|

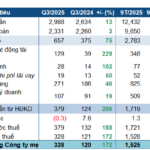

DVN’s Q3/2025 Business Targets

Source: VietstockFinance

|

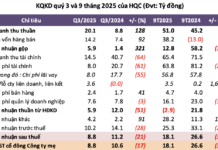

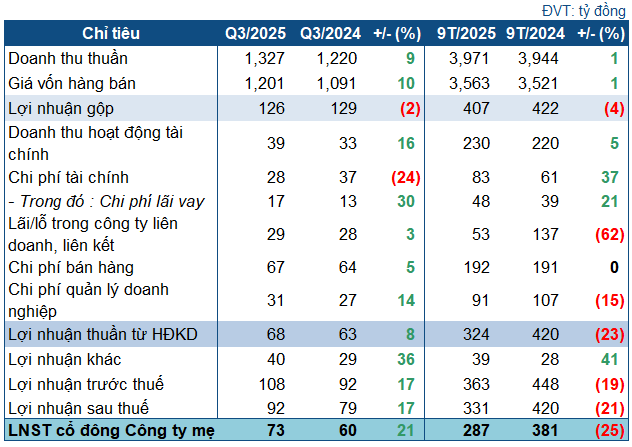

In Q3, DVN reported net revenue exceeding 1.3 trillion VND, a 9% increase year-over-year. However, the cost of goods sold rose by 10%, slightly reducing gross profit to 126 billion VND.

A highlight of the quarter was a 16% rise in financial activity revenue to 39 billion VND, while financial expenses decreased by 24% to 28 billion VND. Additionally, profits from affiliated companies contributed 29 billion VND, a modest 3% increase. Coupled with a 37% surge in other income to 40 billion VND, DVN posted a net profit of nearly 73 billion VND, up 21%.

According to DVN, the profit increase was primarily due to lower financial expenses in Q3 (attributed to reduced provisions for financial investments compared to the same period last year) and increased other income from subsidiaries.

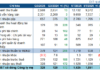

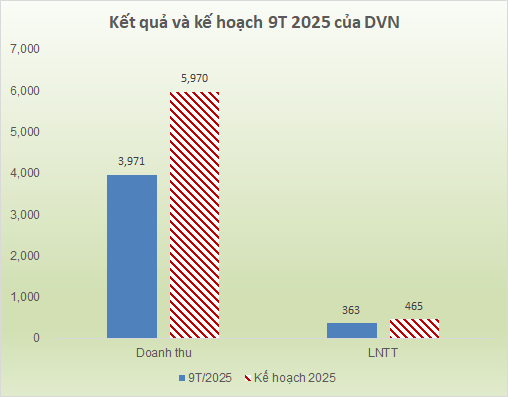

Despite the positive Q3 results, DVN‘s year-to-date performance has lagged due to high comparables from the previous year (record profits in 2024). Nine-month net revenue remained flat at over 3.97 trillion VND, with net profit declining 25% to 287 billion VND. The company has achieved nearly 67% of its revenue target and over 78% of its after-tax profit goal for the year.

Source: VietstockFinance

|

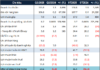

As of September 30, 2025, DVN‘s total assets reached 6.8 trillion VND, a 5% increase from the beginning of the year, with over 4.8 trillion VND in current assets, up 10%. Cash and cash equivalents stood at nearly 1.2 trillion VND, a 12% increase. Inventory rose by 14% to nearly 1.9 trillion VND.

Short-term receivables totaled over 1.7 trillion VND, a 5% increase, primarily from customer receivables.

On the liabilities side, total debt increased by nearly 10% to over 3.2 trillion VND, almost entirely short-term. Short-term loans rose by 20% to nearly 1.5 trillion VND, mostly from banks.

– 10:29 30/10/2025

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a remarkable turnaround from a VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.

DIG Records Q3 Net Profit of Over 210 Billion VND from Lam Ha Center Point Transfer

Fueled by a remarkable third-quarter performance, Construction Development Investment Corporation (HOSE: DIG) witnessed a staggering 14-fold increase in consolidated net profit for the first nine months of the year compared to the same period last year.

Q3/2025 Financial Reports Deadline: Vincom Retail, Nam Long, DIG, Hoa Phat, and More Leading Enterprises Announce Updates by October 29th

In Q3/2025, Gelex’s pre-tax profit soared to VND 1,253 billion, marking a remarkable 149.7% increase compared to the same period last year. Meanwhile, PNJ’s after-tax profit for Q3/2025 reached VND 496 billion, a staggering 129.7% growth, equating to a daily profit of over VND 4.06 billion for the company.