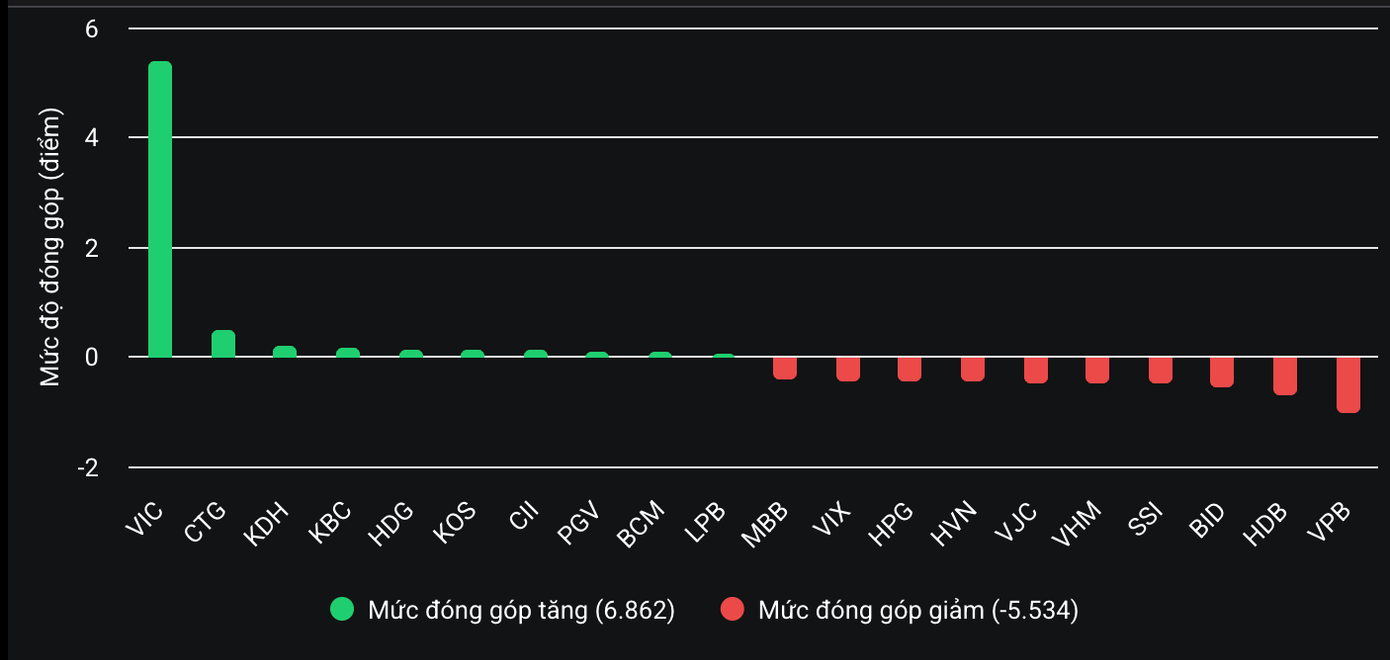

Strong buying pressure from VIC helped narrow the index’s decline. However, this wasn’t enough to offset the downward pressure from numerous large-cap stocks weakening. Red dominated as over 200 stocks on the HoSE fell, with market breadth heavily favoring sellers.

Bank and securities stocks collectively adjusted, putting significant pressure on the index. In the banking sector, several stocks like VPB, HDB, BID, MBB, and LPB declined. Meanwhile, in the securities group, major stocks such as SSI (-3.1%), VND (-2.4%), VIX (-3.4%), and VCI (-2.7%) also dropped.

VIC contributed nearly 6 points to the VN-Index

Most steel stocks adjusted, with HPG, NKG, HSG, VGS, POM, and TVN all in the red. Influential sectors were largely in a less-than-positive state.

Meanwhile, real estate stocks traded more positively, led by VIC. Other sector stocks like CII, CEO, HDG, IJC, and KDH also rose. For Vingroup, this marked the second consecutive session of gains, bucking the market trend. VIC rose 3.8% to 164,000 VND per share. The company’s market capitalization solidified its position as the largest on the exchange, exceeding 636 trillion VND, with a gap of over 100 trillion VND ahead of Vietcombank in second place.

Despite the market adjustment, Vietnam’s richest billionaire’s assets continued to grow. According to Forbes updates, Mr. Vuong’s net worth now stands at $15.8 billion, ranking 162nd among global billionaires. His wife, Pham Thu Huong, also holds assets valued at nearly 28 trillion VND—an increase of nearly 1 trillion VND from the previous day. Mrs. Huong owns 170.61 million VIC shares.

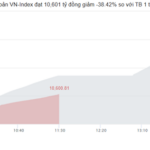

At the close, the VN-Index fell 5.39 points (0.32%) to 1,660.7 points. The HNX-Index dropped 1.59 points (0.57%) to 276.06 points. The UPCoM-Index rose 0.14 points (0.13%) to 110.63 points.

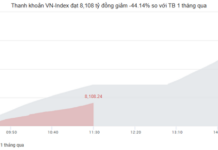

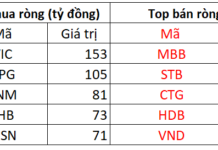

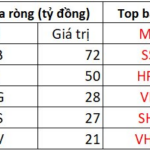

Liquidity decreased, with trading value on HoSE reaching approximately 24.8 trillion VND. Foreign investors continued net selling at 2.163 trillion VND, focusing on SSI, HPG, VIX, SHB, and VHM.

Busy Businesses Paying Dividends

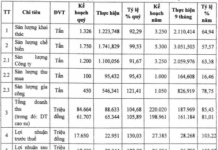

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

Market Pulse 26/09: VN-Index Experiences Volatile Shifts as Foreign Investors Continue Net Selling Streak

At the close of trading, the VN-Index fell by 5.39 points (-0.32%), settling at 1,660.7 points, while the HNX-Index dropped by 1.59 points (-0.57%), closing at 276.06 points. Market breadth tilted toward the downside, with 432 decliners outpacing 305 advancers. Similarly, the VN30 basket saw red dominate, as 21 stocks declined, 5 advanced, and 4 remained unchanged.