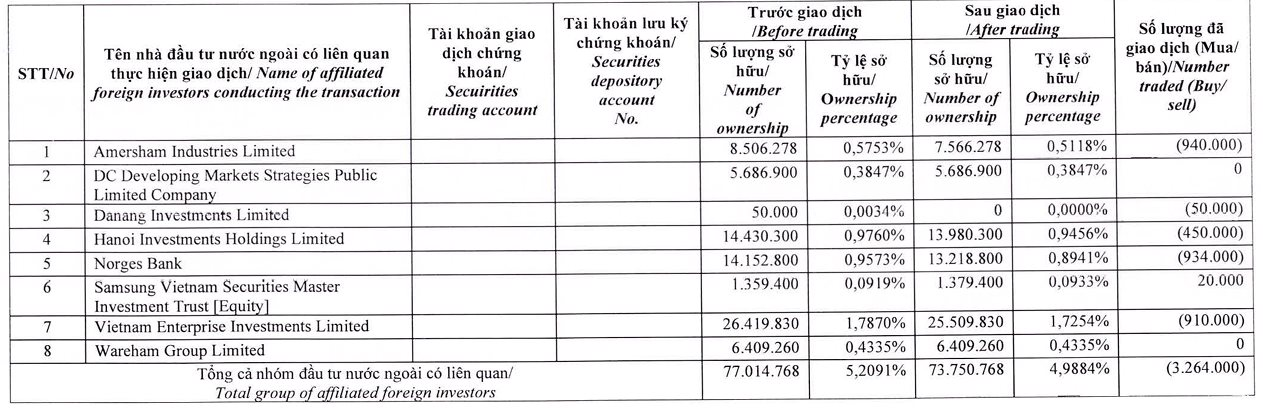

According to a report submitted to the Ho Chi Minh City Stock Exchange (HoSE), funds managed by Dragon Capital sold a net total of 3,264,000 shares of MWG on September 12, 2025. This transaction reduced the group’s total holdings from 77,014,768 shares (5.2%) to 73,750,768 shares (4.99%).

Specifically, the member funds involved in the transaction included Amersham Industries Limited (sold 940,000 shares), Norges Bank (sold 934,000 shares), Vietnam Enterprise Investments Limited (sold 910,000 shares), Hanoi Investments Holdings Limited (sold 450,000 shares), and Danang Investments Limited (sold 50,000 shares). Conversely, Samsung Vietnam Securities Master Investment Trust purchased 20,000 shares.

Previously, on July 31, the group had also sold 1,467,900 shares of MWG.

In addition to the moves by major shareholders, a senior executive of the company also reduced his holdings. From August 21 to September 4, Mr. Pham Van Trong, a Board Member and CEO of Bach Hoa Xanh, successfully sold 500,000 shares of MWG, decreasing his ownership from 0.21% to 0.18% of the charter capital.

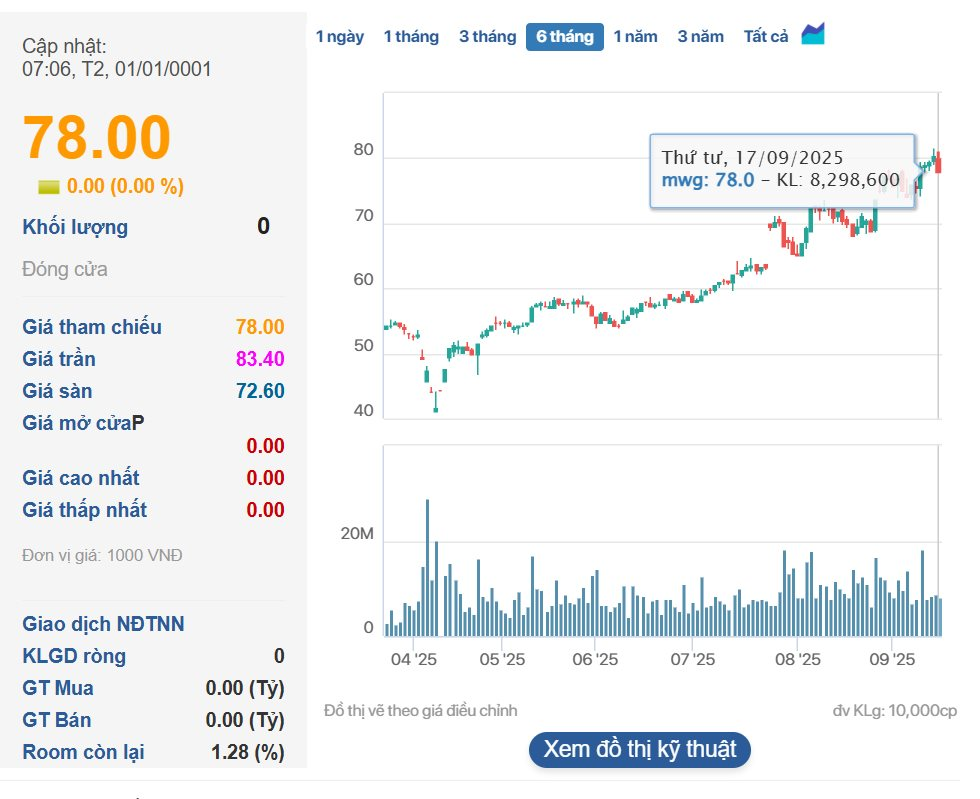

In the stock market, MWG shares have recorded a significant price increase. From April 9 to September 17, the stock price rose by 71%, from VND 45,590 per share to VND 78,000 per share.

In terms of business performance, in the first six months of 2025, Mobile World Investment Corporation (MWG) reported revenue of VND 73,754.9 billion, a 12.4% increase compared to the same period last year. After-tax profit reached VND 3,205.4 billion, up 54.4% year-on-year.

For 2025, the company set a revenue target of VND 150,000 billion and an after-tax profit target of VND 4,850 billion. Thus, after the first half of the year, MWG has achieved 66.1% of its annual profit goal.

“Quiet Markets Post-Holiday: Investment Funds See Lull in Trading Action”

The stock market resumed trading after an extended holiday break with three sessions (September 3-5, 2025) in an attempt to conquer the psychological threshold of 1,700 points, yet it fell short. Amid this backdrop, investment funds’ activities were relatively subdued, with no significant new transaction announcements as of yet.

“Dragon Capital Cuts Stake in Dat Xanh Group”

Dragon Capital divests 3.75 million DXG shares on August 29, reducing its stake in the Dat Xanh Group to 12.67%.

Unleashing the Dragon: Dragon Capital Divests 3.9 Million DXG Shares of Dat Xanh Group

On August 25, 2025, Dragon Capital, through three of its member funds, sold 3.9 million DXG shares, reducing its ownership to 13.6745% in the Dat Xanh Group.