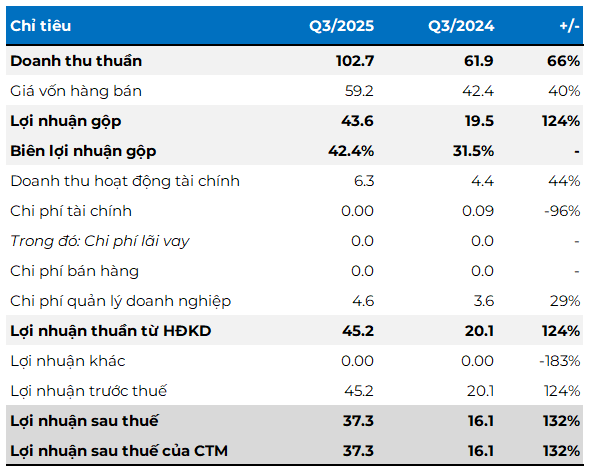

In Q3, a Dong Nai-based stone mining company reported a remarkable 66% year-over-year surge in revenue, surpassing VND 100 billion. Notably, DHA’s profit margin significantly improved from 31.5% to 42.4%. This success is primarily attributed to a substantial 112,683 m³ increase in sales volume, coupled with higher stone prices amid a construction material shortage.

Beyond core operations, the company’s financial revenue climbed 44% to VND 6.3 billion, driven by dividends from Bien Hoa Construction and Building Materials Production JSC (UPCoM: VLB), where DHA holds an 8.3% stake.

These favorable factors propelled DHA to a record-breaking Q3 net profit of over VND 37 billion, a 132% increase year-over-year, marking the most profitable quarter in the company’s history.

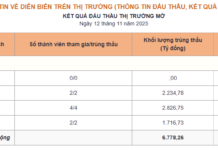

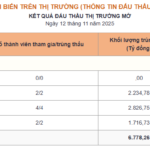

DHA’s Q3 Financial Highlights

Unit: Billion VND

Source: VietstockFinance

|

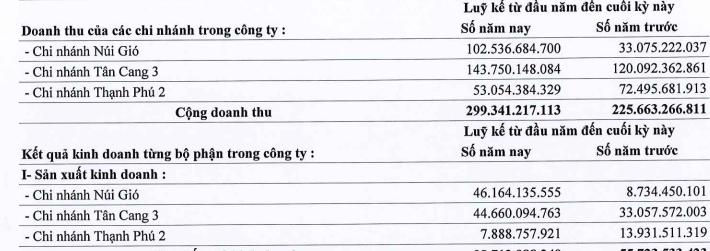

For the first nine months of 2025, DHA recorded nearly VND 300 billion in revenue and VND 94 billion in net profit, up 33% and 114% year-over-year, respectively.

With these robust results, the company achieved 98% of its revenue target and nearly doubled its pre-tax profit goal for 2025.

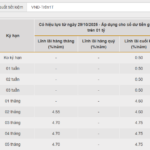

Nui Gio Mine’s Revenue Surge

Analyzing the first nine months of 2025, Nui Gio Mine stood out with a threefold revenue increase to VND 102 billion, up from VND 33 billion in the same period last year.

Tan Cang 3 Mine, DHA’s flagship operation, maintained strong growth, with revenue rising from VND 120 billion to VND 144 billion.

Conversely, Thanh Phu 2 Mine experienced a significant decline, with revenue dropping from VND 73 billion to VND 53 billion. This decrease is primarily due to dwindling reserves and escalating extraction costs.

Source: DHA’s Q3 Financial Report

|

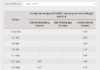

Notable Subsidiary Investment

DHA’s balance sheet reflects a robust financial position. As of Q3 2025, the company held over VND 280 billion in current assets, including VND 236 billion in cash and short-term financial investments.

In long-term assets, a notable VND 129 billion investment in a subsidiary stands out. This investment is directed toward Anh Duong Construction and Mining JSC, aimed at acquiring and developing the Tay Ka Rom 1 mine in Ninh Thuan. Expanding into this new mine will enhance DHA’s stone supply amid market shortages and ongoing public investment projects.

On the liabilities side, DHA’s debt remains modest at VND 42 billion, with no outstanding loans.

– 15:05 28/10/2025