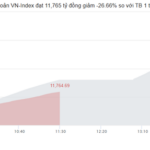

The VN-Index staged an impressive reversal during the afternoon session on October 28, closing near 1,680.5 points (+1.69%). This marked the index’s highest level of the day. From its intraday low, the benchmark index rebounded by nearly 60 points.

Investor sentiment was sharply divided. Some regretted selling in the morning, only to witness stock prices surge just hours later. Others felt relieved as their portfolios shifted from losses to gains, with some stocks even exceeding expectations.

The reversal session highlights the growing unpredictability of short-term market fluctuations.

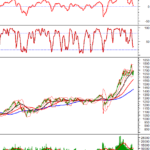

Commenting on market dynamics, Mr. Nguyễn Trọng Đình Tâm, Deputy Director of the Analysis Division at ASEAN Securities Corporation (ASEANSC), attributed the VN-Index’s “withdrawal” to a typical technical reaction as the index tested the strong support level of 1,620 +/-, equivalent to the lower boundary of the September 2025 accumulation channel.

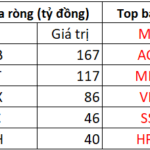

Additionally, foreign investors’ net buying and the positive response of key stocks in Banking, Securities, and Real Estate sectors as they returned to critical support levels contributed to the market’s optimistic outlook.

Alongside the recovery efforts of leading sectors, capital is rotating across various industries, creating short-term profit opportunities for investors. Notable sectors include Technology, Telecommunications, and Logistics.

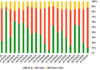

According to ASEANSC experts, a Follow-Through Day (FTD) typically features a strong price increase with above-average trading volume, usually occurring between the 4th and 7th day after the first recovery session following a recent decline. While the October 28 session met the price increase and timing criteria (since the first recovery on October 21), it fell short in terms of trading volume and market trend.

Specifically, trading volume remained low, below the 20-session average, and the preceding market trend was not a clear downtrend but rather a pullback testing the September 2025 accumulation base.

“It’s important to understand that a standard FTD signals only a short-term positive or the potential start of a new uptrend. However, investors should avoid buying impulsively during such sessions, as it often leads to chasing prices,” Mr. Tâm advised.

Instead, investors should closely monitor individual stock charts, wait for clearer entry points, and gradually allocate capital rather than assuming FTDs guarantee optimal buying opportunities.

Mid-Term Beneficiary Sectors

On a macro level, the market is gaining support from recent positive developments. The Federal Reserve’s rate-cutting trend and the joint announcement of the US-Vietnam Trade Agreement could bolster market sentiment in the short term.

However, the Fed’s 0.75% rate cut this year was anticipated after its September meeting. While the US has pledged to reduce tariffs on many Vietnamese exports to 0%, most items still face a 20% tariff, leaving this as an uncertain factor.

ASEANSC experts remain optimistic about Vietnam’s stock market prospects for late 2025 and early 2026, driven by (1) continued accommodative fiscal and monetary policies, and (2) attractive market valuations compared to historical liquidity cycles.

Mr. Tâm added, “Short-term volatility presents opportunities for portfolio rebalancing and optimal position entry. Post-turbulence, the VN-Index is expected to resume its uptrend, targeting 1,800 points by year-end 2025.”

Compared to the previous rally, capital rotation will diversify across sectors in late 2025 and early 2026, fueled by (1) robust earnings growth and (2) sustained supportive narratives (e.g., IPO wave).

The expert highlights favorable prospects for Banking, Real Estate, Securities, Technology, Retail, and Public Investment sectors.

In Banking, accelerated credit growth (projected at 18-19% YTD) coupled with efforts to expand non-interest income, reduce cost-to-income ratios, and lower NPLs post-Resolution 42 will drive earnings growth. Capital raising activities will also support bank stock prices.

Real Estate and Securities sectors benefit from the sustained low-interest-rate environment. Real Estate sees continued legal unblocking across projects, with prices remaining high across segments, boosted by the Thu Thiem land auction plan. Securities firms gain momentum as Vietnam’s upgrade to FTSE Russell’s Frontier Market status fuels a new industry growth cycle.

While Technology stocks have primarily consolidated since early 2025, their mid-term growth prospects remain strong, driven by the megatrend of digital transformation and AI adoption.

Technical Analysis Afternoon Session 29/10: Stochastic Oscillator Signals Buy Opportunity

The VN-Index has continued its upward trajectory, decisively breaking above the 50-day SMA, while the Stochastic Oscillator reinforces the bullish momentum with a fresh buy signal. Simultaneously, the HNX-Index is gaining ground, poised to test the middle band of the Bollinger Bands, signaling potential further upside.

Market Pulse 29/10: Foreign Investors Resume Net Selling, VN-Index Narrows Gains

At the close of trading, the VN-Index climbed 5.33 points (+0.32%) to reach 1,685.83, while the HNX-Index rose 1.26 points (+0.47%) to 268.04. Market breadth favored the bulls, with 490 advancing stocks outpacing 211 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 7 retreated, and 1 remained unchanged.