Source: Author’s Compilation

|

An analysis of 43 active fund management companies in the market that have disclosed complete information reveals that investment portfolio management services, or taking money from customers to invest in securities on their behalf, significantly contribute to their business results. In Q1 2025, out of the sector’s total revenue of over VND 887 billion, nearly VND 415 billion came from investment delegation services, accounting for 47%.

Revenue from this segment increased by 12% compared to the same period last year, largely contributing to the industry’s revenue growth, partly supported by the increase in the value of assets under management.

This reflects the industry’s uniqueness, clearly demonstrated through the value of delegated investment portfolios, which account for the majority of off-balance sheet metrics.

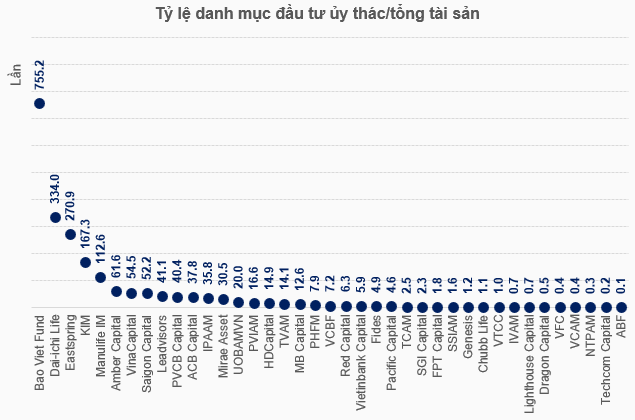

Bond “giants” solidify their positions

As of the end of Q1 2025, the fund management industry had 39 companies engaging in investment delegation activities, of which 31 companies had delegation scales larger than their total assets. The leaders in this regard were companies with insurance backgrounds, such as Bao Viet Fund (under the Bao Viet Group) at more than 755 times, Dai-ichi Life (under Dai-ichi Life Vietnam) at approximately 334 times, Eastspring Investments (under Prudential Vietnam Assurance) at nearly 271 times, and Manulife IM (under Manulife Vietnam) at almost 113 times.

