Vietnam’s Rice Exports Surge in August 2025

According to data from the General Department of Vietnam Customs, Vietnam’s rice exports in August 2025 reached approximately 886,000 tons, valued at $436 million. This marks an increase in both volume and value compared to the previous month.

Consequently, the total rice exports for the first eight months of 2025 reached 6.37 million tons, valued at $3.26 billion. While this represents a 3.7% increase in volume, it reflects a 15.1% decrease in value compared to the same period in 2024. The average export price of rice during this period was $504 per ton, a 19% decline from the previous year.

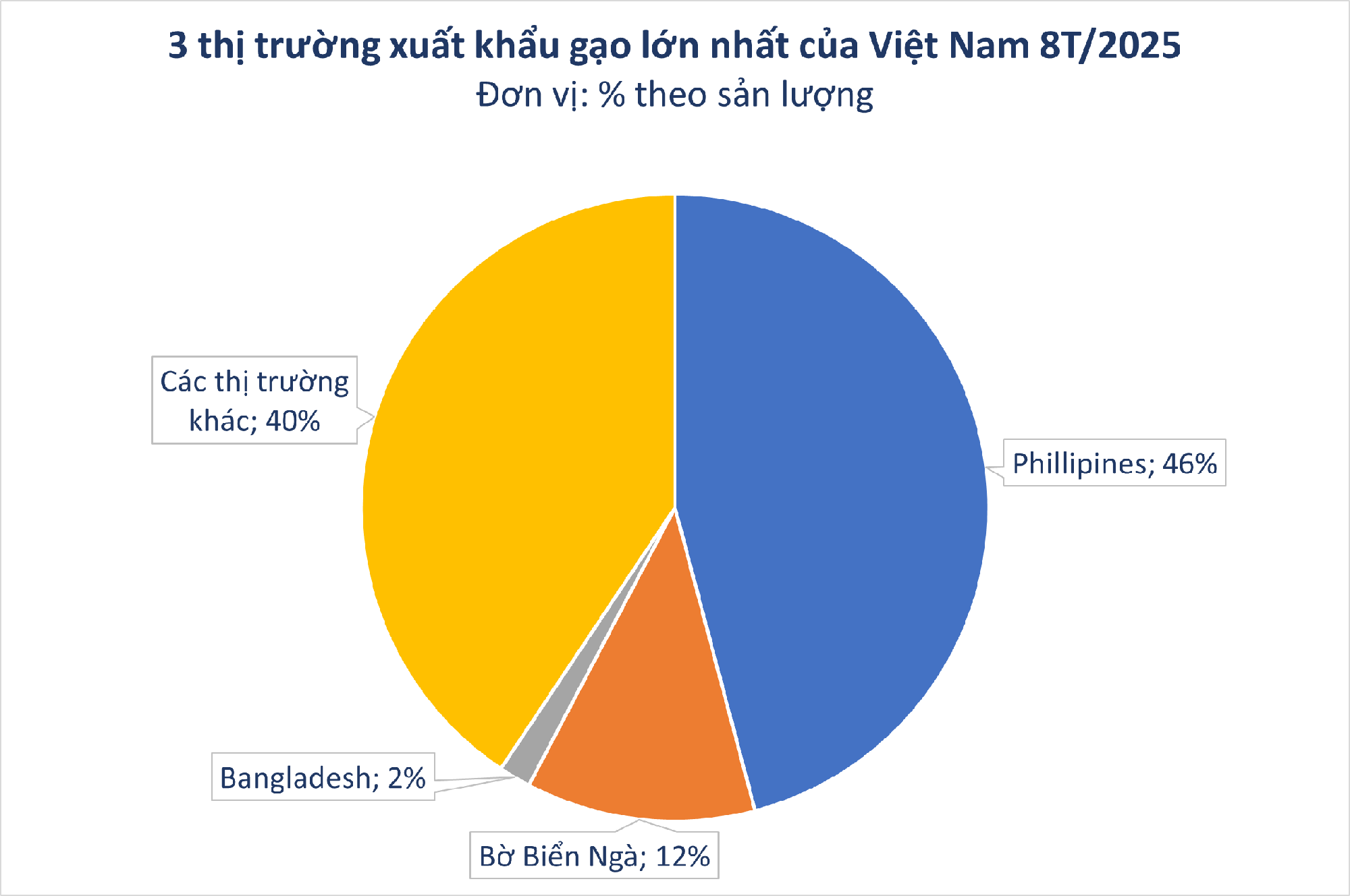

The Philippines remains Vietnam’s largest rice export market, accounting for 45.9% of total exports with over 2.9 million tons. However, starting September 1, 2025, the Philippines imposed a 60-day ban on imports of regular and premium milled rice, excluding specialty rice, to protect its domestic harvest. This move has significantly impacted Vietnamese exporters and domestic prices.

Côte d’Ivoire follows as the second-largest market, with 753,700 tons (11.85% of total exports), a 1.5-fold increase from last year. Ghana saw a 94.8% surge, reaching 662,400 tons (10.4% of total exports).

Key Rice Export Markets in 2025

China, after years of decline, rebounded with 565,300 tons (8.9% of total exports), a 141.3% increase. Among the top 15 export markets, Bangladesh saw the most significant growth, with a 26,800% increase in volume and 16,300% in value compared to the same period last year.

Exports to the Philippines, Côte d’Ivoire, Ghana, China, and Bangladesh have all increased year-on-year, offsetting declines in other markets.

Vietnam aims to achieve $5.7 billion in rice exports for 2025. With $3.26 billion earned in the first eight months, the remaining four months require $2.44 billion. However, due to global market volatility, the Ministry of Agriculture and Environment predicts exports may only reach $5.5 billion, a 4.4% decrease from 2024.

Despite challenges, Vietnam holds significant potential in the high-quality rice segment. Markets like the U.S., Singapore, and Brazil highly value Vietnam’s role in the global rice supply chain.

