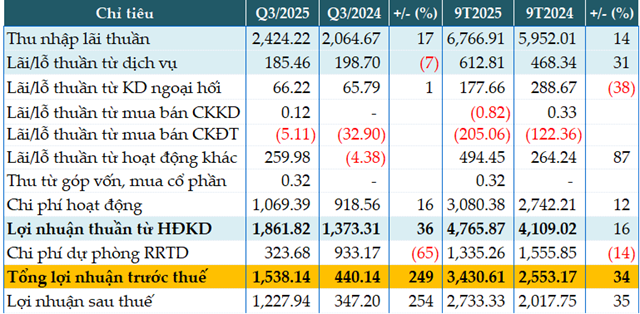

In Q3 alone, OCB‘s primary revenue stream surged by 17% year-over-year, reaching over VND 2.424 trillion in net interest income. This growth is attributed to the expansion of credit scale, effectively meeting customer loan demands.

Non-interest income continued to improve, hitting VND 507 billion, a 2.2-fold increase from the same period last year. Notably, foreign exchange (FX) sales revenue rose by 123%, while other operating income reached VND 260 billion. These results stem from the bank’s strategic restructuring of its business portfolio, diversifying revenue sources, and actively implementing debt management and resolution solutions.

Operating expenses increased by 16% to VND 1,069 billion, leading to a 36% rise in net operating profit to VND 1,861 billion.

During the quarter, OCB reduced credit risk provisioning costs by 65%, allocating only VND 324 billion. Consequently, the bank’s pre-tax profit exceeded VND 1,538 billion, a 3.5-fold increase year-over-year.

For the first nine months of the year, OCB reported a pre-tax profit of nearly VND 3,431 billion, a 34% increase from the same period last year. This achievement represents 64% of the annual pre-tax profit target of VND 5,338 billion.

|

Q3 and 9-month 2025 business results of OCB. Unit: Billion VND

Source: VietstockFinance

|

“In the first nine months of 2025, the economic recovery has positively impacted banking operations, particularly for institutions with strong digital capabilities and effective risk management. At OCB, continued investment in technology and human resources—key drivers of long-term profitability—along with a robust foundation and stable financial capacity, has sustained core business growth in Q3. This demonstrates the bank’s operational efficiency and sets the stage for sustainable development in achieving upcoming goals,” stated Mr. Phạm Hồng Hải, CEO of OCB.

As of September 30, 2025, the bank’s total assets grew by 14% year-to-date to VND 315,171 billion. Market 1 mobilization reached VND 219,998 billion, a 14% increase. Market 1 credit outstanding stood at VND 202,863 billion, up 12%. Customer loan balances rose by 14% to VND 200,054 billion. SME credit outstanding increased by 10% in Q3 compared to Q2.

By the end of Q3, digital channel transactions at OCB accounted for nearly 98%. Transactions on the OCB OMNI app increased by 91%. Simultaneously, Open API transactions with the bank rose by 63% year-over-year, with transaction value up 180%.

The bank’s focus on digitalization has consistently boosted its non-term deposit ratio (CASA). For individual customers, digital CASA grew by 25%, and online savings deposits increased by 36% compared to the same period in 2024. For corporate clients, average CASA rose by 38%. As a result, the overall CASA ratio increased from 14.9% at the end of 2024 to 16% by the end of Q3/2025, reducing funding costs.

– 18:28 28/10/2025

MSB: System Security as the Foundation for Innovation and Growth

In the digital age, data has become a cornerstone asset for organizations, with security emerging as the linchpin of customer trust. Against this backdrop, Maritime Bank (MSB) is committed to crafting a secure digital ecosystem, prioritizing information security, data protection, and a seamless digital experience as the pillars of its long-term growth strategy.

Over 5 Million Household Businesses to Halt Lump-Sum Tax Payments Starting 2026

The implementation of electronic invoices, transparent supply chains, and the elimination of lump-sum tax from January 1, 2026, presents a critical challenge for business management capabilities. This shift demands that all business households adapt and evolve to meet the new requirements.

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a stark contrast to the VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.

Novaland Reports Q3 Net Loss of VND 1.8 Trillion, Inventory Surges to VND 152 Trillion

Our business operations have achieved significant milestones, including accelerated construction across all key projects, with 720 units successfully handed over and 1,935 land titles issued in the first three quarters.