Skyrocketing apartment prices, often dozens of times higher than average incomes, make homeownership a distant dream for many. (Photo: Quốc Khánh/Vietnam+)

|

Property and apartment prices have been on a relentless upward trajectory, with each new wave surpassing the last, showing no signs of abating. This surge has left many middle-income earners unable to afford a home, despite decades of saving.

While this issue has persisted for years, what are the underlying causes? How will state management agencies intervene with regulatory tools to curb real estate prices, making them more aligned with the public’s purchasing power?

Soaring Home Prices Outpace Income Growth

After 22 years of studying and working in Hanoi, Trần Hoàng from Phú Thọ province has been frantically searching for an old apartment to buy. With a family of four currently renting in Vĩnh Tuy district, he recently secured a 56m² apartment, over five years old in Định Công district, for 4.75 billion VND (approximately 80 million VND per square meter).

“Home prices are climbing monthly, yearly, even weekly. My wife and I have saved nearly 3 billion VND over decades, but prices have surged to 4 billion VND. It’s a race we can’t keep up with. We’re considering selling a plot of land back home just to afford an apartment,” Hoàng laments.

Phạm Thị Phương Thảo, an accountant from Hưng Yên province working in Hanoi, faced a similar predicament. On October 3rd, she was offered a four-story, 33m² apartment on Ngọc Thụy street for 4.55 billion VND. Within a week, the price jumped to 4.8 billion VND, and it was snapped up by another buyer.

“In just seven days, the price soared by 300 million VND. The agent explained that the seller raised the price due to neighboring properties experiencing similar exponential increases. With prices escalating weekly, far beyond what most can afford, the dream of owning a home in Hanoi remains elusive without substantial financial backing,” Thảo sighs.

A striking statistic reveals that a Vietnamese civil servant needs nearly 26 years of income to purchase an apartment—a stark contrast to global averages, highlighting the disparity between property prices and earnings.

Over the past years, apartment prices have consistently climbed month after month, year after year. (Photo: Việt Hùng/Vietnam+)

|

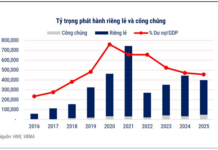

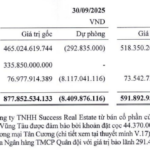

According to the Ministry of Construction’s Q3 2025 report, average primary sale prices for Hanoi apartments range from 70 to 80 million VND/m², up 5.6% from Q1 and 33% from Q3 2024. Luxury apartments in Hanoi fetch between 150 and 300 million VND/m². Land plots in Hanoi trade between 60 and 100 million VND/m², with prime locations like Đông Anh, Long Biên, and Hoài Đức near metro lines and new urban developments reaching 200 million VND/m².

Ministry officials attribute the price surge to a market dominated by mid- to high-end apartments, with a shortage of affordable options for the majority.

“Property prices are rising annually, often disconnected from real value. They exceed the purchasing power of middle-income urban residents. Market distortions persist, including hoarding, price manipulation, and speculation, exacerbating supply-demand imbalances,” the Ministry emphasizes.

Bringing Housing Prices in Line with Incomes

At a September meeting of the Central Steering Committee on Housing Policy and Real Estate Market in Hanoi, Prime Minister Phạm Minh Chính addressed representatives from ministries, localities, and businesses: “So many need homes but can’t afford them. With apartment prices at 70-100 million VND/m², who can buy? Claiming there’s no demand is detached from reality—we’re out of touch with the common people.”

The Prime Minister directed agencies to tighten land management, valuation, and auction controls, and to swiftly address market manipulation and speculation to stabilize the real estate sector.

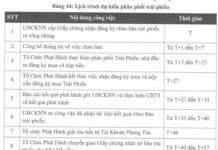

In response, the Ministry of Construction is gathering feedback on a draft resolution to control and curb property prices, expected to be submitted to the Government in October.

Key proposals include establishing a real estate transaction center for transparency, introducing homebuyer loan policies, and promoting affordable commercial housing.

Nguyễn Văn Đính, Vice Chairman of the Vietnam Real Estate Association, supports these measures as essential tools for restoring market stability and sustainable growth.

Đính elaborates that all transactions should be processed through a state-managed center to prevent manipulation and speculation. Centralizing transaction data will ensure legal transparency, streamline public transactions, and enable the government to monitor market dynamics, from pricing and transaction histories to legal compliance.

“Additionally, the government must urgently expand social housing and affordable commercial housing to increase supply, ease market pressure, and control price hikes,” Đính urges.

Market distortions persist, including hoarding, price manipulation, and speculation, driving up property prices. (Photo: Việt Hùng/Vietnam+)

|

Emphasizing credit as a vital regulatory tool, particularly against speculation and unhealthy transactions, Đính notes that authorities must distinguish between speculators and genuine buyers to avoid penalizing those with legitimate needs.

Experts recommend a multi-pronged approach to regulate the real estate market and reduce home prices, including adjusting land use fees and rents, taxing vacant properties and second homes to deter speculation, and using development planning to manage housing supply.

Tống Thị Hạnh, Director of the Department of Housing and Real Estate Market Management (Ministry of Construction), identifies institutional reform as the key to resolving current market challenges. This fundamental issue impacts all market aspects, from supply and transactions to transparency.

“The Ministry plans to revise the Housing Law and Real Estate Law in 2026, focusing on core issues like transaction conditions, real estate services, and market controls to ensure stability and integrity. The goal is to create a progressive legal framework that attracts investment and revitalizes the market,” Hạnh concludes.

Việt Hùng

– 10:47 14/10/2025

Affordable Luxury: Hanoi’s New Residential Projects Priced Between 18-30 Million VND/m²

The Hanoi real estate market has recently witnessed a resurgence in activity within the affordable housing segment, as numerous new projects have been launched, offering prices ranging from VND 18.4 to 29.4 million per square meter.

“Once a Hot Property with 5,000 Buyers: Located on Hanoi’s Most Flood-Prone Street, Yet Prices Surge 1.5x in Just Over a Year”

Over a year since thousands clamored to secure spots at the launch event, resale prices for the Lumi Hanoi project have surged from approximately 65 million VND/m² to nearly 100 million VND/m². Presently, numerous buildings at the site are nearing completion, with both infrastructure and internal amenities being systematically finalized.

26 Years of Savings: The Reality of Homeownership for the Average Citizen

Dr. Can Van Luc highlights a concerning trend in the real estate market: speculative hoarding and price manipulation. A staggering 80% of transactions involve properties resold within a year of purchase, indicating a high level of speculative activity.