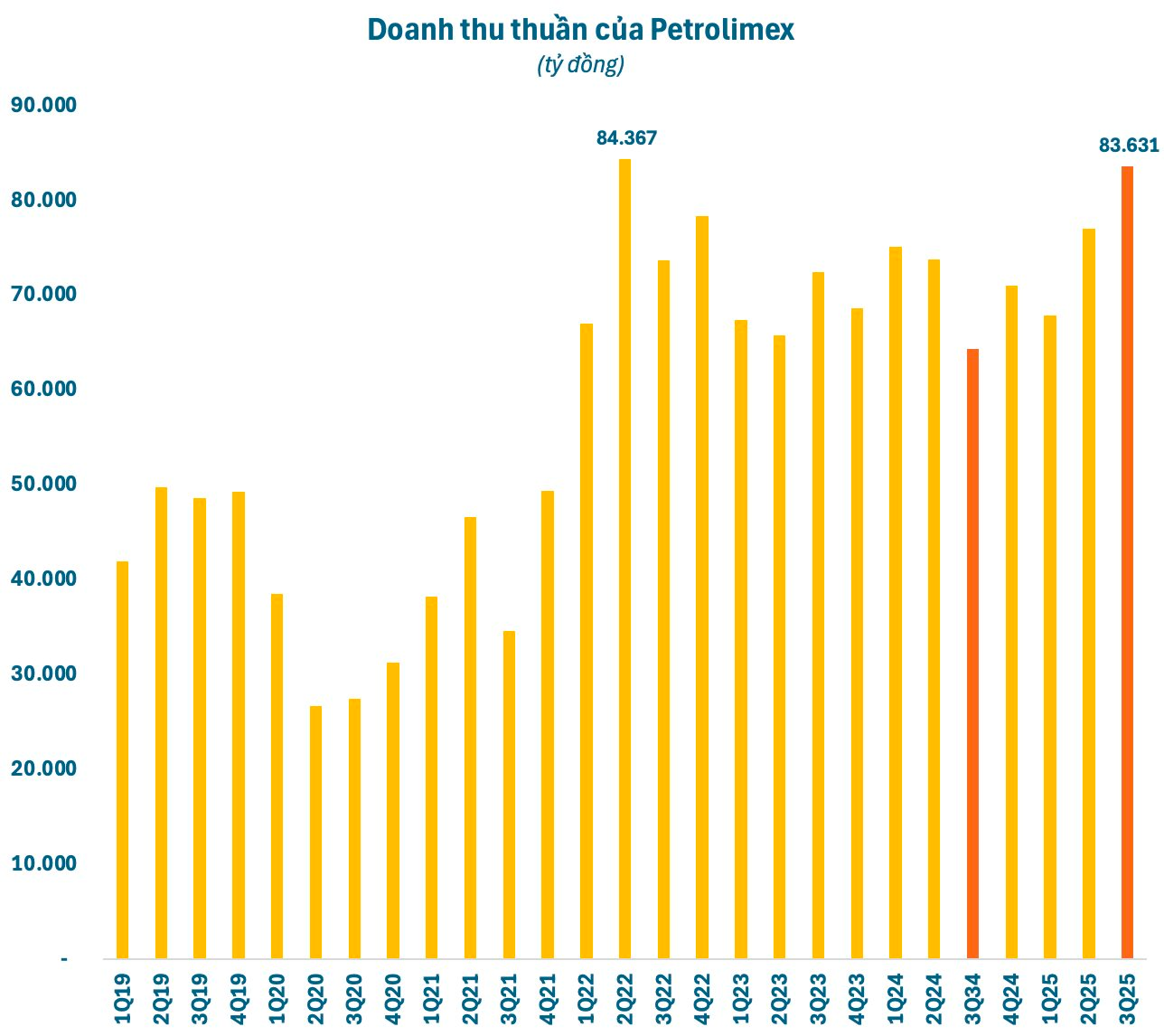

According to the Q3 2025 financial report, Vietnam National Petroleum Group (stock code: PLX) recorded a net revenue of VND 83,631 billion, a 30% increase compared to the same period in 2024. This marks the second-highest revenue in the company’s history, just slightly below the record set in Q1 2022.

On average, Petrolimex earned over VND 900 billion per day in Q3, the highest daily revenue on the stock market. This figure is more than double that of leading revenue-generating companies such as Vingroup, The Gioi Di Dong, Hoa Phat, Vietnam Airlines, PV Oil, and BSR.