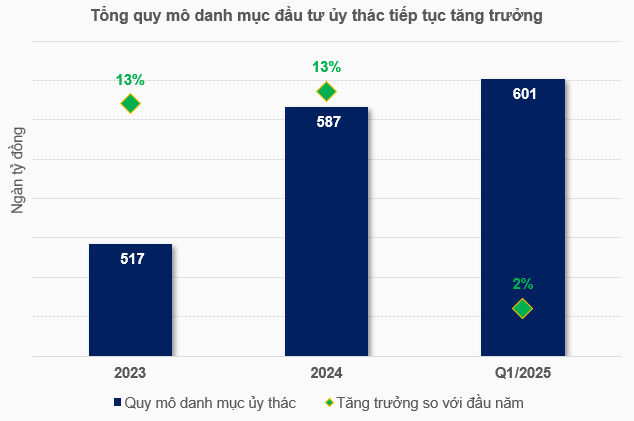

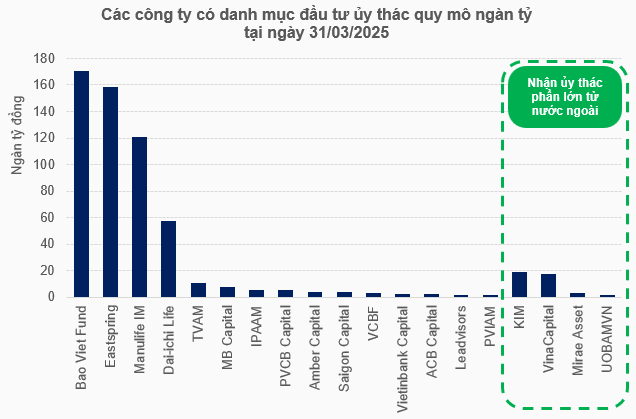

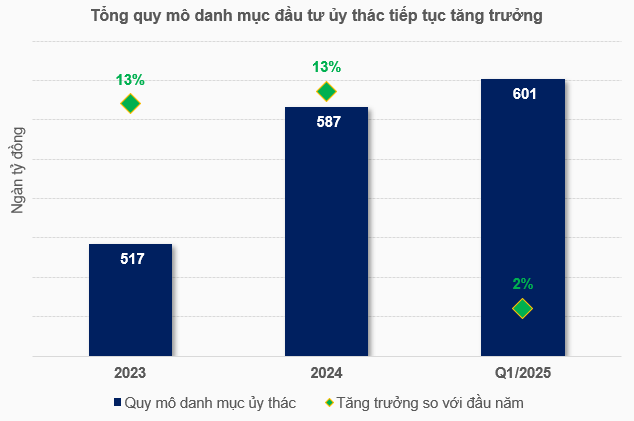

The industry’s delegated investment portfolio scale reached nearly VND 601 trillion, a slight increase of 2% from the beginning of the year. The industry recorded 19 companies with portfolios worth trillions of dong, one more than at the beginning of the year, with the additional presence of PVIAM. Overall, the total delegation scale of the “trillion-dong club” reached nearly VND 596 trillion.

Naturally, by leveraging the abundant funds from insurance companies for investment, the top four positions in the ranking by delegation scale belonged to Bao Viet Fund, with over VND 170 trillion, Eastspring Investments with nearly VND 159 trillion, Manulife IM with almost VND 121 trillion, and Dai-ichi Life with more than VND 57 trillion.

Among the companies with the largest delegation portfolios, there were also those that received delegations mostly from foreign sources, including KIM Vietnam with over VND 19 trillion, VinaCapital with more than VND 17 trillion, and Mirae Asset (Vietnam) with over VND 3 trillion.

Source: Author’s Compilation

|

Source: Author’s Compilation

|

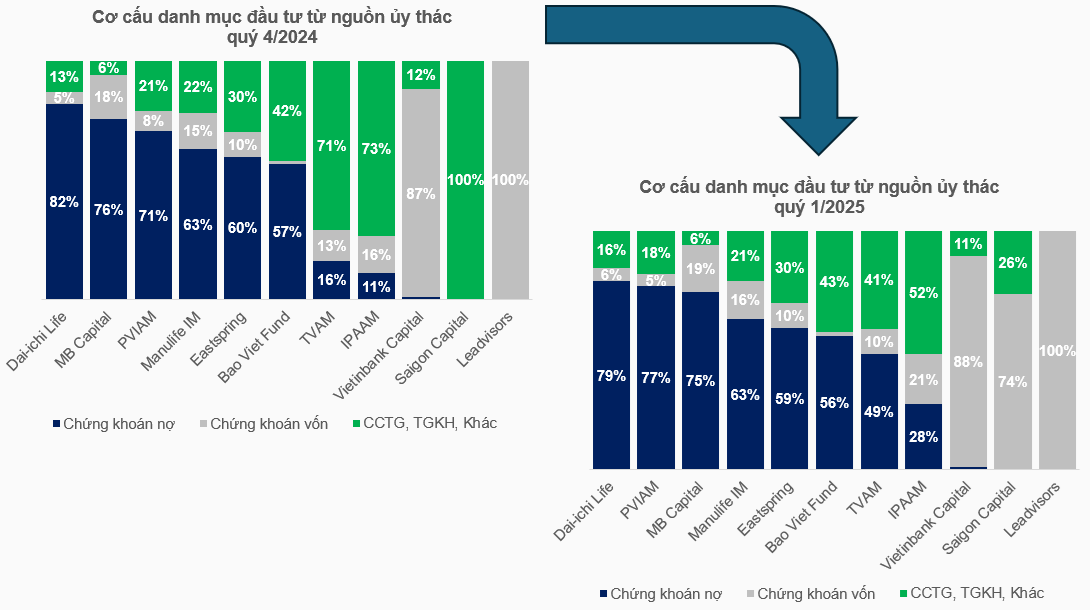

Diverse investment philosophies, many players embrace risk

Examining the delegated investment portfolio structures of the major fund management companies in the market reveals distinct differences in their investment philosophies. Specifically, companies that receive large amounts of money from insurance companies for investment tend to have a higher allocation to bonds, which are considered a safe and stable investment channel. Dai-ichi Life, for example, has a 79% allocation to bonds in its portfolio, followed by Manulife IM (63%), Eastspring Investments (59%), and Bao Viet Fund (56%).

The leaders in bond allocation also include PVIAM at 77% and MB Capital at 75%. These companies are also part of larger ecosystems that include insurance companies.

