Closing the session on October 29, the VN-Index ended at 1,685.83 points, up 5 points (+0.32%).

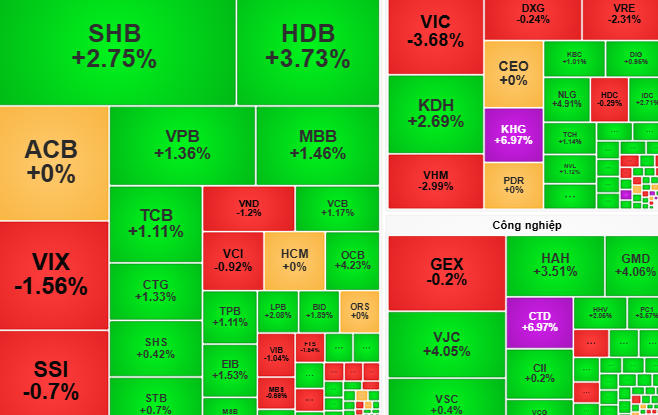

On October 29, the VN-Index swiftly regained a 5-point recovery at the opening. However, the trio of Vingroup’s large-cap stocks (VIC, VHM, VRE) faced price declines, putting significant pressure on the market.

Conversely, a widespread green trend emerged in banking stocks (VPB, HDB, LPB) and construction sector stocks (CTD, DPG), fueled by positive capital rotation.

In the afternoon session, the VN-Index continued to be supported by strong demand in the banking sector and a surprising surge in the livestock and seafood industry. Stocks like HAG hit the ceiling (+6.9%), DBC (+3.68%), and VHC (+3.74%), propelling the VN-Index to surpass the 1,690-point mark. However, the final 15 minutes of the session saw intense profit-taking pressure from Vingroup stocks, narrowing the market’s gains.

At the close, the VN-Index settled at 1,685.83 points, up 5 points (+0.32%).

According to Rong Viet Securities (VDSC), the reduced liquidity in the October 29 session is a positive sign, as supply pressures remain minimal. “This presents an opportunity for capital to support the VN-Index in retesting the 1,700-1,730 point range,” VDSC stated.

Meanwhile, VCBS Securities noted that the tug-of-war dynamics in the October 29 session are typical following a technical recovery. Market capital showed clear polarization, focusing on stocks with positive Q3/2025 earnings or unique narratives.

“Investors can leverage pullbacks to acquire stocks poised for upward breakouts, particularly in retail, public investment, and banking sectors,” advised VCBS Securities.

Market Pulse October 31: Financial and Real Estate Sectors Struggle, VN-Index Retreats to 1,640 Points

At the close of trading, the VN-Index dropped 29.92 points (-1.79%), settling at 1,639.65 points, while the HNX-Index fell 1.11 points (-0.42%), closing at 265.85 points. Market breadth tilted toward decliners, with 414 stocks falling and 330 advancing. Similarly, the VN30 basket saw red dominate, as 21 constituents declined, 8 rose, and 1 remained unchanged.