Speakers sharing at the seminar on the afternoon of October 24, 2025. Screenshot.

|

Interest rates may rise slightly, with exchange rate pressure easing from mid-2026

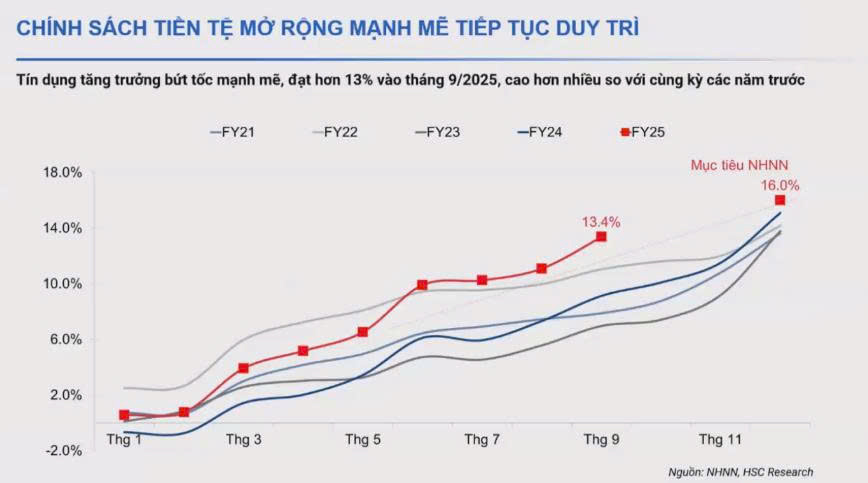

Ms. Pham Lien Ha – Senior Research Director of Financial Services at HSC stated that Vietnam’s monetary policy remains accommodative, with low policy rates and a high credit growth target.

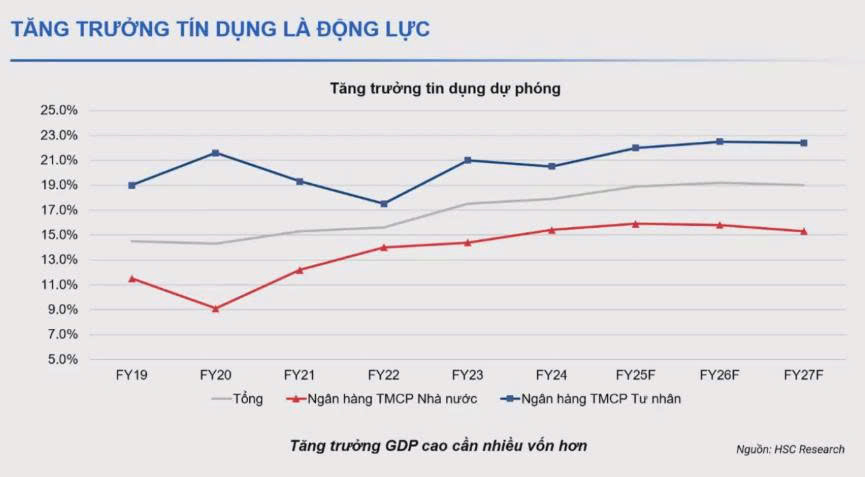

Credit growth in the first nine months of 2025 reached 13.7%, the highest level in the past decade. The State Bank of Vietnam (SBV) initially set a target of 16% for the year but recently mentioned a higher target of around 18-20%, which HSC believes is achievable.

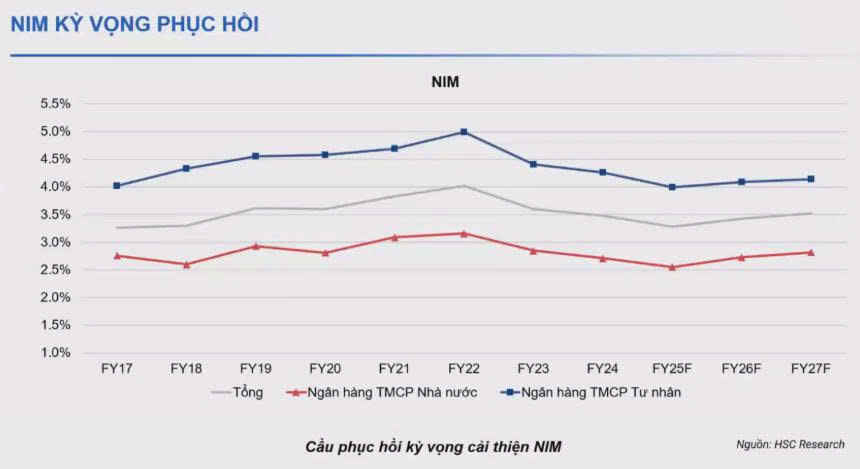

Deposit interest rates have remained stable for nearly two years at a record low. Lending rates have also been kept low, with many preferential packages, especially for home loans. As a result, the net interest margin (NIM) of banks has significantly declined in 2024-2025, reflecting the industry’s efforts to reduce interest rates.

