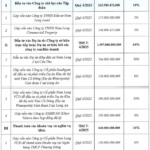

According to the plan, KIS Vietnam aims to offer over 78.9 million shares to existing shareholders, at a ratio of 100:20.98 (shareholders holding 100 shares will be entitled to purchase an additional 20.98 shares). All shares will be unrestricted for transfer.

With an offering price of 10,000 VND per share, the company expects to raise more than 789 billion VND. The entire proceeds will be allocated to support the company’s business operations and expand its business activities. If approved, the Annual General Meeting of Shareholders (AGM) will authorize the Board of Directors to decide on the detailed use of the funds raised from the offering.

As introduced on the KIS Vietnam website, the company was established in December 2010 by Korea Investment & Securities Co., Ltd (KIS Korea) in partnership with the Vietnam Textile and Garment Group and other shareholders. KIS Korea held a 48.8% stake in KIS Vietnam as of November 2010 and has gradually increased its ownership over the years, with the current official ownership standing at 99.8%.

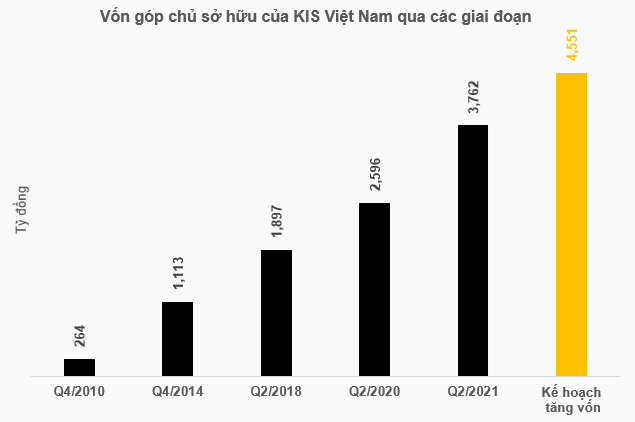

After several capital increases, the company’s current owner’s equity amounts to nearly 3,762 billion VND. If the upcoming capital raise is successful, the equity will further grow to over 4,551 billion VND. KIS Vietnam notes that the total expected capital raise may be adjusted by the Board of Directors based on actual mobilization conditions.

Source: VietstockFinance

|

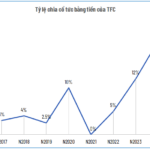

In the first half of 2025, KIS Vietnam reported pre-tax profits of over 229 billion VND, a decrease of 90 billion VND compared to the same period last year (down 28%), and achieved 31% of its annual plan. Consequently, the company’s net profit reached nearly 183 billion VND, a decline of 73 billion VND (down 29%).

The securities company attributed the decline primarily to a 133 billion VND decrease in profits from proprietary trading activities (stock and warrant trading) after deducting expenses and recognizing losses. However, there were some positive aspects, including a 90 billion VND increase (up 29%) in margin lending and advance interest income, a 20 billion VND rise (up 43%) in deposit interest income, and newly generated bond underwriting agency revenue of over 4 billion VND.

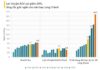

| KIS Vietnam’s Semi-annual Net Profit 2020 – 2025 |

– 1:37 PM, September 26, 2025

Nam Long Plans Capital Increase for Subsidiary Companies

Nam Long has revised its detailed plan for utilizing the VND 2.5 trillion raised from the issuance of over 100 million shares. The company intends to allocate these funds primarily for investment and capital contributions to its subsidiaries.

Sonadezi to Disburse Nearly VND 490 Billion in Dividends at 13% Rate

Sonadezi is set to distribute over VND 489.4 billion in dividends for 2024, with a payout ratio of 13%. The final shareholder registration date is October 8, 2025, and the expected payment date is October 23, 2025.