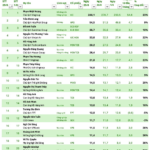

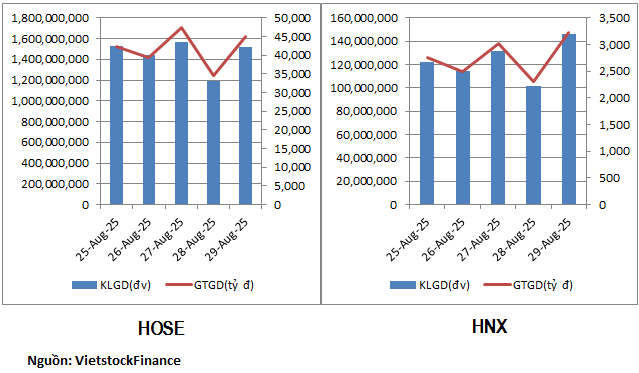

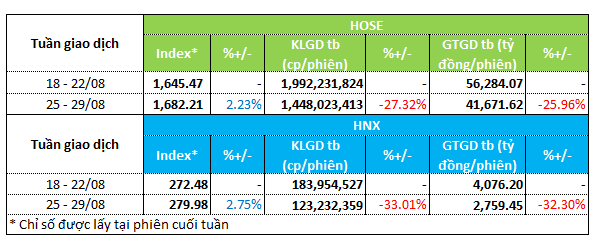

The market ended the last week of August 2025 on a positive note in terms of indices. The VN-Index rose 2.2% to 1,682.2. HNX-Index gained nearly 3% to 280. However, liquidity was withdrawn ahead of the 02/09 holiday. On the HOSE floor, liquidity fell by about 25-26%. Trading volume fell to 1.4 billion units/session, while trading value returned to VND41.6 trillion/session.

On the HNX floor, liquidity decreased by approximately 33%. Trading volume fell to 123.2 million units/session, and trading value decreased to VND2.7 trillion/session.