High credit growth is expected to continue in the coming years to support the target of double-digit GDP growth. However, interest rates may rise slightly towards the end of the year due to exchange rate risks and liquidity concerns.

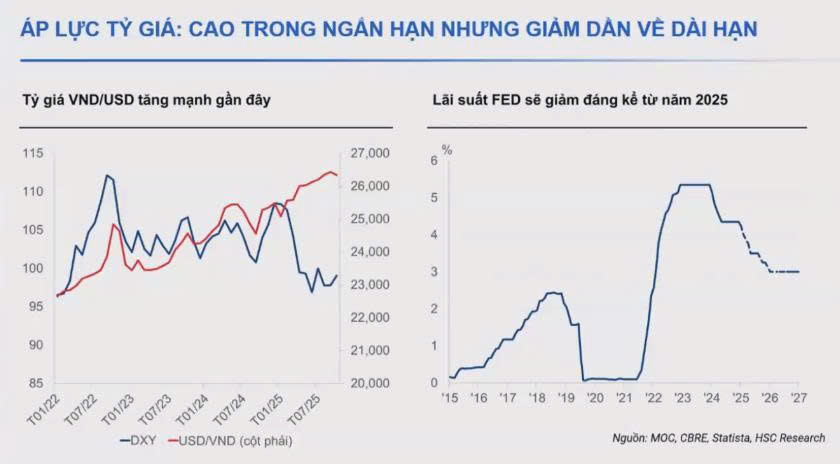

Mr. Le Khanh Tung – Head of Financial Services Research at HSC noted that exchange rate pressure is a significant issue, with the rate increasing by nearly 6% since the beginning of the year. As of the end of October 2025, the exchange rate at state-owned banks reached 26,300 VND/USD, even higher in the unofficial market. However, pressure is expected to ease from mid-2026 as the US Federal Reserve begins to cut rates, from 4.5% to around 3% in 2026-2027. This will reduce the interest rate gap between Vietnam and the US, helping to stabilize the exchange rate and providing room for the SBV to maintain its accommodative monetary policy for 1-2 more years.

Numerous policies expected to support the banking sector

Ms. Pham Lien Ha mentioned that since the beginning of the year, several legal documents have been issued, positively impacting the system, such as the Law on Resolution 42, which aims to accelerate bad debt resolution; the shift from credit growth limits to growth based on the capital adequacy ratio (CAR), and the application of Basel III to enhance risk and capital management capabilities.

Other regulations, such as the development of an international financial center, a sandbox mechanism for fintech and peer-to-peer lending, cryptocurrency regulations, and amendments to the gold market mechanism, may not show immediate effects but are crucial for the banking sector’s long-term development.

Decrees related to foreign ownership limits (FOL), such as Decree 69 (effective from July 19, 2025), which raises the FOL ceiling to 49% for private banks participating in the compulsory transfer of weak banks, benefit three banks: HDBank, MB, and VPBank. In fact, HDBank and VPBank have already taken steps to find strategic investors and issue additional shares to support the expected high credit growth (around 30%) in the coming years.

Additionally, Resolution 22 on establishing financial centers in Ho Chi Minh City and Da Nang will introduce pilot preferential policies (corporate income tax and personal income tax incentives for eligible personnel until 2030, relaxed foreign exchange regulations, simplified market entry procedures, and visa/work permit support) to attract global financial experts. Pilot policies for new financial products (carbon credits, green finance, digital assets) are also encouraged.

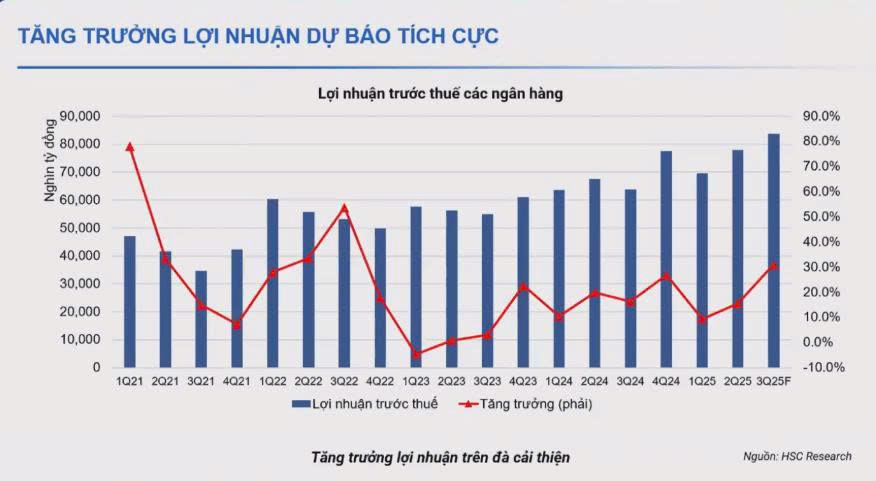

Banking sector outlook through credit growth and NIM

Ms. Pham Lien Ha believes that the sector’s profit growth is recovering after hitting a low in Q1/2023. Profit growth in Q1/2025 reached nearly 10%, and Q2 is expected to be around 15-16%. HSC estimates Q3/2025 growth at 31% (due to the low base of the previous year). In subsequent quarters, HSC expects growth to reach 15-20%.

