I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON SEPTEMBER 24, 2025

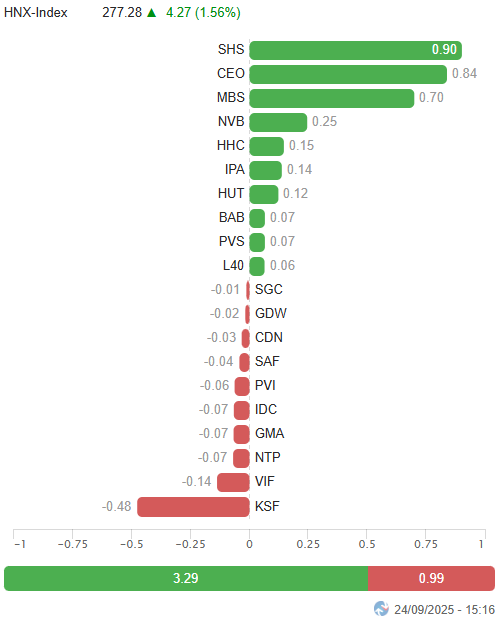

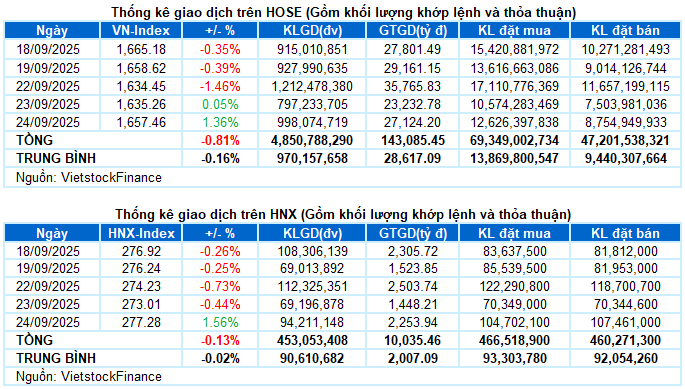

– Key indices rebounded strongly during the September 24 trading session. Specifically, the VN-Index rose by 1.36%, reaching 1,657.46 points, while the HNX-Index also increased by 1.56%, closing at 277.28 points.

– Market liquidity significantly improved compared to the previous session’s low. Trading volume on the HOSE floor surged by 43.4%, exceeding 942 million units. Meanwhile, the HNX recorded 91 million matched units, a 60.4% increase.

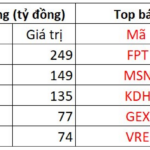

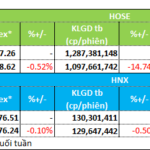

– Foreign investors continued to net sell, with a value of over 1.5 trillion VND on the HOSE and 42 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

