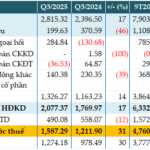

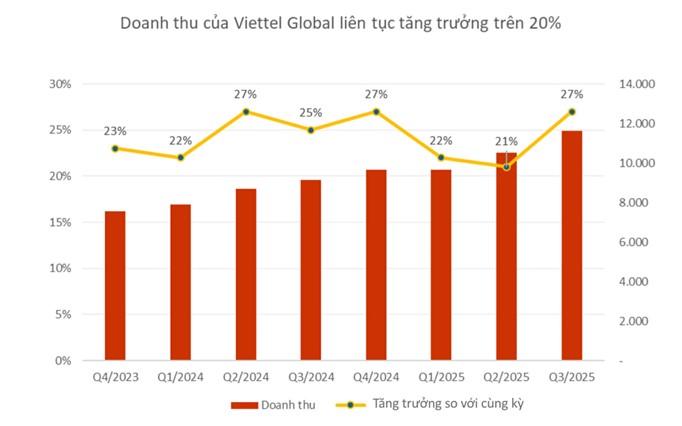

In Q3, consolidated sales revenue and service provision reached VND 11,622 billion, a 27% increase compared to Q3/2024. This marks the 8th consecutive quarter the company has maintained a growth rate exceeding 20%. After-tax profit hit VND 4,160 billion, a 569% surge year-over-year, setting a new quarterly profit record and marking the best growth for Viettel Global.

|

Notably, all markets where Viettel operates saw significant revenue growth. Highlights include Viettel Tanzania (+46%), Viettel Haiti (+32%), and Viettel Myanmar (+31%). Even in markets where Viettel holds over 70% market share, such as Burundi and Lumitel, growth reached up to 40%.

In saturated markets like Cambodia, Timor-Leste, and Laos, Viettel maintained strong growth at 16%, 14%, and 12%, respectively. Viettel Global retained its leading position in telecommunications across most markets and expanded its growth into digital services. Digital wallet companies saw impressive growth, including U-money in Laos (+64%), Halopesa in Tanzania (+45%), e-Money in Cambodia (+44%), Mosan in Timor-Leste (+38%), e-Mola in Mozambique (+36%), and Lumicash in Burundi (+32%).

For the first nine months, VGI’s net revenue reached VND 31,881 billion, 24% higher than the same period last year. After-tax profit stood at VND 7,427 billion, more than double the figure from the first nine months of 2024.

Beyond revenue and profit growth, Viettel Global’s asset scale also improved significantly. As of September 30, 2025, total consolidated assets reached VND 73,877 billion, an increase of VND 10,438 billion (16%) compared to the beginning of the year.

In October, Viettel Laos (Unitel) launched Unitel Logistics, positioning Unitel as a multi-service technology group in Laos. This initiative symbolizes modern, stable, and effective cooperation between the Ministries of Defense of Vietnam and Laos, setting a model for economic and defense collaboration in the digital era. This strategic move underscores Viettel Global’s efforts to expand beyond traditional telecommunications.

|

Q3/2025 also marked Viettel Timor becoming the first operator to officially launch 5G services in Timor-Leste. The 5G inauguration, combined with the Telemor Expo, was attended by Prime Minister Kay Rala Xanana Gusmão and other national leaders, who experienced the service firsthand.

|

With robust business results and strategic expansion initiatives, Viettel Global continues to solidify its position as Vietnam’s leading international telecommunications investor. The company maintains steady growth and strengthens its financial foundation for long-term development.

Services

– 15:30 30/10/2025

MSB’s Q3 Pre-Tax Profit Surges 31% on Strong Forex Gains

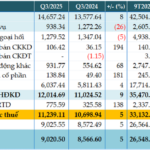

The Q3/2025 consolidated financial report reveals that Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) achieved pre-tax profits exceeding VND 1.587 trillion, marking a 31% year-on-year increase. This impressive growth is attributed to the bank’s robust core income expansion and successful foreign exchange operations.

FPT Long Châu Pharmacy Owner Surpasses $1.5 Billion in Revenue After 9 Months

Over the first nine months, FPT Retail recorded a cumulative revenue of VND 36,170 billion, marking a 26% year-on-year increase. Pre-tax profit surged impressively by 125%, reaching VND 804 billion.

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

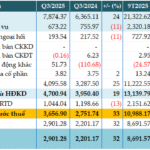

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.

VIB Reports 9-Month Profit of Over VND 7,040 Billion, Up 7%, with 21% Dividend Payout for 2025

Vietnam International Bank (HOSE: VIB) has announced its business results for the first nine months of 2025, reporting pre-tax profits exceeding 7.04 trillion VND, a 7% increase compared to the same period in 2024. The bank achieved impressive growth in credit and deposit mobilization, with rates of 15% and 11%, respectively. Asset quality continues to improve, with safety management maintained at optimal levels.