|

Source: PNJ

|

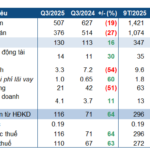

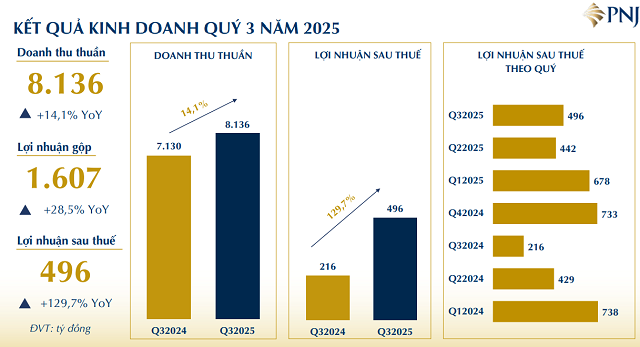

According to the recently released business report, in Q3/2025 alone, PNJ recorded net revenue of VND 8,136 billion and post-tax profit of VND 496 billion, up more than 14% and 2.3 times year-on-year, respectively. The profit growth outpaced revenue growth primarily due to an improved gross margin, rising from 17.5% to 19.8%, reflecting effective cost control.

Source: PNJ

|

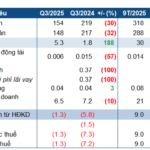

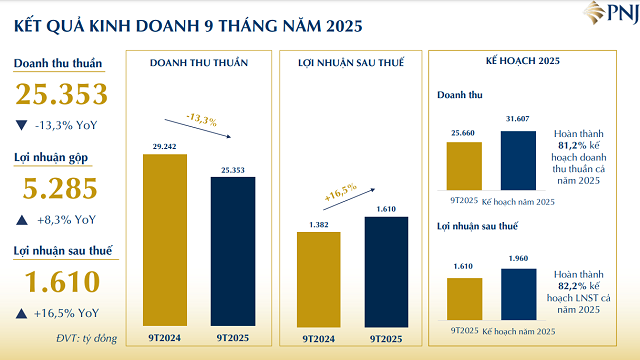

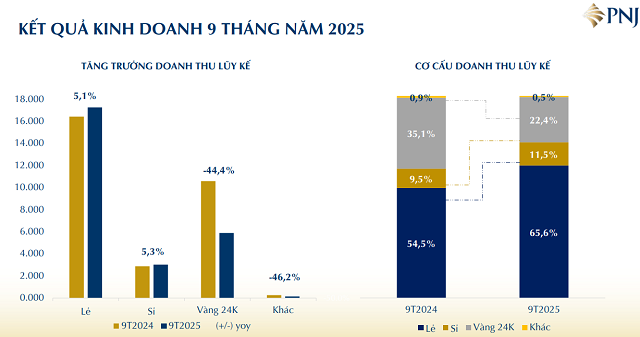

In the first nine months of 2025, PNJ achieved net revenue of VND 25,353 billion, down 13% year-on-year. However, post-tax profit still increased by 17%, reaching VND 1,610 billion. The main driver was the jewelry retail segment, which saw a 5.1% revenue growth, helping the average gross margin rise to 20.8% (compared to 16.7% in the same period in 2024).

Source: PNJ

|

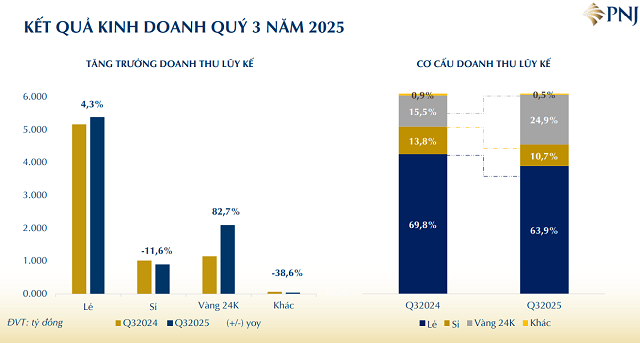

Revenue structure continued to shift positively: the proportion from jewelry retail increased to 65.6%, up 11.1 percentage points year-on-year. Additionally, PNJ benefited from the recovery of the value of repurchased goods amid rising gold prices, along with effective operating cost control.

As of the end of September 2025, PNJ operated 429 stores nationwide, including 422 PNJ stores, 3 Style by PNJ stores, 3 CAO Fine Jewellery stores, and 1 wholesale center. In the first nine months, the company opened 10 new stores and closed 10 stores, demonstrating a flexible network restructuring strategy.

According to PNJ, the positive results stemmed from the expansion of the retail system, enhanced marketing programs, new customer acquisition, and a flexible product strategy aligned with consumer trends. The wholesale segment also recorded a 5.3% revenue growth, thanks to its production reputation and product traceability capabilities.

Conversely, 24K gold revenue declined sharply by 44% year-on-year due to raw material scarcity and product supply disruptions from late 2024 to early 2025.

Over the nine months, PNJ achieved 81% of its revenue target (VND 31,600 billion) and over 82% of its profit target (VND 1,960 billion) for the year.

– 13:00 23/10/2025

Revenue Plummets, Yet Duc Giang Chemical’s Subsidiary Surges 63% in Profit

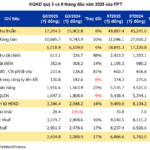

Apatit Vietnam Phosphorus Joint Stock Company (UPCoM: PAT), a subsidiary indirectly owned by Duc Giang Chemicals (HOSE: DGC) through its wholly-owned subsidiary Duc Giang Chemicals – Lao Cai Co., Ltd., has released its Q3/2025 financial report. Despite declines in revenue and sales volume, the company reported a significant year-over-year increase in profits.

Routine Maintenance Plunges Ninh Binh Thermal Power into Loss After Two Consecutive Profitable Quarters

Ninh Binh Thermal Power Joint Stock Company (HNX: NBP) has released its Q3/2025 financial report, revealing a net loss despite profitable results in the previous two quarters. However, the situation shows significant improvement compared to the same period last year.

German Chemicals Giant Duc Giang (DGC) Posts Modest Profit Growth Through Cost-Cutting Measures

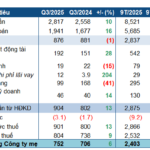

Leveraging its substantial cash reserves and streamlined sales expenses, Duc Giang Chemical Group Corporation (HOSE: DGC) reported a net profit of over VND 752 billion in Q3/2025, marking a slight increase year-over-year despite a modest decline in gross profit.