At the “Promoting Rice Production, Export, and Market Stabilization” conference, Ms. Bùi Thanh Tâm, Chairwoman of Northern Food Corporation (Vinafood1), stated: “Given current conditions, the outlook for Vietnamese rice is not overly concerning. Over the past decade, we’ve reduced dependence on China. When China reduced imports, domestic businesses faced difficulties.

However, we’ve diversified into other markets, reducing reliance and expanding exports. Vietnamese rice quality is now recognized globally, ensuring market flexibility.”

Regarding the Philippines, Ms. Tâm added: “The Philippines remains a key market. Their import suspension is temporary. By year-end, during holiday seasons, they’re likely to resume imports. Businesses should prepare accordingly.”

“Vietnam Achieves a Surplus of Nearly $14 Billion in the First Eight Months of 2025”

According to the latest statistics released by the General Statistics Office, the total import and export turnover of goods in August reached an impressive $83.06 billion, marking a 0.9% increase from the previous month and a significant 16.0% surge compared to the same period last year. For the first eight months of 2025, the cumulative import and export turnover of goods stood at $597.93 billion, reflecting a robust 16.3% year-on-year growth. This growth was driven by a 14.8% increase in exports and an even more substantial 17.9% rise in imports. The trade balance recorded a surplus of $13.99 billion, indicating a thriving and dynamic economic landscape.

A Grainy Concern: The Ongoing Challenge of Rice Exports

The Vietnamese rice industry faces a challenging period with prices at a low ebb. The primary culprit is the temporary cessation of purchases by the Philippines for the next two months, which has significantly impacted the output and sales of Vietnamese rice.

The Top Stocks to Watch This Morning: August 28th

“Unveiling the movers and shakers of the stock market, this list showcases the top-performing and worst-performing stock codes from recent sessions. These stocks have experienced significant volatility, capturing the attention of investors and traders alike. As we delve into this list, we uncover the stories behind these codes, revealing the potential opportunities and pitfalls that lie within.”