A standout performer was the financial statement audit services for public interest entities, which witnessed a remarkable 52.49% growth, generating over VND 451 billion in revenue.

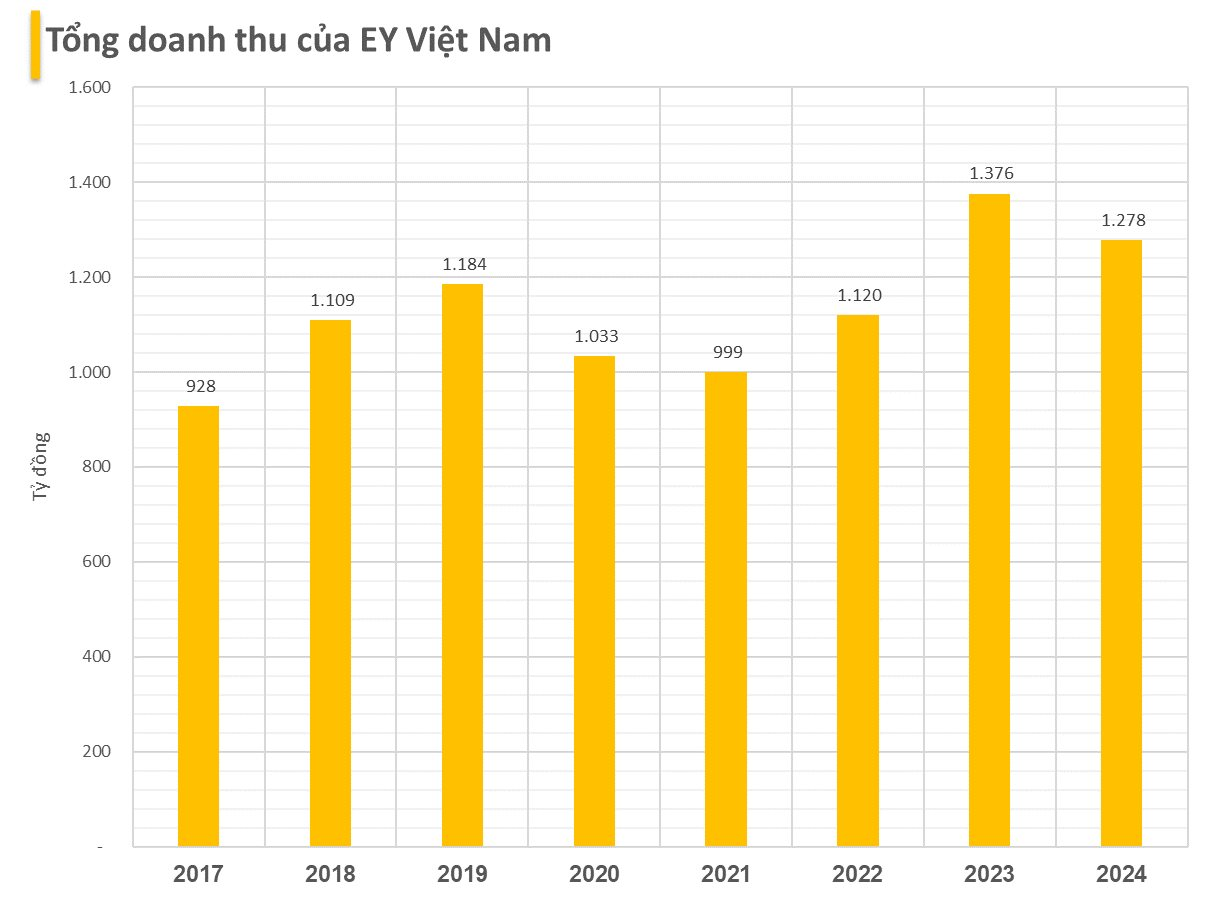

However, revenue declines were observed in other segments. Audit services for other entities witnessed a significant drop of 24.43%, resulting in just over VND 630 billion. Similarly, revenue from other services fell by 20.07% to nearly VND 197 billion. These decreases offset the growth in the audit segment, leading to an overall revenue decline for the company.

