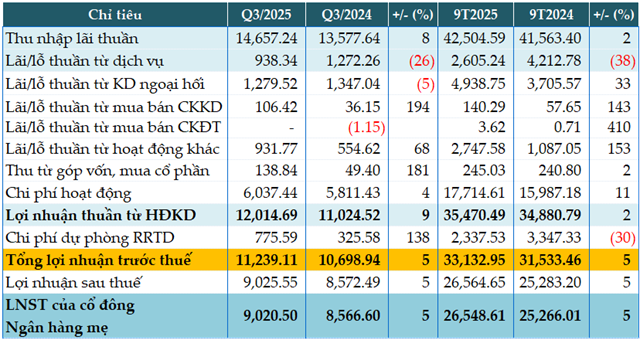

In Q3 alone, Vietcombank’s net interest income surged by 8% year-on-year, reaching over VND 14,657 billion.

Non-interest income streams showed mixed performance. Fee income declined by 26% to VND 938 billion, while foreign exchange gains dipped by 5% to VND 1,280 billion.

Meanwhile, trading securities generated a profit of VND 106 billion, nearly tripling the previous year’s figure. Other operating income soared by 68% to nearly VND 932 billion. Investment income from capital contributions and share purchases reached nearly VND 139 billion, 2.8 times higher than the same period last year.

During the quarter, the bank effectively managed operating expenses, which rose by only 4% to VND 6,037 billion. Consequently, net profit from operations increased by 9% to VND 12,015 billion.

Despite setting aside VND 776 billion for credit risk provisions in Q3, 2.3 times higher than the previous year, Vietcombank still achieved a 5% growth in pre-tax profit, reaching VND 11,239 billion.

For the first nine months of the year, Vietcombank’s pre-tax profit totaled nearly VND 33,133 billion, a 5% increase compared to the same period last year, primarily due to a 30% reduction in credit risk provisions (VND 2,337 billion).

|

Q3 and 9M 2025 Business Results of VCB. Unit: Billion VND

Source: VietstockFinance

|

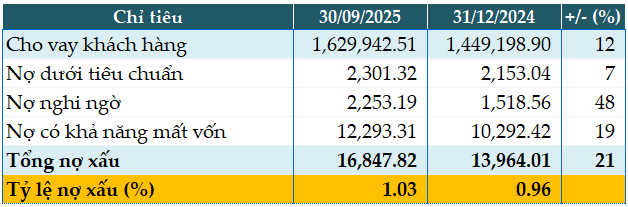

As of the end of Q3, Vietcombank’s total assets reached nearly VND 2,380 trillion, a 14% increase from the beginning of the year. Customer loans and deposits stood at nearly VND 1,630 trillion and VND 1,610 trillion, respectively, growing by 12% and 6% compared to the year’s start.

As of September 30, 2025, Vietcombank’s total non-performing loans amounted to VND 16,847 billion, a 21% increase from the beginning of the year. The NPL ratio slightly rose from 0.96% at the start of the year to 1.03%.

|

Loan Quality of VCB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 7:58 PM, October 30, 2025

FPT Long Châu Pharmacy Owner Surpasses $1.5 Billion in Revenue After 9 Months

Over the first nine months, FPT Retail recorded a cumulative revenue of VND 36,170 billion, marking a 26% year-on-year increase. Pre-tax profit surged impressively by 125%, reaching VND 804 billion.

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a remarkable turnaround from a VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.

VIB Reports 9-Month Profit of Over VND 7,040 Billion, Up 7%, with 21% Dividend Payout for 2025

Vietnam International Bank (HOSE: VIB) has announced its business results for the first nine months of 2025, reporting pre-tax profits exceeding 7.04 trillion VND, a 7% increase compared to the same period in 2024. The bank achieved impressive growth in credit and deposit mobilization, with rates of 15% and 11%, respectively. Asset quality continues to improve, with safety management maintained at optimal levels.