PV Power Seeks to Boost Capital and Expand Operations

Vietnam Petroleum Power Corporation (PV Power), stock code: POW, has recently released documents for an upcoming extraordinary general meeting of shareholders, scheduled for September 25, 2025, in Hanoi.

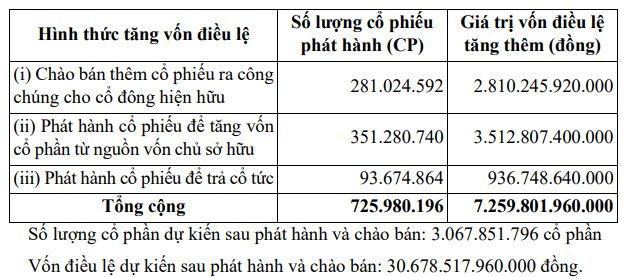

A notable item on the agenda is the proposal to increase the company’s charter capital from VND 23,418 billion to VND 30,678 billion, representing an additional VND 7,259 billion in capital.

PV Power’s plans for capital increase

The plan includes offering existing shareholders a total of 281 million new shares, equivalent to a 12% ratio (for every 100 shares held, shareholders will have the right to buy 12 new shares). The share purchase rights will be transferable once. The offering price is set at VND 10,000 per share, aiming to raise VND 2,810 billion.

This capital will be allocated to fund the Nhon Trach 3 and Nhon Trach 4 Power Plant projects, specifically for payments to contractors and partners.

Additionally, the corporation proposes to issue bonus shares to increase charter capital from equity sources, with a ratio of 15% (for every 100 shares held, shareholders will receive 15 new shares). This will result in the issuance of over 351 million shares, utilizing the Investment Development Fund as stated in the 2024 audited financial statements.

Furthermore, PV Power intends to issue shares to pay dividends at a ratio of 4% (for every 100 shares held, shareholders will receive 4 new shares). The source of this issuance will be from undistributed post-tax profits as per the 2024 audited financial statements.

The Board of Directors proposes to implement these three methods of offering and issuing shares simultaneously, with the timeline commencing after obtaining approval from the State Securities Commission.

The proceeds from the offering to existing shareholders (expected to be VND 2,810 billion) will be utilized to finance the Nhon Trach 3 and Nhon Trach 4 Power Plant projects, specifically for payments to contractors and partners for the development of these projects. The disbursement is planned for the fourth quarter of 2025 and the first quarter of 2026.

Nhon Trach 4 Power Plant

According to PV Power’s half-year report for 2025, the EPC contractor is expected to commence trial operations in July 2025, with the Nhon Trach 3 Power Plant commencing commercial operations in the third quarter of 2025 and Nhon Trach 4 by the end of the year. With a combined capacity of 1,624 MW and an investment of VND 32,486 billion (30% equity and 70% debt), these projects mark the first LNG-fired power plants in Vietnam. Their operation will contribute approximately 9 billion kWh of electricity annually to the national grid and support the government’s net-zero emissions commitment made at COP26.

PV Power completed its equitization in 2018, selling 468 million shares during its IPO at an average price of VND 14,938 per share. The corporation held its first shareholder meeting in June 2018 and subsequently listed its shares on the Ho Chi Minh Stock Exchange (HoSE) on January 14, 2019.

PV Power’s shareholder structure

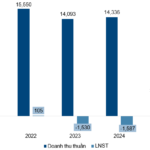

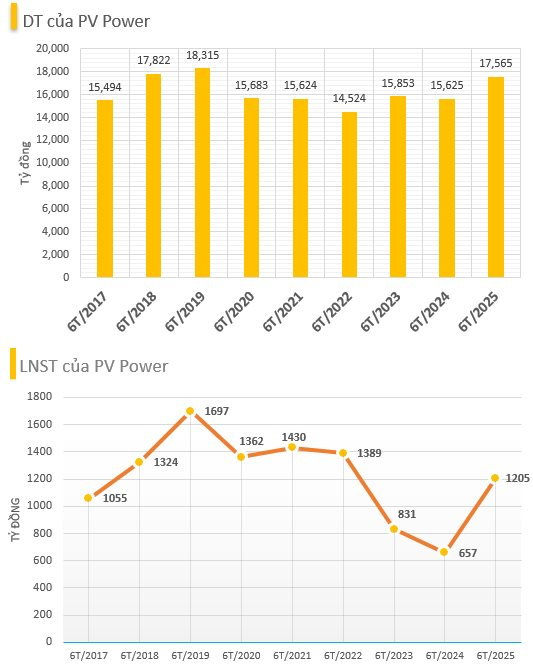

In terms of financial performance, for the first six months of 2025, PV Power recorded VND 17,565 billion in revenue, a 12% increase compared to the same period last year, and VND 1,205 billion in after-tax profit, an 83% surge year-on-year, nearly matching its full-year 2024 profit.

Compared to the 2025 plan of VND 38,185 billion in revenue and VND 439 billion in after-tax profit, the company has achieved 46% of its revenue target and significantly surpassed its profit target.

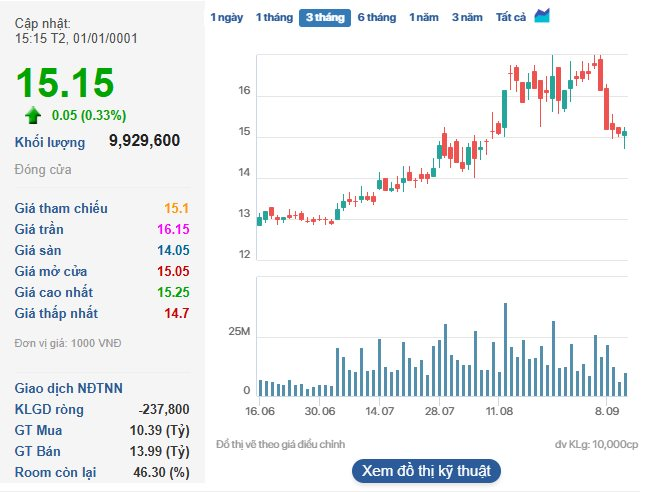

On the stock market, as of the close of the trading session on September 11, POW shares were priced at VND 15,150 each, with a market capitalization of over VND 35,000 billion.

POW stock price movement

The Commercial Banking Sector: Accelerating Budgetary Contributions and Strengthening National Resources

On September 9, at the Private 100 and VNTax 200 Awards, organized by CafeF (VCCorp), the banking industry once again demonstrated its pivotal role in the economy. This prestigious event recognized the top 200 businesses making the most significant contributions to the national budget, with several prominent banking institutions featuring prominently in the rankings.

“TPBank Recognized as a Top Private Bank in Vietnam for Its Significant Tax Contributions.”

“At the 2025 Enterprise Budget Contribution Awards, TPBank made a remarkable impression by ranking among the top 20 banks in Vietnam for budget contribution, and an impressive 9th position among private banks. “

MSN – Strengthening its Position for Sustainable Growth (Part 2)

The Masan Group (HOSE: MSN) is witnessing positive signals across its various business segments, including WinCommerce, Masan MEATLife, and Masan High-Tech Materials. These divisions are anticipated to significantly contribute to the company’s long-term growth and solidify its foundation for stable operations. With its current valuation, MSN stock presents an attractive investment opportunity for long-term investors seeking exposure to a well-diversified and robustly performing company.