On June 2, 2025, a press conference was held to mark the 5th anniversary of the “Cashless Day 2025” campaign, with the theme “Cashless Payments Drive the Digital Economy.” This event highlighted the progress made in Vietnam’s journey towards a cashless society.

Mr. Pham Anh Tuan, Director of the Payment Department of the State Bank of Vietnam (SBV), emphasized that cashless payments are more than just a transaction method. They are a strategic foundation that connects all components of the digital economy. This approach is vital to fostering a robust and seamless digital ecosystem, propelling Vietnam towards a modern, transparent, and inclusive economic landscape.

Vietnam has made significant strides in establishing the legal framework and infrastructure necessary for a cashless society. The Law on Credit Institutions of 2024 includes provisions on refining regulations related to electronic banking services and agency activities in the payment domain. It also paves the way for testing and deploying new technologies, products, services, and business models in the banking sector.

Mr. Pham Anh Tuan, Director of the Payment Department, State Bank of Vietnam (SBV)

|

Building on this legal foundation, the SBV has presented the government with decrees and circulars regulating cashless payments and controlled testing in the banking sector. In terms of infrastructure, the SBV has successfully implemented the Interbank Electronic Payment System, ensuring stable and seamless operations.

The financial switching and electronic clearing system has been operating securely and efficiently, continuously expanding in scale and connectivity while incorporating new features. This system facilitates cross-border retail payments with Thailand, Cambodia, and Laos and is currently being extended to include China and South Korea.

Mr. Pham Anh Tuan revealed that out of 200 million bank accounts in Vietnam, only 113 million individual accounts and over 711,000 organizational accounts remained active after the SBV mandated biometric authentication. This process involved matching biometric information with the national population database. Inactive accounts may include dormant, fraudulent, or non-compliant accounts opened in the past.

“Over the past seven years, while we encouraged people to open bank accounts, some issues emerged. Now, we must work together to combat fraud,” Mr. Pham Anh Tuan shared. According to statistics from the General Statistics Office of Vietnam, as of the end of 2024, there were 69 million adults (aged 15 and above) in the country, and over 68 million of them had bank accounts. This indicates a significant shift towards cashless payments in Vietnam.

Another significant development is the recognition of e-wallets as a legitimate means of payment from July 1, 2025, akin to cash, cards, and bank accounts. This change will enable e-wallet users to make payments and transfers directly from their e-wallets, without necessarily routing through linked bank accounts. This regulatory shift expands the potential for e-wallets to penetrate the market and offer services, especially in remote areas.

Mr. Pham Anh Tuan also addressed the upcoming amendments to Circular 40, expected to come into force on September 1, 2025. These changes aim to facilitate the growth of e-wallets while ensuring compliance with the law and preventing their use for illegal activities such as black-credit, gambling, and unauthorized trading platforms.

|

In the first quarter of 2025, transactions through the Interbank Electronic Payment System neared 35.7 million, totaling VND 81.46 quadrillion, reflecting increases of 9.6% and 36.81%, respectively, compared to the same period in 2024. Transactions through Napas, a leading domestic payment network, reached 2.45 billion, totaling VND 14.97 quadrillion, representing increases of 13.53% and 2.54%, respectively, compared to 2024. Meanwhile, POS transactions amounted to nearly 181.23 million, totaling VND 292,241 billion, a slight decrease of 0.48% in value compared to the previous year. In contrast, ATM transactions witnessed a decline, dropping by 15.22% in volume and 4.22% in value compared to the same period in 2024, with 183.3 million transactions totaling VND 662,835 billion. |

– 4:51 PM, June 2, 2025

The Ultimate Guide to the Bien Hoa – Vung Tau Expressway: Unveiling the Transformation After Two Years of Construction in Dong Nai

After almost two years of construction, the Bien Hoa – Vung Tau expressway, spanning through Dong Nai province, has witnessed significant progress with asphalt paving completed on numerous sections and nearly 100% of the required land area cleared.

The U.S. Remains a Promising Market for Vietnamese Textile and Footwear Industries.

“In a recent statement, the Trade Counselor of the Vietnamese Embassy in the US quoted President Donald Trump as saying that a booming textile industry is not a necessity for the US, and that textile products such as shirts and socks can be ‘very well made elsewhere.’ This presents a promising and opportunistic outlook for Vietnamese textile and footwear exports to the US market.”

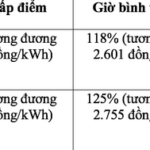

Electric Car Charging Stations: A New Electricity Rate Structure for a Greener Future

Electric vehicle charging stations will now have their own dedicated electricity retail prices, based on voltage levels. During peak hours, the rates can go as high as VND 4,298 per kWh.