The main growth drivers are credit growth, NIM, and fee income.

Firstly, with a nominal GDP growth target of around 13-17% per year, system-wide credit growth is projected at 18-20%. Private banks will lead with growth above 20%, especially those supporting zero-dong banks (25-30%). If the SBV removes credit limits, banks with high CAR ratios like Techcombank could achieve credit growth of 22-25%.

Secondly, as the economy recovers and credit demand increases, NIM is expected to improve, even with short-term increases in funding costs due to liquidity and exchange rate pressures. Q2 and Q3 data show that banks have maintained and slightly improved their NIM by 10-20 basis points. HSC believes NIM has bottomed out and will recover slightly but will not return to the high levels of 2021-2023.

Lastly, fee income growth is expected to improve with the recovery of bancassurance and new growth drivers. In the first nine months of 2025, many private banks recorded positive fee income growth.

Mr. Nguyen Thanh Tung – Head of Financial Services Research at HSC analyzed that since 2016, the bad debt ratio has significantly improved, rising slightly in 2023 due to the economic downturn and the 2022 bond market crisis but stabilizing again in 2024. The formation of new bad debts peaked in Q3/2023 and has since declined, indicating improving asset quality. However, macroeconomic risks, particularly tariffs, could impact the economy from Q4.

New growth drivers from securities companies, digital assets, and gold

Mr. Le Khanh Tung identified two new growth drivers for the banking sector in the future.

Firstly, over the past 1-3 years, the profit contribution from bank-affiliated securities companies has increased significantly. Notably, Techcombank (TCBS) and VPBank (VPBankS) have seen securities companies contribute 16-21% of the bank’s after-tax profit (as of the first half of 2025). These securities companies operate as the bank’s Investment Banking (IB) arm, generating profits from advising on corporate bond issuances—a market with significant potential.

Secondly, despite fluctuations since early 2020, stock market trading volume has grown strongly, from VND 5-6 trillion per session in 2020 to over VND 45 trillion per session in Q3/2025. This shows that the stock market is a dynamic investment channel, and securities companies benefit significantly from brokerage and margin lending.

Long-term growth comes from digital assets. Resolution 05 (2025) and the Digital Industry Law have provided a clear legal framework for the digital asset/cryptocurrency market. Around 10 securities companies and three major private banks have pioneered this service. If successful, Vietnamese cryptocurrency trading volume could reach USD 700 million per day (50% of the stock market), generating brokerage revenue of over VND 6,000 billion (excluding margin income). Thus, the digital asset market will be a “blue ocean” in the long term, providing significant income for securities companies and parent banks.

Mr. Nguyen Thanh Tung added that another driver is the gold market. Recently, Decree 232 eliminated the monopoly on SJC gold bar production, opening opportunities for commercial banks with charter capital of VND 50 trillion or more and certain enterprises. This creates a new business segment, providing risk-free income (unlike credit risk), which banks aim to increase. The decree requires gold transactions over VND 20 million to be conducted through banks, increasing liquidity and CASA for the system. However, the profit is not significant compared to large bank profits, though it helps diversify fee income.

Banks are also beginning to enter the insurance sector, although it contributes little to profits. A medium-sized non-life insurance company can earn VND 300-500 billion annually. Life insurance companies may earn more but require 3-5 years to establish systems and start profiting.

Ms. Pham Lien Ha forecasts bank profit growth for 2026-2027 at around 20%. However, this projection does not include new growth drivers (digital assets, gold, etc.). Therefore, there is potential for upward revisions as more specific regulations are issued.

– 20:51 24/10/2025

Record-Breaking Deposits: Which Bank Offers the Highest Interest Rates?

Amidst a surge in credit growth, numerous banks are hiking deposit interest rates to attract more savings from the public. Several banks are now offering rates exceeding 6% per annum for long-term deposits.

Advocating for the Retention of 4.8% Interest Rate on Social Housing Loans

At the seminar titled “Addressing the Demand for Affordable Housing and Solutions to Attract Residents to New Urban Areas,” Mr. Lê Hoàng Châu, Chairman of HOREA, asserted that the 6.6% interest rate for social housing buyers is excessively high. He urged the Government to maintain the rate at 4.8%, ensuring that citizens, particularly young people, have a viable opportunity to secure housing that aligns with their income levels.

Why Are Bank Deposits Surging Despite Low Interest Rates?

In the current economic landscape, interest rates remain at historically low levels, yet deposits from individuals and businesses into the banking system continue to surge. This is not a paradox, but rather a reflection of a strategic defensive posture of capital during the transitional phase of the economic cycle.

Historic Liquidity Injection: SBV Executes Record-Breaking Forward Purchase Operation

On October 22nd, the State Bank of Vietnam (SBV) injected a record-breaking VND 55 trillion into the financial system through open market operations, utilizing a fixed interest rate of 4% per annum. This marks the largest single-day injection ever conducted by the central bank via this channel.

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.