According to the Hanoi Stock Exchange (HNX), two bond codes HVC12501 and HCV12502, each with a volume of 400 bonds, were domestically issued on May 23 and 26, with a par value of 1 billion VND per bond.

Specifically, bond code HVC12501 has a term of 728 days and will mature on May 21, 2027, while bond code HCV12502 has a term of 24 months and will mature on May 26, 2027.

These are all “triple-no” bonds – non-convertible, non-warrant, and unsecured. The issuance interest rate for both is 6.8%/year, with interest paid periodically every 12 months.

Source: HNX

|

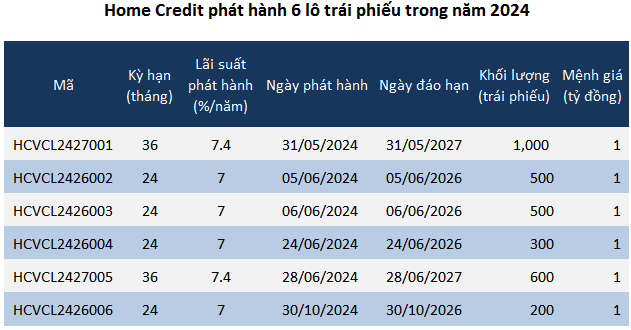

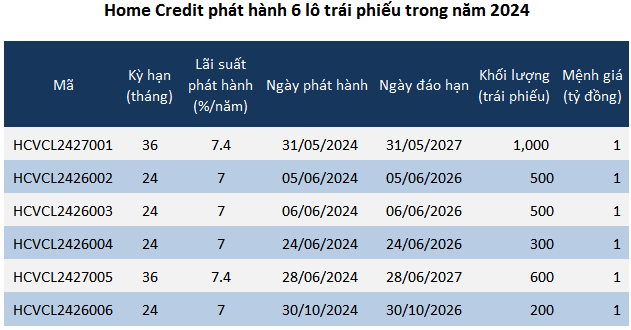

Previously, in 2024, Home Credit made six bond issuances totaling 3,100 billion VND, with interest rates ranging from 7-7.4%/year and tenors of 24 to 36 months. As of now, these bond batches have not yet reached their maturity dates.

In terms of capital structure, as of December 31, 2024, Home Credit reported bank loan balances of 5,898 billion VND, an 8% decrease compared to the beginning of the year. In contrast, bond debt increased sharply, doubling to 3,100 billion VND. As a result, the Company’s total loan balance increased by 20%, exceeding 8,997 billion VND.

Home Credit Vietnam was once a member of the Home Credit Group – one of the largest consumer finance companies headquartered in the Czech Republic, operating in several European and Asian countries. Entering the Vietnamese market in 2008, Home Credit quickly became a leading name in consumer lending, especially in installment loans for electronics, motorcycles, and cash loans.

In February 2024, the Home Credit Group announced the transfer of 100% of its capital contribution in Home Credit Vietnam to The Siam Commercial Bank Public Company (SCB), a member of SCBX Public Company (SCBX) – a large financial institution in Thailand. The transfer agreement was valued at approximately 800 million euros (equivalent to 865 million USD).

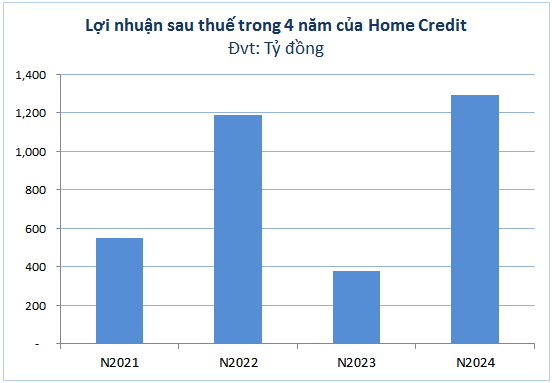

After a rapid growth phase, Home Credit experienced a slowdown due to the impact of the COVID-19 pandemic and changes in the risk control policies within the industry. Following a dip in profits in 2023, the company started to recover strongly, amidst a rebound in domestic consumer demand and a low-interest rate environment.

Source: VietstockFinance

|

2024 marked a breakthrough in Home Credit’s business results, with after-tax profits surpassing 1,291 billion VND – the highest in four years and 3.4 times higher than in 2023.

– 13:55 30/05/2025

“Vingroup Backs VinFast’s Issuance of up to VND 5,000 Billion in Bonds”

Over the past month, Vingroup, owned by billionaire Pham Nhat Vuong, has issued six bond offerings, raising a total of VND 15,000 billion (approximately USD 640 million).

Denied Appeal, TOP Stock Suspended from Trading on UPCoM

“The company is yet to release its audited financial statements for the years 2022-2024, and no remedial measures have been implemented. This lack of transparency raises concerns among investors and stakeholders, casting doubt on the company’s credibility and financial health. The absence of audited reports prompts questions about the reliability of their financial data and the potential risks associated with their business operations.”