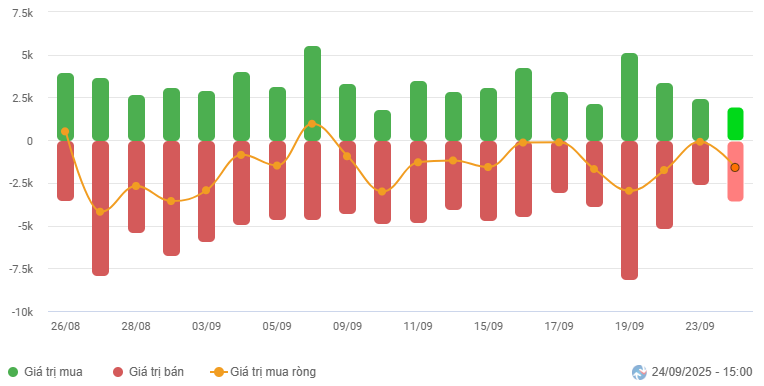

Net Trading Value by Stock Code. Unit: Billion VND

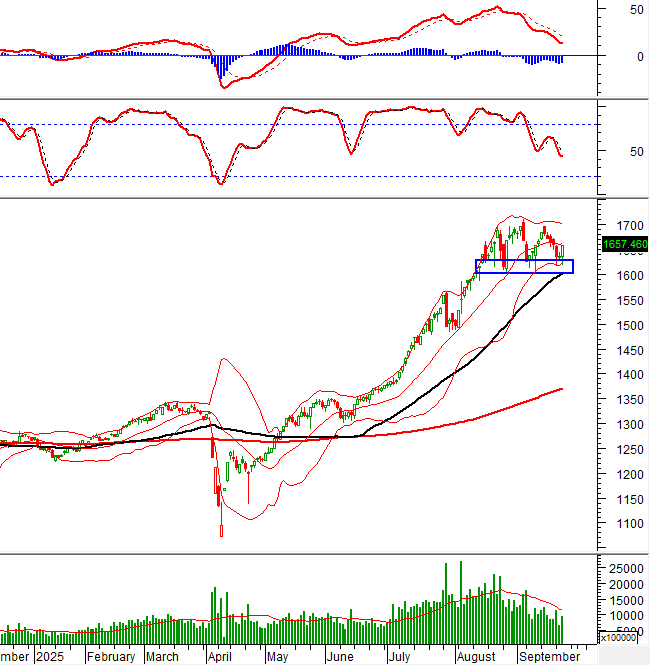

– The September 24 session began on a challenging note, with the VN-Index quickly retreating to around 1,620 points within the first half-hour. Subsequent recovery efforts were insufficient to turn the index green in the morning session. However, the tide turned dramatically in the afternoon. A strong comeback by large-cap stocks sparked a widespread positive effect. The VN-Index steadily widened its gains, closing at the session’s high of 1,657.46 points, up 22.2 points from the previous session.

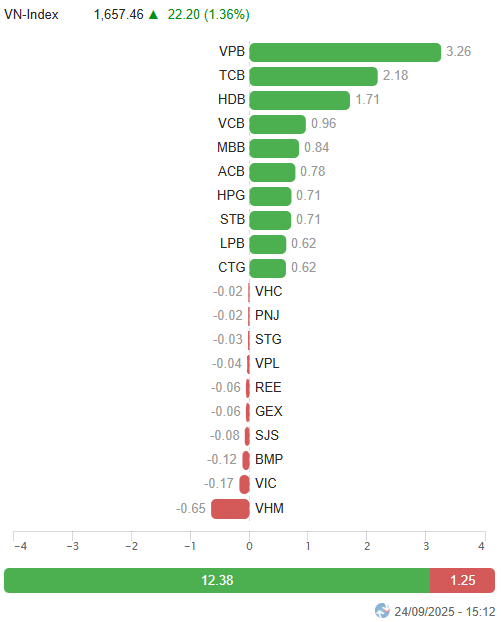

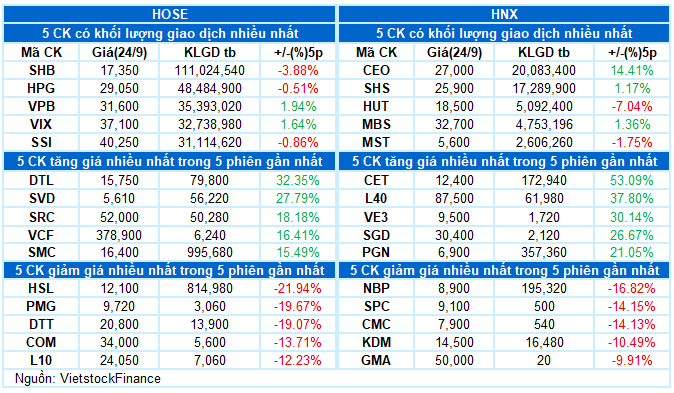

– In terms of influence, 9 out of the top 10 contributors to the VN-Index were banking stocks, collectively adding nearly 12 points (the remaining stock was HPG). Conversely, VHM was the only significant drag, subtracting 0.65 points from the index.

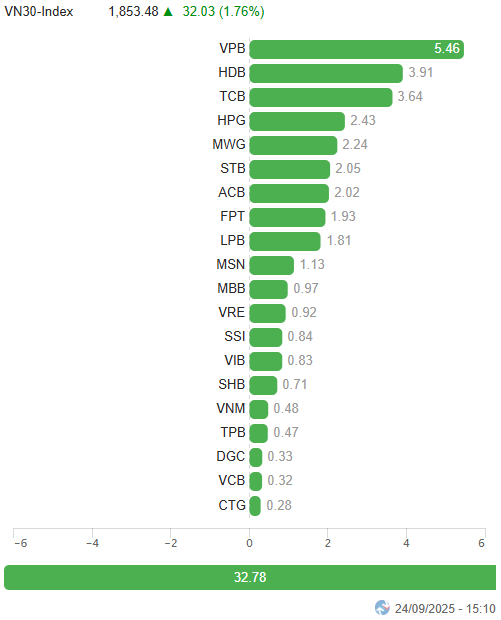

Top Stocks Impacting the Index. Unit: Points

– The VN30-Index ended the session with a gain of over 32 points, reaching 1,853.48 points. Buyers dominated with 27 advancing stocks, only 2 declining, and 1 unchanged. HDB stood out with a vibrant purple hue, followed by VPB, TCB, and VIB, all rising above 3%. On the flip side, VHM and VIC struggled, declining by 0.7% and 0.1%, respectively, while GAS remained flat at the reference level.

Green returned across all sectors by the end of the session. The financial sector contributed the most to the market’s recovery, with standout performers including HDB hitting the ceiling, VPB (+5.69%), SHB (+2.06%), TCB (+3.47%), MBB (+1.71%), TPB (+2.34%), STB (+2.89%), ACB (+2.56%), VIB (+3.27%), SSI (+2.16%), VND (+3.82%), SHS (+5.71%), and VCI (+4.18%).

