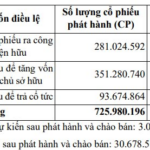

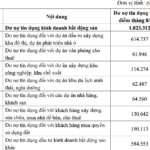

Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR) has proposed to its shareholders a plan to increase its charter capital by over VND 19,068 billion by issuing nearly 1.91 billion shares in 2025, thereby raising its capital from VND 31,005 billion to over VND 50,073 billion.

Specifically, in the first phase, BSR plans to issue over 930 million shares as dividend payment to existing shareholders, equivalent to a ratio of 30% (shareholders owning 100 shares will receive an additional 30 shares).

The total issuance value at par value is approximately VND 9,301 billion, which will be deducted from undistributed post-tax profits in 2024. The expected timeline for this phase is the third and fourth quarters of 2025, after obtaining approval from the State Securities Commission.

Secondly, Binh Son Refinery will issue more than 976.6 million shares to increase capital contribution from owner’s equity, equivalent to a ratio of 31.5% (shareholders owning 100 shares will receive an additional 31.5 shares).

The total issuance value at par value is about VND 9,766 billion, which will be deducted from the investment development fund in the 2024 audited financial statements. This issuance will not change the ownership ratio of shareholders, including foreign ownership, and all new shares will be fully registered and listed according to regulations.

The company will simultaneously implement both issuance methods by selecting the same record date to finalize the list of shareholders entitled to receive dividends in shares and to increase capital contribution from owner’s equity.

The additional capital aims to serve the project of upgrading and expanding the Dung Quat Oil Refinery.

This capital increase plan has been approved by the 2025 General Meeting of Shareholders. According to BSR, increasing the charter capital is a crucial step to meet capital demands and enhance the effectiveness of implementing the Dung Quat Oil Refinery Upgrade and Expansion Project. This project aims to increase the processing capacity from 148,000 barrels/day to 171,000 barrels/day.

The Dung Quat Refinery Upgrade Project was approved in principle by the Prime Minister in 2014, and the investment registration certificate was granted in 2016. The initial goal was to increase the capacity to 192,000 barrels/day (equivalent to 8.5 million tons/year), with a total investment of approximately $1.8 billion, to be completed before 2022. However, due to delays, the scale has been adjusted to 171,000 barrels/day, with an investment of $1.26 billion. The project is currently expected to be operational in the first quarter of 2028.

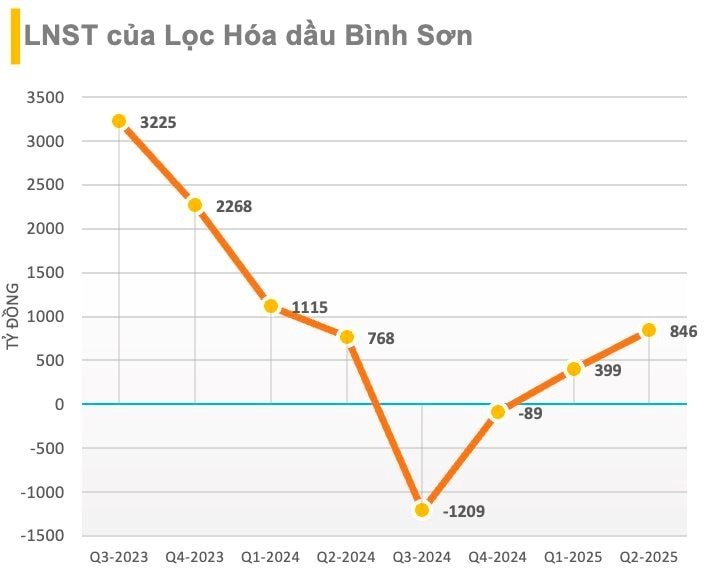

In terms of business performance, BSR reported positive results in the second quarter of 2025, with net revenue of nearly VND 36,800 billion, a 51% increase compared to the same period last year, and after-tax profit of VND 846 billion, an over 8% increase.

In the stock market, as of September 9, BSR shares were priced at VND 25,850/share, with a market capitalization of over VND 80,100 billion. According to Vietcap Securities (VCSC), PVN is likely to divest approximately 2.13% of its ownership, and discussions with potential investors are underway.

Currently, PVN holds 92.13% of BSR. According to the amended Securities Law, which took effect on January 1, 2025, PVN must reduce its ownership below 90% to meet the requirement of having a minimum of 10% free-floating shares.

“Becamex IJC: Unveiling the Million-Square-Meter Land Bank and the Infrastructure Story Behind its Soaring Profits”

The southern real estate market is entering a new cycle, driven by Ho Chi Minh City’s urban expansion and infrastructure development. This shift is attracting increased attention from investors towards well-established businesses.

“BMSC Seeks $2 Billion in Bond Offering to Refinance Bank Debt”

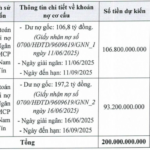

On September 5th, the Board of Directors of Bao Minh Securities Joint Stock Company (BMSC, UPCoM: BMS) passed a resolution to issue the 1st round of private bonds in 2025, aiming to raise VND 200 billion to restructure bank loans.