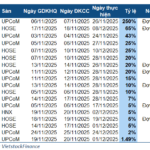

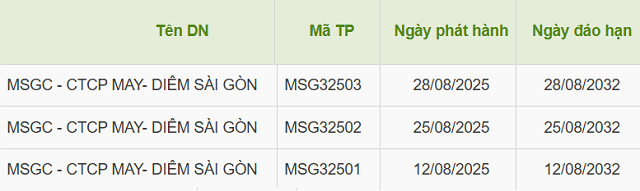

On August 28, the Company issued 14,680 bonds with a face value of VND 100 million each, raising VND 1,468 billion – the largest batch in the last 3 recent issuances. Previously, on August 25, the Enterprise successfully sold a batch worth VND 500 billion.

In total, during August, May – Diêm Sài Gòn mobilized nearly VND 2,500 billion. The bonds are of the “3 non” type (non-convertible, non-warrant attached, and unsecured), with a fixed interest rate of 9.2% per annum and a maturity date of August 2032.

May – Diêm Sài Gòn issued 3 batches of bonds in less than 1 month. Source: HNX

|

Established in 2004, May – Diêm Sài Gòn is headquartered in the former District 4, Ho Chi Minh City, and currently mainly operates in the real estate industry. With a charter capital of over VND 5,000 billion, Ms. Nguyen Chi Mai serves as the Chairman of the Board of Directors and legal representative. In late 2023, a consortium consisting of May – Diêm Sài Gòn, Real Estate Hano-Vid, and Oleco-NQ was the only investor to pass the capacity evaluation round for a residential project in Hung Yen, covering 9.66 hectares with a total investment of approximately VND 1,300 billion.

In August, Saigon Ratings announced for the first time the credit rating of May – Diêm Sài Gòn at the “vnBBB-” level with a “stable” outlook.

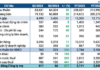

According to the credit rating agency, May – Diêm Sài Gòn’s strongest point lies in its large scale of assets and equity compared to many peers, along with abundant land funds spread across potential localities. The Company also benefits significantly from its association with TNR Holdings – a major shareholder holding 44.97% of its capital. As a result, May – Diêm Sài Gòn can leverage the group’s brand reputation, financial resources, project development experience, and network of partners.

The Company targets a diverse range of products, from commercial housing to projects in other segments, catering to market demands.

However, Saigon Ratings also pointed out some limitations. Many projects are still in the procedural or site clearance phase, resulting in low capital efficiency. The EBITDA profit margin remains modest, while accounts receivable account for a large proportion of total assets, posing potential risks to cash flow. During 2021-2024, May – Diêm Sài Gòn had to postpone or temporarily halt some projects, choosing instead to focus on land fund expansion, leading to financial results that did not fully reflect its potential.

The rating agency stated that the Company’s “stable” outlook is based on the assumption of three factors: guaranteed project progress, absorbable products according to plan, and no significant changes in financial structure.

Additionally, May – Diêm Sài Gòn has the opportunity to improve its credit rating with support from TNR Holdings, including providing additional capital, refinancing, or coordinating internal cash flow. The level of financial and brand association between the two entities is considered a key factor in maintaining the Company’s liquidity as it continues to invest significantly in medium and long-term real estate projects.

|

Another enterprise closely associated with TNR Holdings and Real Estate Hano-Vid is Real Estate Investment and Development Joint Stock Company Thành Vinh. In August, this company issued two batches of private placement bonds worth VND 900 billion, bringing the total capital mobilized in the last two months to VND 2,000 billion. The bonds offer a fixed interest rate of 9.2% per annum, with maturity dates extending to 2031 and 2032, similar to the issuances of May – Diêm Sài Gòn. Real Estate Thành Vinh was established in 2018 with an initial charter capital of VND 20 billion, 90% of which was held by Real Estate Hano-Vid, and the remaining by two individual shareholders, Mr. Le Hong Duc and Mr. Pham Tien Dat. By March 2024, the company’s charter capital had increased to VND 905 billion. Previously, Real Estate Thành Vinh’s capital was directly held by TNR Holdings. In its credit rating report published in April, Saigon Ratings stated that Real Estate Thành Vinh enjoys a competitive advantage due to its strategic cooperation with TNR Holdings, enabling it to access and leverage resources from the TNR ecosystem, a strategy also employed by May – Diêm Sài Gòn.

|

May – Diêm Sài Gòn raises VND 490 billion from bond issuance

– 09:53 10/09/2025

Unveiling the 3 Major Real Estate Tycoons in Ho Chi Minh City with Outstanding Tax Debts

In the latest list of major tax debtors revealed by Ho Chi Minh City’s Tax Department, three real estate businesses top the chart with a combined debt of over 100 billion VND. These companies, all operating in the realm of real estate investment and development, now face public scrutiny as their substantial tax liabilities come to light.

The Billionaire’s Clean Project Hunt

“Savvy investors know that when it comes to choosing a project, it’s all about legal peace of mind. The majority of discerning investors will prioritize projects that have their legal ducks in a row, or are at the very least, a hair’s breadth away from completion. This provides an assurance that their investment is secure and that the project is legitimate and compliant with all necessary regulations.”

The Dream Home: Turning Your Vision into Reality at The Felix Project

In a crowded real estate market, the launch of The Felix, a C-Holdings development, coupled with ACB’s “First Home” loan package, offers a distinct advantage: it provides home buyers with a tailored financial solution. With its attractive terms, the project sold out quickly, and it is now in the stage of buyers finalizing their financial arrangements.

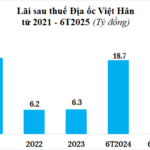

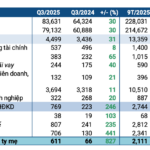

“Real Estate Giant Việt Hân’s Profits Plummet by Over 40%, Burdened by $400 Million Debt”

In the first half of 2025, Dia Oc Viet Han reported a net profit of nearly VND 11 billion, a significant 42% decrease compared to the same period last year. Meanwhile, the company is burdened with a staggering debt of over VND 20.1 trillion, more than half of which comprises bond debt.

Prime Minister: Boosting Supply and Combating Speculation to Stabilize the Gold Market

“At the meeting on September 7, Prime Minister Pham Minh Chinh instructed the State Bank of Vietnam to immediately research and implement solutions to increase the supply of gold and balance its supply and demand dynamics. He also emphasized the need to curb speculation, smuggling, and policy exploitation in the gold market.”