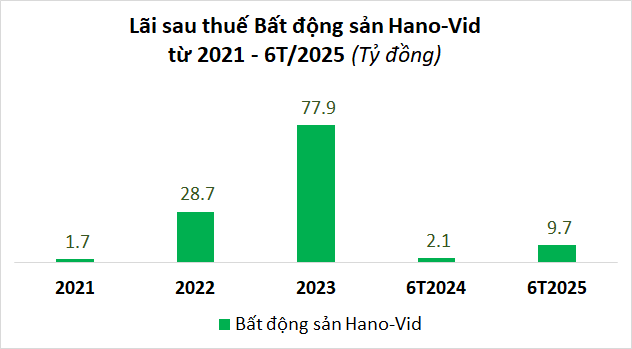

Hanoi-Vid Real Estate JSC reported its business results for the first six months of 2025, with a net profit of nearly VND 10 billion, a 4.6-fold increase compared to the same period last year.

Source: Author’s compilation

|

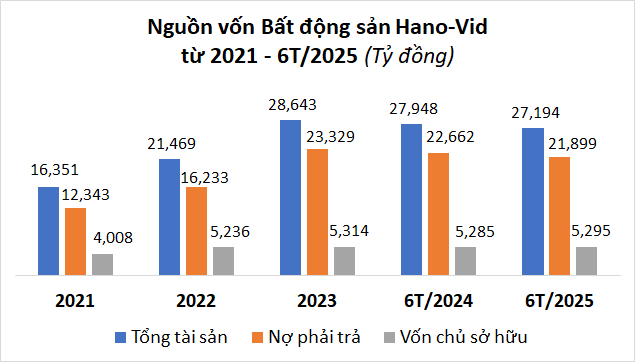

As of the end of June, Hanoi-Vid Real Estate had total assets of over VND 27,194 billion, a 3% decrease compared to the first half of 2024. Owners’ equity slightly increased to over VND 5,295 billion, including undistributed profits of over VND 409 billion.

Liabilities accounted for the majority of the capital structure, with VND 21,899 billion, including VND 9,544 billion in bonds, VND 2,255 billion in bank loans, and over VND 10,100 billion in other payables.

Source: Author’s compilation

|

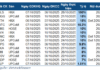

According to data from HNX, Hanoi-Vid Real Estate has 182 lots of bonds currently in circulation, with a total issuance value of nearly VND 9,655 billion and a circulation value of VND 9,544 billion.

Of these, 180 lots were issued from July to August 2020, with Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) as the depository organization, and two lots were issued in March 2022, with the Vietnam Securities Depository and Clearing Corporation as the depository organization. The 182 lots have a term of 5-7 years, with an issuance interest rate of 10-10.5% per annum.

Notably, 120 out of 182 lots, valued at nearly VND 5,655 billion, will mature simultaneously in October and November this year. This is considered a significant financial pressure, leading Hanoi-Vid Real Estate to extend the bond term by announcing changes in the conditions and terms of the issued bonds.

Specifically, from June 30 to September 4, 2025, Hanoi-Vid Real Estate announced 119 resolutions of bondholders regarding the extension of 119 lots, valued at over VND 5,600 billion, with a two-year extension and a fixed interest rate ranging from 8.4% to 9.4% per annum. As a result, the maturity date of these lots has been postponed to July, August, and September 2027.

Hanoi-Vid was established on December 1, 2010, and is headquartered at 430 Cau Am, Van Phuc Ward, Ha Dong District, Hanoi, with its main business lines being consulting, brokerage, and auction of real estate and land use rights.

The company currently has a charter capital of nearly VND 4,886 billion, and Mr. Nguyen The Dat holds the position of General Director and legal representative.

Thin profit, two related companies of ROX Group owe more than VND 57 trillion

– 11:07 09/05/2025

PNJ Offers Over 3 Million ESOP Shares to Employees

“PNJ, a leading jewelry brand in Vietnam, is set to release over 3.2 million ESOP shares to its dedicated staff and employees. With a share price of 20,000 VND, this move showcases PNJ’s commitment to its workforce, offering them a chance to own a piece of the company they work for. The subscription period for this exclusive employee offering runs from September 9, 2025, to September 23, 2025, providing a two-week window for employees to invest in their future with PNJ.”

Maximized Profits Quadruple Initial Estimates, Sending DIC Corp (DIG) Stock Soaring to Year’s Best

With a remarkable post-tax profit surge, the company has witnessed a staggering sevenfold increase compared to the same period last year, totaling over 28 billion VND. This outstanding performance far surpasses the self-reported indicator target of 6.7 billion VND, resulting in a significant difference of 21.3 billion VND.

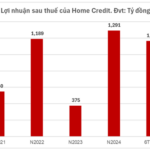

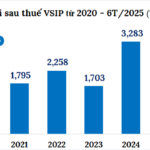

“VSIP Records a Profit of Over 1.1 Trillion VND in the First Half of 2025”

In the first half of 2025, VSIP, a leading industrial park developer, recorded impressive financial results with a 3% increase in profit after tax, amounting to over VND 1,100 billion compared to the same period last year. The company’s total assets surpassed VND 42,000 billion, showcasing its robust performance and solid financial standing.