Xuân Thiện Securities JSC (XTSC) has just announced its resolution to deploy a plan to offer share sales to existing shareholders and conduct a private placement to increase its charter capital.

Offering 135 Million Shares to Shareholders

According to the plan approved at the 2025 Annual General Meeting of Shareholders, Xuân Thiện Securities will offer 135 million shares (10 times the number of shares currently in circulation) to existing shareholders.

The rights execution ratio is 1:10, meaning that for every 01 share owned, shareholders will have the right to purchase 10 new shares. The expected offering price is VND 10,000/share.

If this issuance is completed, Xuân Thiện Securities’ charter capital will increase from VND 135 billion to VND 1,485 billion.

According to the list of shareholders as of August 4, XTSC has a total of 62 shareholders. Among them, there are 6 major shareholders, including: Khang An Agricultural Trading Company Ltd. holding 20%; Mr. Le Huy Dung owning 20.03%; Mr. Ho Ngoc Bach holding 19.88%; Mrs. Thai Kieu Huong with 15.12%; Vo Van Von with 9.9%; and Construction Materials Corporation No. 1 – Fico with 5%.

Chairman of Xuan Thien Group to Purchase 50 Million Shares

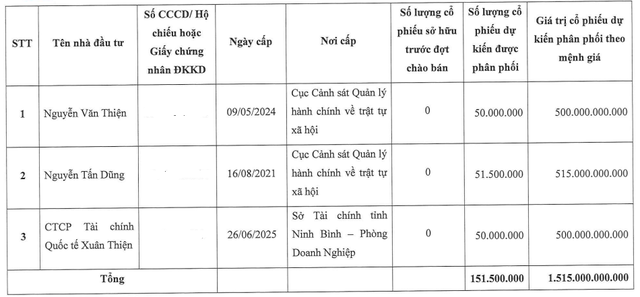

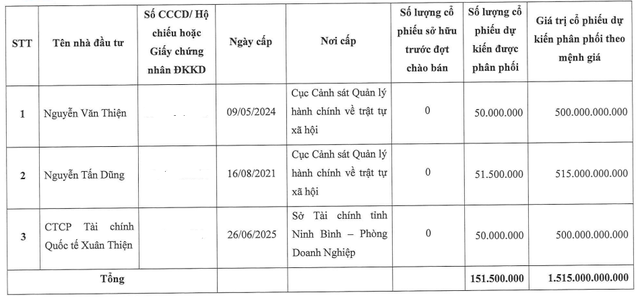

In addition, Xuan Thien Securities also plans to offer 151.5 million shares in a private placement to 3 investors: Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, expected to buy 50 million shares; Mr. Nguyen Tan Dung expected to buy 51.5 million shares; and Xuan Thien International Finance JSC expected to buy 50 million shares. The privately placed shares will be restricted from transfer for 3 years.

With an issuance price of VND 10,000/share, XTSC expects to raise VND 1,551 billion from this offering. Of this, 65% will be used to supplement margin and advance payment activities; 30% will be allocated to proprietary trading, and 5% will be used for working capital.

If both issuances mentioned above are completed, XTSC’s charter capital will exceed VND 3,000 billion.

Xuan Thien Securities is the new name of Sen Vang Securities (GLS) since the 2025 Annual General Meeting of Shareholders held in June.

At the meeting, GLS’ management board mentioned the participation of a large shareholder, Khang An Agricultural Trading Co., Ltd., a member of the Xuan Thien Group ecosystem.

Therefore, the name change is a strategy to leverage and inherit the brand value and strengths of the Xuan Thien Group. Consequently, the meeting approved the company name change.

The meeting also approved an ambitious business plan for 2025, with a revenue target of VND 179 billion, an increase of 1,205%, and an after-tax profit of VND 70 billion, a surge of 19,839% compared to 2024.

Currently, the group operates in various sectors, including energy, construction materials – green steel, agriculture, logistics, real estate, and education.

Most recently, Xuan Thien Group commenced the construction of the Nam Dinh Green Steel project in Nghia Hung (former name). This complex has a capacity of 9.5 million tons of steel per year, with a total investment of VND 98,000 billion and an area of over 400 hectares.

Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, is the brother of Mr. Nguyen Duc Thuy, Chairman of LPBank.

TCBS Announces IPO Price at VND 46,800 per Share, Valuing the Company at Over USD 4 Billion

The Board of Directors of Techcom Securities Joint Stock Company (TCBS) approved a resolution on August 5th to adjust and replace certain contents of the previous IPO plan outlined in the resolution of July 9th. Notably, the company announced a sale price of VND 46,800 per share, corresponding to a valuation of approximately 4.1 billion USD.

DongA Bank: A Troubled Institution’s Forcible Handover and the End of Shareholder Power?

Prior to being placed under special control, DongA Bank’s institutional shareholders included: Bac Nam 79 Construction, owned by Vu “Nhom”, which held 10%; PNJ with 7.7% of the charter capital; Ho Chi Minh City Party Committee Office with 6.9%; Ky Hoa Tourism and Trading with 3.78%; An Binh Capital with 2.73%; and Nha Phu Nhuan with 2.14%.

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”

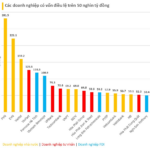

State-Owned Refinery to Join $2 Billion Capitalized Group, Joining Ranks with Hoa Phat Dung Quat, MB, and Vietinbank

Among the 19 businesses with a charter capital of over $2 billion, there is a diverse mix of ownership structures. This includes 9 state-owned enterprises, showcasing the strong presence of the public sector, alongside 4 foreign-invested companies, and 6 private enterprises, each bringing their unique contributions to the table.