According to a recent announcement by the Hanoi Stock Exchange (HNX), Man Duong Joint Stock Company has disclosed its financial statements for the first half of 2025.

For the six months ended June 30, 2025, Man Duong reported a net loss of over VND 17.4 billion, an improvement of 65.3% compared to the same period last year.

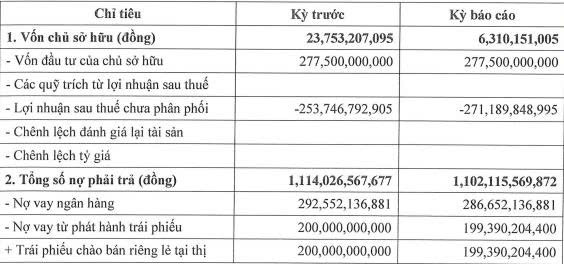

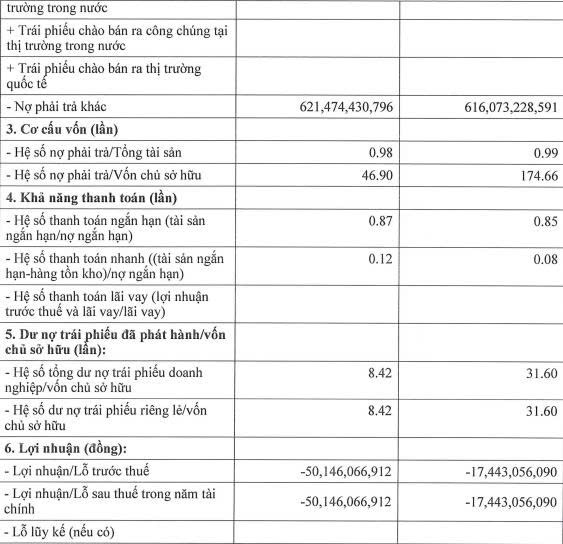

As of June 30, 2025, the company’s owner’s equity stood at more than VND 6.3 billion, a decrease of 73.5% from the previous period. Meanwhile, the company’s invested capital remained unchanged at VND 277.5 billion, and its retained earnings were negative, at nearly VND 271.2 billion.

On the other side of the balance sheet, total liabilities were 174.66 times the owner’s equity, amounting to over VND 1,102.1 billion, a slight decrease of VND 11.9 billion compared to the same period last year.

Source: HNX

Breakdown of liabilities includes bank loans of nearly VND 286.7 billion, other payables of almost VND 616.1 billion, and bond issuance debt of approximately VND 199.4 billion.

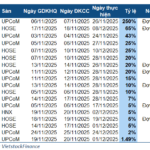

Currently, Man Duong has one bond issue, with the code DMBOND2017, listed on the HNX. The bond was issued on November 20, 2017, with a total value of VND 200 billion and a seven-year term, maturing on November 20, 2024.

On June 12, 2025, the company was scheduled to repay the principal amount of VND 200 billion for this bond issue. However, they have only managed to repay approximately VND 609.8 million, with the remaining VND 199.4 billion outstanding.

In their explanation, Man Duong attributed the delay to prolonged economic challenges, preventing them from securing the necessary funds as planned. They are currently in negotiations with investors regarding the settlement of this bond debt.

Established in February 2002, Man Duong has a charter capital of VND 277.5 billion, with Mr. Nguyen Huu Duong (born in 1954) owning 88% of the capital and serving as the Chairman of the Board of Directors. Since September 2021, Mr. Tran Minh Thong has taken over as Chairman from Mr. Duong.

Man Duong is also a member of Hoa Binh Joint Stock Company (Hoa Binh Group), which was founded in 1993. According to their website, Hoa Binh Group’s core business activities include the production and trading of beer, beverages, and construction in various sectors. They also produce malt, a key ingredient in beer production, and have interests in real estate, restaurants, and hotels.

As of the latest update on May 9, 2025, Hoa Binh Group has a charter capital of VND 1,500 billion, with Mr. Nguyen Huu Duong serving as the General Director and legal representative, while also holding 47.68% of the capital.

Mr. Nguyen Huu Duong is also known as “Duong Bia” due to his reputation as the first producer of malt in Vietnam. Man Duong supplies malt to numerous domestic beer manufacturers.

What’s the Bottom Line Impact of Half-Year Audit on Listed Companies?

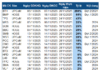

According to statistics from VietstockFinance, 1,006 listed companies on the HOSE, HNX, and UPCoM exchanges experienced a collective loss of over VND 473 billion in net profit after audits, leaving them with just under VND 285 trillion. This decrease equates to nearly 0.2% of their pre-audit profits.

“From Billion to Billions: The Story of a Struggling Cybersecurity Giant”

Since 2019, Bkav Pro has witnessed a significant decline in its profits. As of the first half of this year, the company’s return on equity (ROE) stood at a mere 0.98%.

Title: Hano-Vid Records Nearly VND 10 Billion Profit in H1, Extends Maturity of VND 5.6 Trillion Bond Notes to 2027

The first half of 2025 saw Hano-Vid Real Estate record a promising performance with a net profit of nearly VND 10 billion, a remarkable surge of 4.6 times compared to the same period last year. Despite this impressive feat, the company still grapples with a substantial bond debt that necessitates a two-year extension to alleviate impending cash flow pressures.