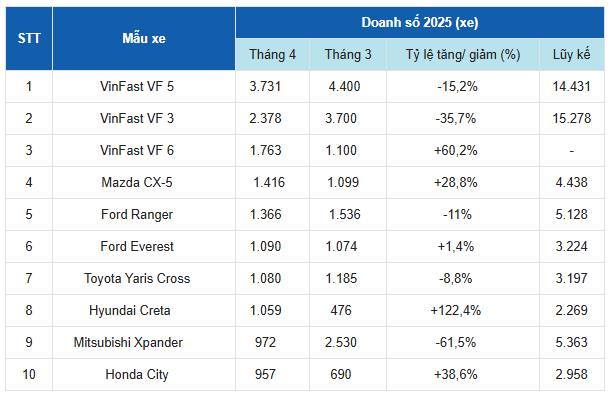

Top 10 best-selling models in the Vietnamese market in March and April 2025 (Source: VAMA, TC Motor, VinFast)

Most of the models in the ranking experienced a decline in sales. Nevertheless, VinFast, the Vietnamese automotive brand, remained steadfast in the leading position, delivering 9,588 vehicles to customers (equivalent to 320 cars/day) in April. In the first four months of 2025, a total of 44,691 VinFast electric vehicles were sold in the domestic market.

Notably, the VinFast VF 5 model continued to hold the top spot among the best-selling vehicles in April 2025 with 3,731 units sold.

Compared to the sales of 4,400 units in March 2025, VF 5 witnessed a decrease of over 15.3%. However, the cumulative four-month sales of VF 5 remained impressive at 14,431 units.

This success stems from the model’s suitability for both personal use and business service purposes. Currently, the VinFast VF 5 is priced at 529 million VND (including the battery) and remains a prominent name in Vietnam’s electric vehicle market thanks to its modern design, advanced technology, and cost-effectiveness.

The model is exempt from registration fees until the end of February 2027, resulting in savings of around 50-60 million VND when on the road.

Closely following VF 5 in the ranking is its “sibling” VF 3, with April sales reaching 2,378 units.

However, the cumulative sales of this model in the first four months stood at 15,478 units. Along with VF 5, the VF 3 mini SUV has consistently contributed to VinFast’s robust sales growth.

Particularly, since the Vietnamese automaker stopped the battery leasing policy and applied an attractive price of only 299 million VND (including the battery), the VF 3 has become increasingly popular and chosen by many customers.

The unique design, high customization, and affordable price are the key factors that make the VinFast VF 3 appealing to Vietnamese consumers, especially those who want to explore and experience electric vehicles.

The third position in the ranking of best-selling models in April 2025 went to another VinFast representative: VF 6.

VF 6 witnessed impressive sales growth in April, with 1,763 units sold, compared to 1,100 units in March 2025, an increase of over 60%. This performance helped VinFast secure the top three positions in the ranking.

The VF 6, a highly-rated model in the B-segment, is known for its design, equipment, and performance, catering to both individual and family buyers. Currently, VinFast VF 6 is available in Vietnam in two versions, with prices ranging from 694 to 759 million VND.

The Tech-Savvy Taxi Cooperative’s Bold Move: Purchasing and Leasing 5,000 Vinfast Electric Vehicles

On September 4, 2024, the Southern Economic Union Cooperative Alliance took a significant step towards a greener future by signing a strategic cooperation memorandum with GSM Corporation. The alliance plans to lease and purchase 5,000 VinFast electric vehicles in 2024, aiming to gradually replace their existing fleet of gasoline-powered cars.