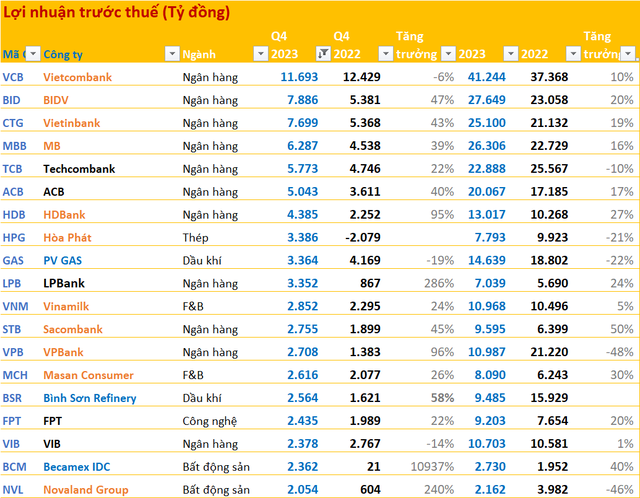

Source: VietstockFinance

|

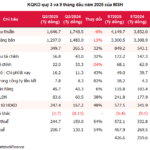

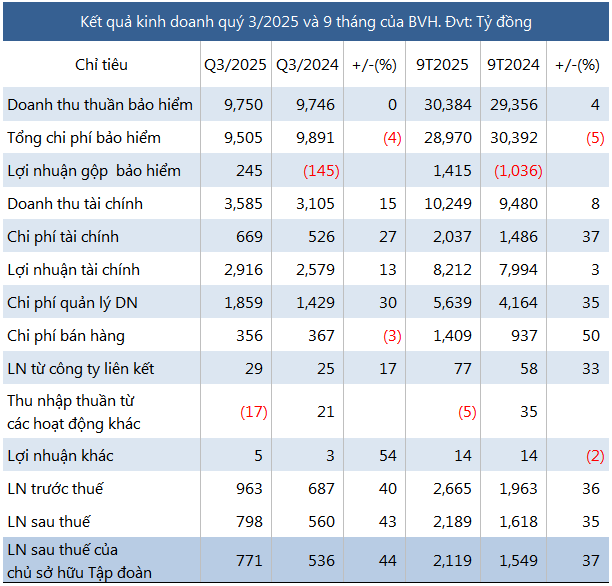

In Q3 2025, BVH’s insurance business continued its upward trajectory, posting a gross profit of VND 245 billion, a significant turnaround from the VND 145 billion loss recorded in the same period last year. This improvement was primarily driven by reduced compensation expenses, stable insurance premium revenue, and a substantial increase in reinsurance commission income.

Financial activities also shone brightly, generating a gross profit of VND 2,916 billion, a 13% year-on-year increase, and significantly contributing to the group’s overall profitability.

| BVH’s Q3 2025 net profit reaches an all-time high |

For the first nine months of the year, BVH achieved a net profit of VND 2,119 billion, a 37% increase compared to the same period last year. Insurance business gross profit reached VND 1,415 billion, reversing from a VND 1,036 billion loss in the previous year, while financial activities saw a modest 3% growth, contributing VND 8,212 billion in gross profit.

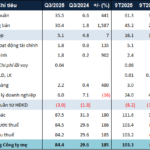

BVH has set a 2025 post-tax profit target of VND 1,275 billion for the parent company, an 8% increase from 2024. After nine months, the group has already achieved over 70% of its annual plan.

As of Q3 2025, BVH’s total assets reached nearly VND 273 trillion, a 9% increase since the beginning of the year. Bank deposits accounted for nearly half of total assets, with a balance of VND 133 trillion, up 6%.

In its investment portfolio, BVH holds over VND 32 trillion in corporate bonds (up 18%) and more than VND 71 trillion in government bonds (up 3%).

Liabilities primarily consist of long-term insurance reserves, totaling over VND 197 trillion, a 6% increase year-to-date. Additionally, short-term borrowings reached over VND 4.3 trillion, up 48%, to support working capital, with interest rates ranging from 2.5% to 7.6% per annum.

– 3:00 PM, October 31, 2025

Red River Garment Smashes Quarterly Profit Record, Invests Nearly VND 1.6 Trillion in Bonds

Record-breaking Q3 profits for Hong Ha Garment Joint Stock Company (HOSE: MSH) as the company continues to maintain a substantial financial investment portfolio, with nearly one-third of its assets in bonds, while simultaneously ramping up production and overseas investments.

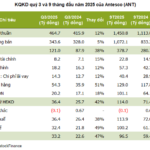

Western Region’s Fruit & Vegetable Enterprises Hit Record Profits, Expanding 1,500 Workforce Ahead of Market Upgrade

Ahead of its upcoming listing on HOSE, An Giang Fruit and Vegetable Processing Joint Stock Company (Antesco, UPCoM: ANT), a leading player in the Mekong Delta’s processed fruit and vegetable sector, reported a staggering 63% surge in nine-month profits, surpassing its entire 2024 earnings. This remarkable growth is complemented by a significant workforce expansion, now exceeding 1,500 employees.

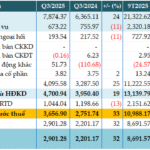

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.