The real estate and industrial sectors also showcased notable highlights, such as CEO (+8.43%), DIG (+5.37%), PDR (+5.5%), NVL (+3.19%), HDC (+4.84%), VRE (+2.47%), NLG (+2.56%), VCG (+3.01%), GMD (+1.73%), VSC (+2.21%), HHV (+2.67%), VGC (+2.05%), and CII and CDC reaching their upper limits.

The VN-Index surged after retesting the August 2025 lows (equivalent to the 1,600-1,630 range). In the upcoming sessions, the index needs to break above the Middle line of the Bollinger Bands, accompanied by trading volume exceeding the 20-day average, to solidify the recovery trend.

II. PRICE TREND AND VOLATILITY ANALYSIS

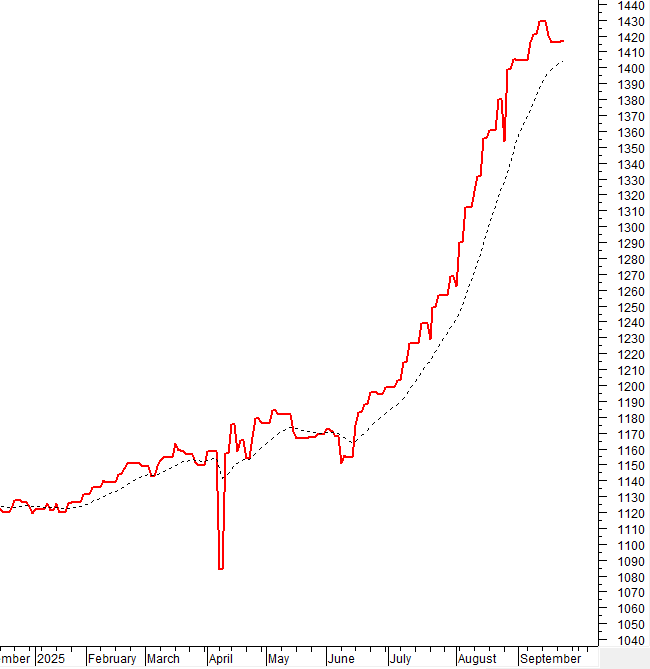

VN-Index – August 2025 Lows Serving as Strong Support

The VN-Index rebounded sharply after retesting the August 2025 lows (equivalent to the 1,600-1,630 range).

In the upcoming sessions, the index needs to break above the Middle line of the Bollinger Bands, accompanied by trading volume exceeding the 20-day average, to solidify the recovery trend.

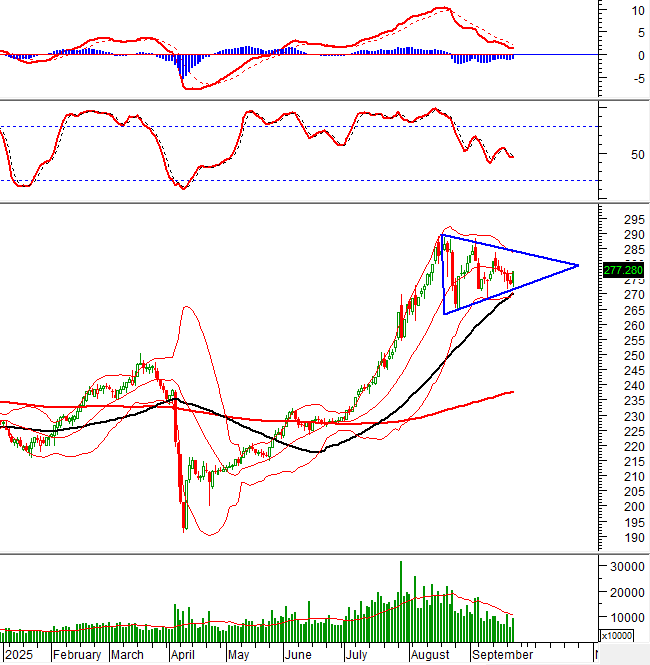

HNX-Index – Breaking Above the Middle Line of the Bollinger Bands

The HNX-Index ended its prolonged decline with a strong session, breaking above the Middle line of the Bollinger Bands. The index is likely to continue oscillating around this level as a Triangle pattern forms.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued to net sell in the September 24 session. If foreign investors maintain this action in the upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS ON SEPTEMBER 24, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:13 September 24, 2025

Capital Vanishes from the Stock Market

Today’s stock market (September 23rd) remained in a state of stalemate, with the VN-Index hovering narrowly around the reference point. Investor caution prevailed, leading to a noticeable contraction in trading volume and a significant decline in liquidity compared to previous sessions.