Real estate plays a pivotal role in economic development, not only as the largest capitalized market but also as a powerful catalyst for numerous other sectors. At the forum “Real Estate Market Development – A Boost Towards Double-Digit GDP Growth” held on September 26, experts emphasized that sustainable market growth hinges on two critical factors: diversified capital sources and modern transportation infrastructure.

According to Dr. Lê Xuân Nghĩa, the real estate market’s capitalization is several times larger than the GDP. In Vietnam, real estate capitalization has reached approximately $1.5 trillion, triple the national GDP. Notably, housing prices in Hanoi surged by an average of 12% annually between 2009 and 2019, outpacing both gold price increases and inflation rates.

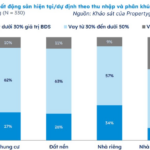

Despite its massive scale, the real estate market remains heavily reliant on bank credit, accounting for about 25% of total outstanding loans. Alternative financing channels, such as corporate bonds, stocks, and housing investment funds, only meet a fraction of the demand. For instance, real estate bonds represent just 20–30% of the corporate bond market, covering a mere 7% of the industry’s capital needs.

To foster sustainable growth, Dr. Lê Xuân Nghĩa advocates for diversifying capital sources. This includes enhancing financial transparency, implementing credit ratings for businesses, and developing housing funds and co-ownership real estate funds to support middle- and low-income earners. Additionally, encouraging innovative financial models can reduce dependence on banks.

Dr. Lê Xuân Nghĩa emphasizes that Vietnam must accelerate capital diversification to ensure the real estate market’s sustainable development.

While capital acts as the “lifeblood” of the market, infrastructure serves as the “skeleton” shaping its growth. Assoc. Prof. Dr. Architect Nguyễn Vũ Phương, Deputy Director of the Construction Strategy and Personnel Development Academy (Ministry of Construction), highlights the critical role of transportation infrastructure in real estate development.

Over the past decade, Vietnam’s expressway network has expanded from 90 km in 2010 to 1,700 km in 2023, with projections reaching 5,000 km by 2030. Major projects like the Hanoi and Ho Chi Minh City metro systems, Long Thanh Airport, and Cai Mep – Thi Vai Port not only expand development space but also reshape the market through compact urban models, 15-minute cities, and transit-oriented development (TOD).

However, Vietnam faces significant challenges. Annual infrastructure investment needs amount to $25–30 billion, yet funding remains limited. Urban rail projects often face delays, cost overruns, and land clearance issues. The real estate market also grapples with speculative “virtual land fever,” poorly synchronized urban development, and a surplus of high-end properties alongside a shortage of social and worker housing.

International experience underscores the need for seamless integration between transportation infrastructure and real estate for sustainable growth. In Hong Kong, the “Rail + Property” model enables metro operators to develop projects around stations, generating reinvestment funds. Singapore mandates that 20–30% of TOD land be allocated for social housing, allowing 80% of its population to live affordably near the MRT system. Europe’s “15-Minute City” model reduces car dependency and enhances property value through improved quality of life.

Drawing from these examples, Assoc. Prof. Dr. Architect Nguyễn Vũ Phương suggests Vietnam adopt a comprehensive strategy. TOD projects should incorporate social housing and affordable homes, while mechanisms to recapture land value increases from new infrastructure should fund community reinvestment. Pilot “Rail + Property” models in Hanoi and Ho Chi Minh City, combined with functional regional planning (FUA/FRA), can optimize urban, satellite, and ecological real estate distribution, preventing central overburden.

Capital and infrastructure are the “wings” propelling Vietnam’s real estate sector. Overreliance on bank credit or disjointed infrastructure development risks market imbalances, bubbles, and instability. A synchronized strategy—diversifying capital sources while investing in modern, equitable housing infrastructure—will position real estate as a cornerstone of sustainable economic growth.

Transforming Quang Tri into a New Growth Hub: A Distinctive Center for Energy, Logistics, and Tourism

Following its merger with Quang Binh, Quang Tri is poised to seize new opportunities and emerge as a dynamic growth hub in the Central region. With an expansive development space stretching from the mainland to the islands, and a natural area ranking among the top 10 largest provinces and cities nationwide, Quang Tri boasts not only a strategic position but also immense potential for comprehensive breakthroughs across multiple sectors.

West Lake West Real Estate Booms Thanks to Rare Feng Shui Location

Nestled along the auspicious axis of Ba Vì – West Lake, Jade Square embodies the pinnacle of luxury living in Hanoi’s elite circles. Its prime location, steeped in feng shui principles, harnesses the prosperous energy of this golden coordinate, elevating it to a symbol of sophistication and prestige in the West Lake area.