In Q1, except for PVIAM, the aforementioned companies slightly reduced their bond allocation as this investment channel did not perform very dynamically.

Source: Author’s Compilation

|

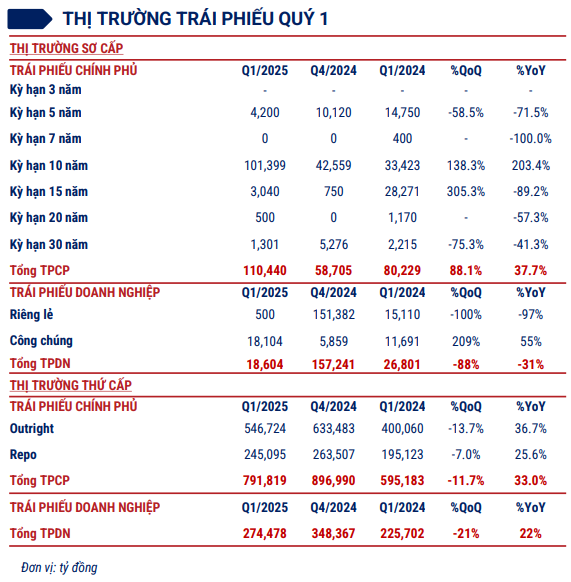

According to the Vietnam Bond Market Association (VBMA)’s Q1 2025 bond market report, the total trading value reached nearly VND 1.2 quadrillion, an 18% decrease from the previous quarter. The trading values across different channels showed mixed results.

For government bonds, the trading value on the primary market increased significantly, with an average issuance term of 10.23 years and an average interest rate of 2.91%. However, the secondary market witnessed a decline in both Outright and Repo channels. The 10-year term accounted for 32% of the total Outright trading value, the largest among all term groups. Repo transactions were mainly conducted at a 14-day term with interest rates ranging from 3.83% to 4.4%.

Regarding corporate bonds, the trading value decreased on both the primary and secondary markets. The average issuance rate was 7.29%, a decrease of 17 percentage points. Corporate bond debt decreased slightly by 2% from the beginning of the year to VND 1.19 quadrillion, equivalent to 7.6% of the economy’s total credit debt. Since the end of 2023, the market scale has remained relatively stable at around VND 1.2 quadrillion.

Source: VBMA

|

In contrast, some companies oriented their portfolios towards stocks, which carry higher risks, such as Vietinbank Capital with an 88% allocation, Saigon Capital with 74%, and Leadvisors with a full 100% allocation.

Additionally, several fund management companies significantly altered their portfolio structures. Notable examples include TVAM, IPAAM, and Saigon Capital, which increased their investments in both bonds and stocks. In Q1 2025, the VN-Index rose from 1,267 points to 1,307 points, even surpassing 1,336 points at one point, accompanied by an average trading value of VND 16.4 trillion per day, an improvement from the previous quarter’s VND 15 trillion. With the stock market becoming more vibrant, it is understandable that these companies were more willing to embrace risk.

How Did the Fund Management Industry Perform in the First Quarter of the Year?

– 10:00 02/06/2025

Expert Insights: Tune in to the Market Rhythm and Seize Investment Opportunities in These Two Sectors

Stepping into June, market experts predict a period of consolidation for the first half of the month, with the index hovering around the 1,320-point mark for approximately 8-10 sessions.

The Flow of Funds: A Cautious Short-Term Approach

The VN-Index’s fourth consecutive weekly gain couldn’t mask underlying weakness as profit-taking pressures emerged last week. The gains were largely driven by the first two sessions, after which stocks turned south amid robust selling pressure, with the VN-Index failing to breach the 1,340-point peak.

[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates

The upcoming periodic information disclosures in June encompass several notable events in the stock market. These include the release of the PMI, the effective portfolio and market classification by MSCI, disclosure and effectiveness of the FTSE ETF and VNM ETF portfolios, the socio-economic situation report for May, the maturity of VN30F2506 futures contracts, and the Fed’s announcement of FOMC meeting results.

The Stock Market Slump: Shares Tumble Across the Board

The pressure to secure profits after a streak of consecutive gains, coupled with the fatigue of leading stocks, dragged the benchmark away from its previous peak. As the week’s final trading session concluded, the VN-Index witnessed a decline of over 9 points, with more than 230 stocks drowning in red.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-150x150.png)