On the expense side, EY Vietnam’s total operating expenses for 2024 amounted to nearly VND 1,273 billion, a 6.59% decrease from the previous year. Employee salary and bonus expenses, the largest expense category, saw a slight reduction of 1.26% to nearly VND 695 billion. Other expenses also witnessed significant savings of 12.35%.

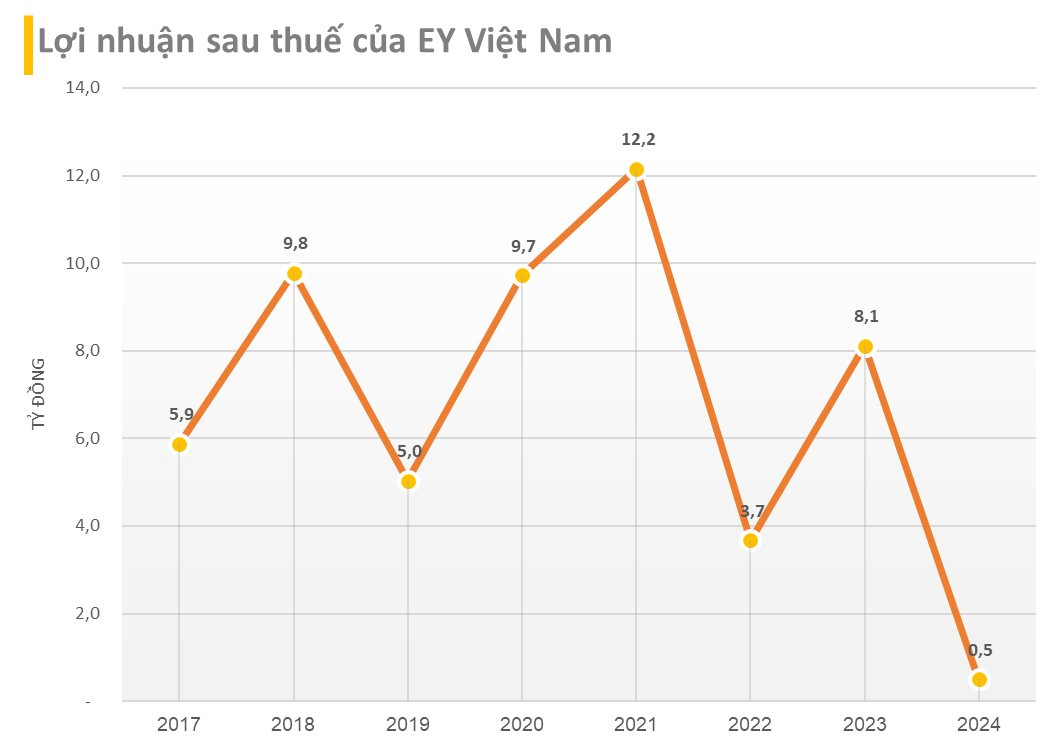

Despite the cost-cutting measures, the decline in expenses couldn’t keep pace with the drop in revenue. As a result, EY Vietnam’s net profit for 2024 stood at just VND 494.7 million, a steep 93.9% decline compared to the previous year’s profit of over VND 8.1 billion. This profit figure is also the lowest in the period from 2017 to the present.

EY Vietnam’s total tax liability to the state budget decreased significantly by 94.38% to just over VND 11.2 billion. Notably, the company’s corporate income tax liability for 2024 was zero, compared to nearly VND 4.3 billion in 2023.

The Nation’s Largest Pawnshop Network Releases Detailed Financial Statements: Nearly VND 3,700 Billion in Loans, Maximum Interest and Fees of 7.5% per Month, with Profits Derived Primarily from Asset Disposal

As of this writing, F88 has short-term borrowings of VND 1,457 billion and long-term borrowings of VND 1,450 billion with an interest rate cap of 12% per annum. The company also offers bonds with a fixed interest rate ranging from 10.5% to 11.5% per annum.

“Insider Shareholder Plans to Exit SaigonBus, Stock Plunges”

The share price of Saigon Bus Joint Stock Company (SaigonBus, UPCoM: BSG) plummeted to its floor price of VND12,200 per share during the morning session on May 15, following a series of registration for divestment by major shareholders related to Mr. Tran Ngoc Dan, a member of the company’s Board of Directors.