On October 28th, Vietjet Aviation Joint Stock Company’s (VJC) shares surged 6.96% to a record high of 187,500 VND per share, marking the highest level in its history. Prior to the closing bell, VJC shares had even hit their daily limit.

Trading volume exploded, with over 3.6 million shares changing hands. This streak of consecutive gains propelled Vietjet’s market capitalization to over 110.9 trillion VND, nearly doubling since the beginning of the year.

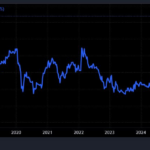

VJC shares have been a standout performer, rallying 46% over the past two months amidst a volatile broader market.

HDB shares of Ho Chi Minh City Development Commercial Joint Stock Bank, where billionaire Nguyen Thi Phuong Thao serves as Vice Chairwoman, also saw impressive gains. By the close of trading on October 28th, HDB shares had risen 3.54% to 32,200 VND per share.

Alongside the share price increase, billionaire Nguyen Thi Phuong Thao’s wealth has also accelerated rapidly.

According to Forbes’ real-time rankings, as of October 28th, Thao’s net worth stood at $4.4 billion, ranking her 930th among the world’s wealthiest individuals. This represents an increase of $95 million, or nearly 2.5 trillion VND, from the previous day.

With this ranking, Thao sits just above Brazilian billionaire siblings Wesley Batista and Joesley Batista, owners of JBS S.A., the world’s largest meat processing company.

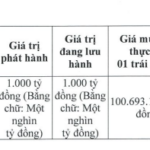

Vietjet plans to issue 118.3 million dividend shares at a 20% ratio, meaning shareholders will receive 20 additional shares for every 100 held. The issuance is expected to take place between Q4 2025 and Q1 2026, following receipt of complete documentation from the State Securities Commission.

Post-issuance, Vietjet’s chartered capital will increase from 5.916 trillion VND to 7.1 trillion VND. The additional 1.183 trillion VND will be allocated to support business expansion, enhance financial capacity, strengthen market position, improve bidding capabilities, and ensure compliance with solvency margin regulations.

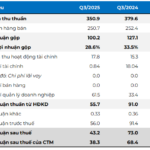

Why Did SGN’s Q3 Profits Plummet by 44%?

Revised Introduction:

Saigon Ground Services JSC (HOSE: SGN) has released its Q3 2025 financial report, revealing a significant decline in business performance.

Vietjet Settles VND 1 Trillion in Bonds One Year Post-Issuance

Vietjet has successfully repurchased the entire batch of VJCH2429002 bonds at an actual redemption price of nearly 1,007 billion VND, just one year after their issuance.