|

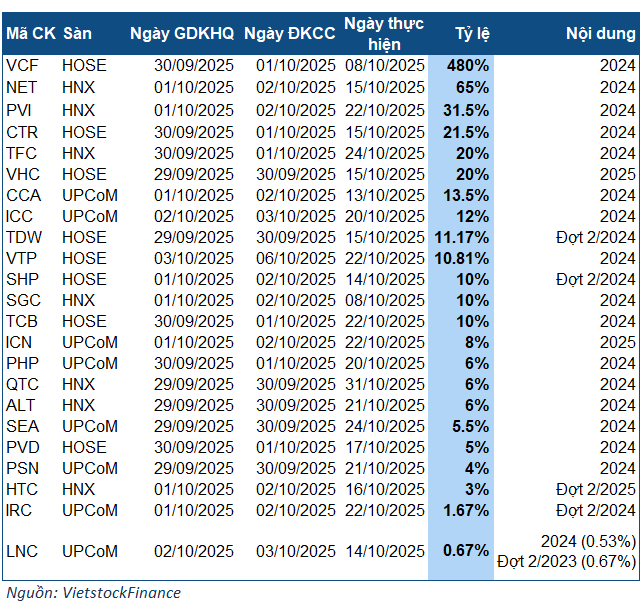

Companies Announcing Cash Dividends for the Week of September 29 – October 3

|

VCF stands out as the most impressive name next week, announcing a staggering 480% cash dividend. With over 265.7 million outstanding shares, this dividend payout amounts to nearly VND 1,276 billion. The ex-dividend date is September 30, with payment scheduled for October 8, 2025.

The majority of this dividend will go to the parent company, Masan Group (HOSE: MSN), which owns nearly 99% of VCF. Recently, VCF announced it no longer meets the requirements for a public company due to this concentrated ownership. According to the list of securities holders by VSDC on July 28, 2025, VCF has a total of 538 shareholders, with Masan Beverage (a subsidiary of MSN) holding 98.79% of the voting shares. The remaining 537 minority shareholders hold only 1.21%.

With such concentrated ownership, VCF fails to meet the minimum requirement of 10% of voting shares held by at least 100 non-major investors, as per the 2024 amended Securities Law.

In second place is NET’s record 65% dividend (VND 6,500 per share). The ex-dividend date is October 1, with payment on October 15. With nearly 22.4 million outstanding shares, the total payout will be approximately VND 146 billion. Major shareholders, holding over 88% of Netco’s capital, will benefit significantly. Vinachem owns 36%, while Masan HPC, a Masan Group subsidiary, holds the controlling stake at 55.25%.

Next is PVI with a 31.5% dividend (VND 3,150 per share). PVI currently has over 234 million outstanding shares, corresponding to a payout of around VND 738 billion. The ex-dividend date is October 1, with payment expected from October 22.

PVI has consistently paid cash dividends for 16 years. In 2021, the company recorded its highest dividend at 33%. While subsequent years haven’t matched this peak, dividends have remained above 30%. The 2024 dividend rate is slightly lower than 2023, reflecting the impact of Typhoon Yagi on business results.

Viettel’s CTR is also notable with a 21.5% dividend (VND 2,150 per share), totaling nearly VND 246 billion. The ex-dividend date is September 30, with payment on October 15.

The Viettel Group, holding 65.66% of CTR’s capital, and Mr. Đoàn Hồng Việt, owning nearly 5%, will be the primary beneficiaries. Mr. Việt also serves as Chairman of Digiworld (HOSE: DGW), a leading technology and consumer electronics distributor in Vietnam.

Additionally, VHC (Vinh Hoan) and TFC (Trang Company) both announced a 20% dividend (VND 2,000 per share). Their ex-dividend dates are September 29 and 30, with payments on October 15 and 24, respectively.

No companies are announcing stock dividends next week.

– 13:58 28/09/2025

Gelex Infrastructure Unveils IPO Plan: Targeting $28,000–$30,000 per Share, Aiming to Raise $300 Million, Potentially Valuing Company at $1 Billion

According to BVSC Securities, Gelex Infrastructure Corporation is poised to raise approximately VND 3,000 billion, a strategic move to bolster capital for its real estate segment and re-evaluate the market’s perception of the “engine” that currently constitutes two-thirds of the group’s total assets.

“All Recent Reforms Aim to Elevate Vietnam’s Market Status, Says Mr. Bui Hoang Hai (SSC)”

At the Vietnam Financial Advisors Summit (VWAS) held on the afternoon of September 25th under the theme “New Era, New Momentum,” Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that market upgrading is not merely an endpoint but a means to achieve a more transparent, stable, and efficiently operating market. This transformation aims to provide investors with greater opportunities to pursue profitable returns.