Image source: Forbes Vietnam

CTCP Investment Thanh Thanh Cong (TTC Group), a prominent Vietnamese conglomerate, has released its financial report for the first half of 2025. The company boasts impressive results, with a net profit of nearly VND 523 billion, a significant increase of 5.2 times compared to the same period last year.

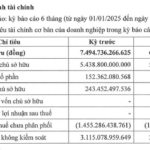

As of June 30, 2025, TTC Group’s total assets amounted to over VND 27,702 billion, with owner’s equity standing at more than VND 6,483 billion. The company’s liabilities, including bond debt, are VND 21,219 billion and VND 1,634.5 billion, respectively.

TTC Group has diverse business interests spanning agriculture, energy, real estate, industrial real estate, tourism, and education. With a strong presence in Vietnam and a growing reach in countries like Laos, Cambodia, Singapore, and Australia, the group continues to expand its influence.

TTC Group’s four subsidiary companies are listed on the Ho Chi Minh City Stock Exchange: Thanh Thanh Cong – Bien Hoa (TTC AgriS; ticker symbol: SBT), Dien Gia Lai (GEG; ticker symbol: GEG), Dia Oc Sai Gon Thuong Tin (TTC Land; ticker symbol: SCR), and Du Lich Thanh Thanh Cong (TTC Hospitality; ticker symbol: VNG). TTC Group holds significant stakes in these companies, with direct ownership percentages of 21.91%, 14.24%, 22.7%, and 30.36%, respectively.

According to data from the Hanoi Stock Exchange, TTC Group currently has seven bond issues outstanding, with one issue, TTCCH2125004, maturing on December 28, 2025, with a face value of VND 120 billion.

TTC Group has come a long way since its humble beginnings as a liquor production facility established in 1979 by its founders, Mr. Dang Van Thanh, and his wife, Mrs. Huynh Bich Ngoc. Today, Mr. Dang Van Thanh serves as the Chairman of the Board, while Mrs. Huynh Bich Ngoc is the CEO, leading the group to new heights.

Taseco Group’s Half-Year Profit Surges 68%: Borrowing 5000 Billion VND from Banks to Focus on Real Estate

The Taseco Group’s 2025 semi-annual financial report showcases a robust picture of growth, with a significant surge in profits and a substantial expansion in asset size.

The Ultimate Guide to Automotive Profitability: Navigating Tasco Auto’s Thin Margins and Turning Losses Around

In the first half of 2025, Tasco Auto Joint Stock Company returned to profitability, albeit modestly, while its accumulated losses exceeded VND 1.8 trillion.