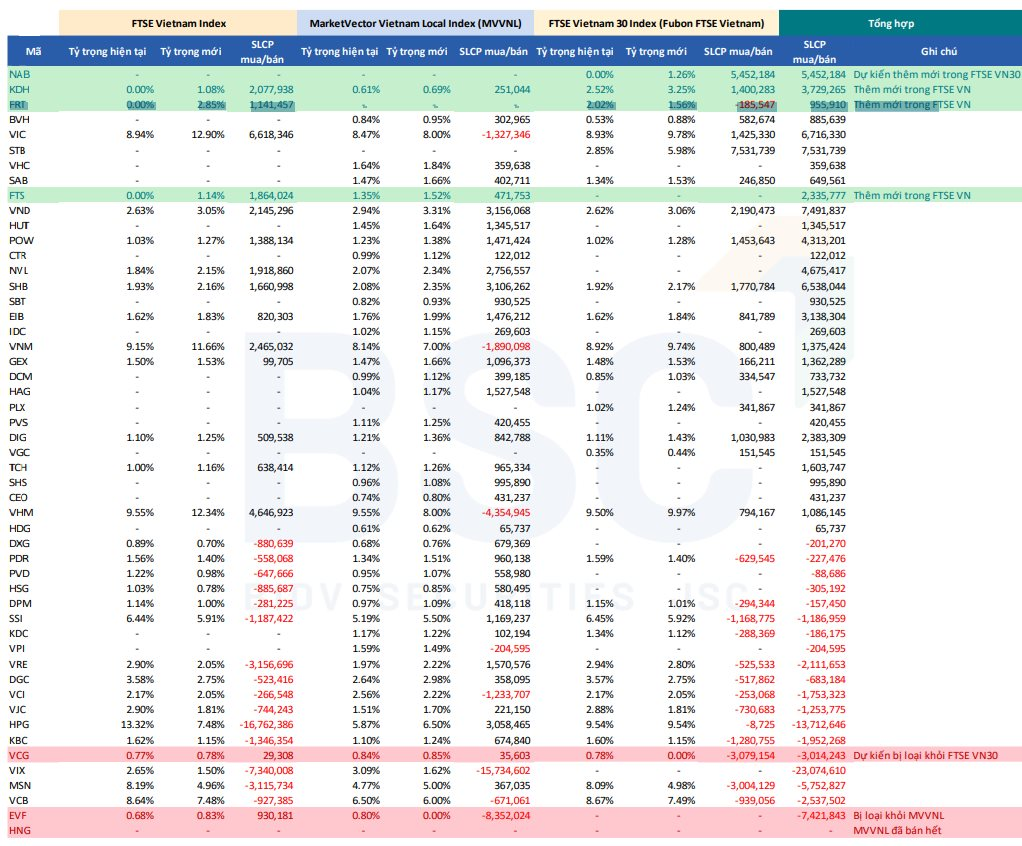

|

Liquidity Overview for Week 25 – 29/08

|

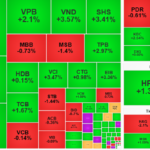

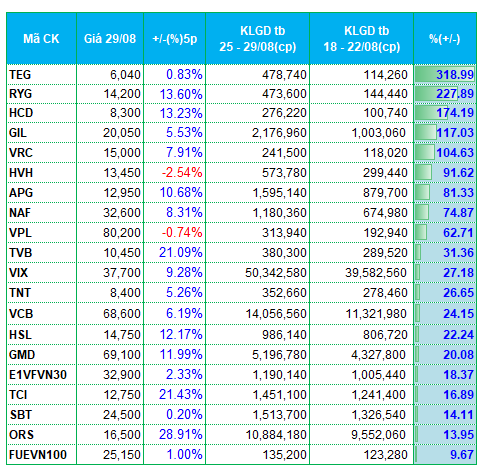

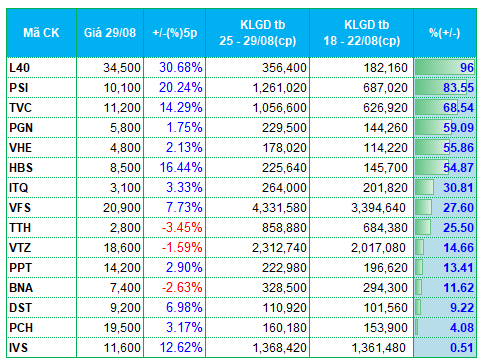

Despite the significant decline in liquidity, several sectors attracted money flows. First and foremost were securities stocks, with numerous representatives in the top gainers in terms of liquidity. APG‘s average trading volume increased by 80% compared to the previous week. Similarly, PSI led the liquidity gainers on the HNX floor, with average trading volume up more than 83.5% from the previous week.

This group also saw a surge in liquidity for several stocks, including TVB, VIX, TCI, PSI, TVC, HBS, VFS, and IVS.

Food stocks witnessed positive developments with inflows. HSL, SBT, BNA, and VHE were among the stocks that witnessed a significant increase in liquidity compared to the previous week.

Plastic stocks experienced divergent money flows. PGN, VTZ, and PCH were among the top gainers in liquidity. In contrast, APH, TNH, NTP, and others witnessed outflows, with declines ranging from 64% to 70%.

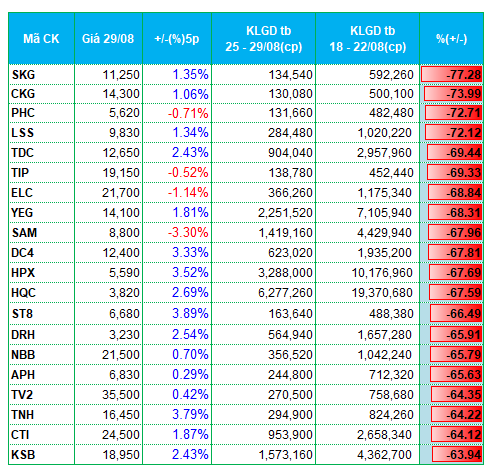

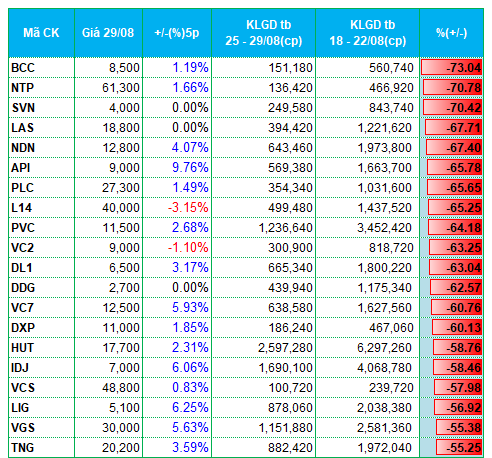

On the declining side, real estate stocks witnessed the most notable outflows. CKG, TDC, TIP, HPX, HQC, DRH, NBB, NDN, API, L14, and IDJ saw trading volumes decrease by 55-70%. Some construction material stocks on the HNX floor followed suit. BCC, VCS, and VGS were among the top losers in liquidity on the HOSE and HNX floors.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX

|

The list of stocks with the highest and lowest liquidity changes is based on a minimum average trading volume of 100,000 units/session.

– 19:28 03/09/2025

[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries

The upcoming periodic information disclosures in September encompass notable events in the stock market. These encompass the Effective Portfolio (MSCI, FTSE ETF, VNM ETF), the release of the PMI, the announcement of the constituents (FTSE ETF, VNM ETF), the socio-economic report for August, the maturity of VN30F2509, the outcome of the FOMC (Fed) meeting, the market ranking report (FTSE), and the 15th IR Awards ceremony.

The Stock Market Surge: Expert Tips on Stocks to Boost Your Portfolio

Despite predictions to the contrary, the VN-Index has been on a remarkable upward trajectory, consistently reaching new highs. This has left investors pondering which stock sectors to invest in for the remainder of the year.

![[IR AWARDS] September 2025 Disclosure Calendar: Mark Your Diaries](https://xe.today/wp-content/uploads/2025/09/T9_NoiDung-150x150.png)