The gold market is highly volatile, leading many to purchase gold on the “black market” at higher prices to avoid long queues. What does the legal framework say about this?

Decree 24/2012/NĐ-CP, amended by Decree 232/2025/NĐ-CP, stipulates in Clause 6, Article 4:

“The production of gold bars, buying and selling of gold bars, and the production of gold jewelry and art are conditional business activities. These require a License for Gold Bar Production, a License for Buying and Selling Gold Bars, and a Certificate of Eligibility for Producing Gold Jewelry and Art from the State Bank of Vietnam.”

Only licensed enterprises and banks are permitted to trade SJC gold bars. Photo: Tấn Thạnh

Clause 7, Article 4 states: “The buying and selling of gold jewelry and art is a conditional business activity that does not require a business eligibility certificate.”

Clause 9, Article 4 defines other gold trading activities as “restricted business activities. Organizations and individuals may only engage in these activities after obtaining permission from the Prime Minister and a license from the State Bank of Vietnam.”

Thus, trading in gold bars, jewelry, and art is conditional. Gold bar trading must be conducted by licensed credit institutions and enterprises (Article 10). While gold jewelry and art trading does not require a certificate, businesses must meet specific conditions (e.g., registration, location, facilities) as per Article 8.

Article 19 outlines prohibited acts in gold trading, including:

“Trading gold bars without a State Bank license; exporting or importing gold without a license; using gold as a means of payment; engaging in unlicensed gold trading activities.”

These regulations emphasize that gold trading is state-regulated. Therefore, unauthorized “black market” gold trading is illegal, as such entities fail to meet legal requirements and lack state approval.

Is individual gold trading considered illegal?

The decree applies only to “individuals engaged in gold trading.” Casual purchases from individuals (e.g., family members) are not considered violations. However, frequent, profit-driven transactions may be deemed unlicensed trading, subject to legal penalties, including administrative fines or criminal charges.

Violators may face fines of 300–400 million VND for individuals and double for organizations, plus additional measures like gold confiscation or license suspension (Decree 88/2019/NĐ-CP).

Severe cases may constitute criminal offenses under the 2015 Penal Code, such as “Smuggling” (Article 188) or “Money Laundering.”

Note: Using gold as payment is prohibited under Clause 4, Article 19 of Decree 24/2012/NĐ-CP.

Why Don’t Vietcombank and Techcombank Produce Their Own Gold Bars? The Case for Outsourcing Production

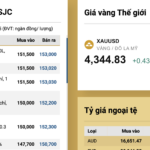

Gold prices surge as SJC gold bars hit VND 153 million, prompting Vietcombank and Techcombank to seek gold bar manufacturing partnerships.

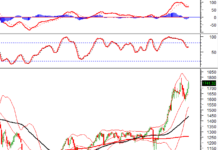

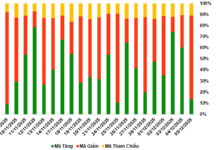

Gold Prices Surge Beyond Expectations: Experts Urge Caution for Investors

Domestic gold prices surge to nearly 160 million VND per tael, surpassing all forecasts. Experts advise caution, urging individuals to avoid herd mentality; gold should constitute no more than 5% of total investment portfolios, serving as a long-term defensive asset.