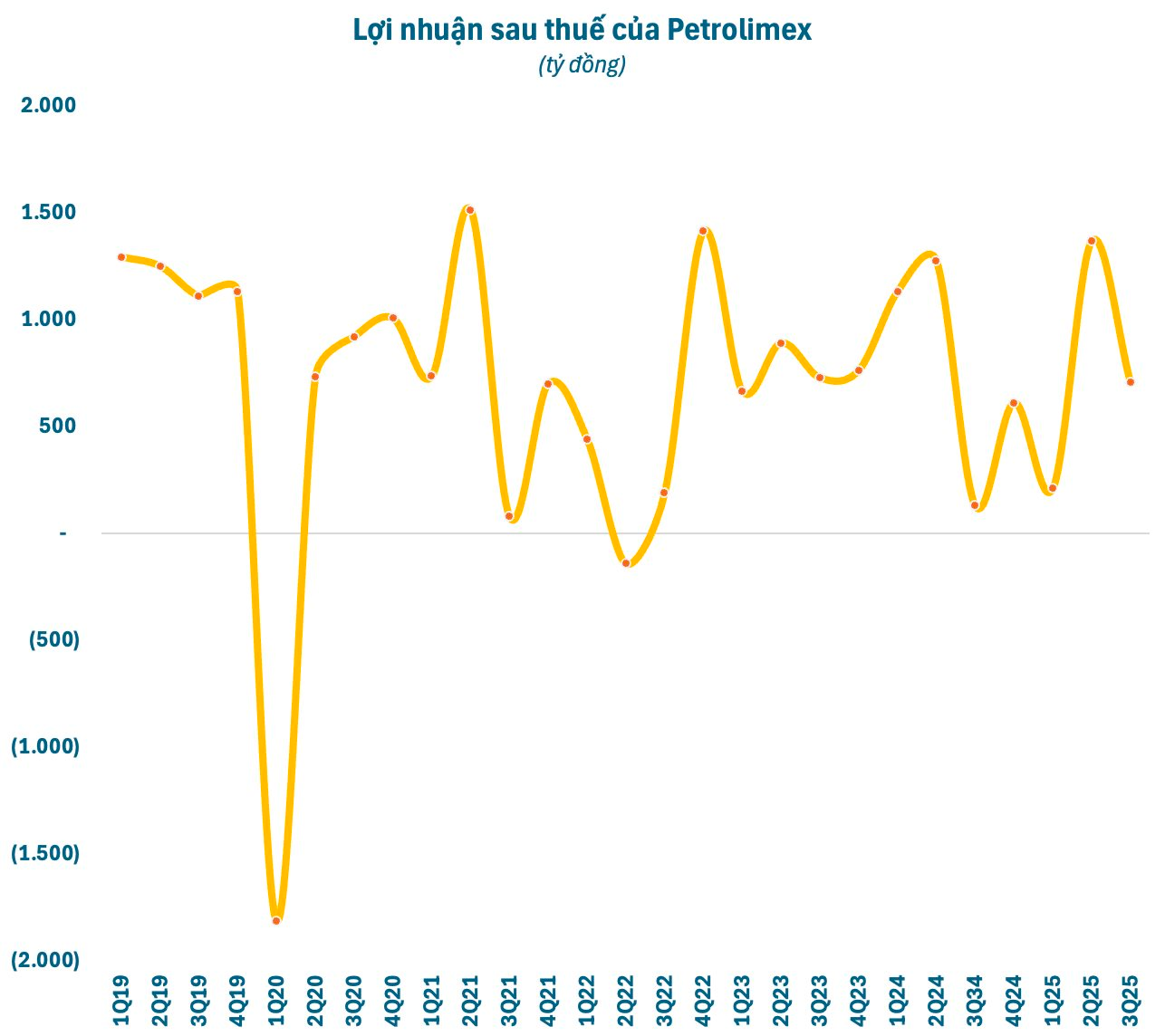

After deducting costs, Petrolimex’s after-tax profit reached VND 706 billion, a 440% increase year-over-year but significantly lower than the previous quarter. The parent company’s net profit attributable to shareholders was nearly VND 611 billion, over nine times higher than the same period last year.

In the first nine months of 2025, Petrolimex achieved a net revenue of over VND 228,000 billion, a 7% increase year-over-year and 66% of the annual target. However, pre-tax profit decreased by 12% to VND 2,812 billion, meeting 88% of the year’s goal. After-tax profit was VND 2,341 billion, an 8% decline compared to the same period last year.

As of Q3 2025, Petrolimex’s total assets stood at VND 91,575 billion, an increase of over VND 10,000 billion since the beginning of the year. Inventory reached VND 16,600 billion, nearly VND 1,000 billion higher than at the start of the year. Cash and cash equivalents totaled nearly VND 32,200 billion, up by over VND 2,000 billion.

On the stock market, PLX shares closed at VND 34,550 per share on October 30, a nearly 5% decrease year-to-date. The market capitalization was approximately VND 44,000 billion.

In other developments, Petrolimex recently notified the State Securities Commission, the Stock Exchange, and Petrolimex Hanoi Trading and Transportation JSC (stock code: PJC) of a related-party transaction. Petrolimex plans to acquire over 3.7 million PJC shares (51.06% stake) from Petrolimex Petroleum Service Corporation.

The transaction aims to transfer ownership rights as part of a corporate merger. It is scheduled to take place from October 27, 2025, to November 26, 2025, through an off-exchange transfer at VSDC.

BIDV’s Total Assets Surpass 3 Quadrillion VND, Q3 Pre-Tax Profit Surges 17%

BIDV’s consolidated Q3/2025 financial report reveals a pre-tax profit of nearly VND 7,594 billion, marking a 17% year-on-year increase. As of the end of Q3, the bank’s total assets surpassed VND 3,000 trillion.

FPT Retail Reports Q3 Net Profit of Nearly VND 220 Billion, Up 55% YoY

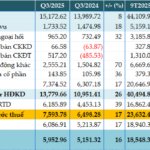

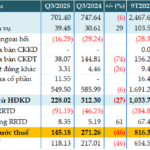

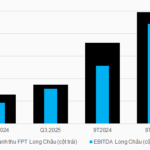

FPT Digital Retail Joint Stock Company (FPT Retail, HOSE: FRT) has released its consolidated Q3/2025 financial report, revealing a net revenue of VND 13.1 trillion and a net profit of VND 219 billion. These figures represent a remarkable 26% and 55% year-on-year growth, respectively, compared to the same period last year.

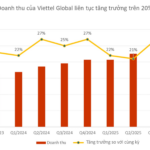

Viettel Global Reports Record-Breaking Q3 2025 Profits, Revenue Surges Over 20% for 8 Consecutive Quarters

Viettel Global (stock code: VGI) has released its consolidated financial report for Q3/2025, showcasing remarkable growth in both revenue and profit, marking another quarter of exceptional business performance.