Illustrative Image

After a six-month hiatus due to trade tensions, China has resumed exports of heavy rare earth magnets to India—a move seen as a lifeline for manufacturers in the electric vehicle, renewable energy, and consumer electronics sectors within the South Asian nation.

According to The Economic Times, Beijing has granted import licenses to four Indian companies—Hitachi, Continental, Jay-Ushin, and DE Diamonds—after they completed local government approval procedures. However, the shipments come with strict conditions: no re-export to the U.S. and no use for military purposes.

This is viewed as a conditional easing of restrictions by China, which is under significant trade pressure from Washington. Beijing controls 90% of global rare earth production, holding near-monopoly power in the supply chain for critical materials used in electric vehicle motors, renewable energy equipment, aerospace, and defense.

In April this year, China tightened export controls on medium and heavy rare earths, citing national security concerns. The new regulations require exporters to obtain permits from China’s Ministry of Commerce, while buyers must pledge not to use the materials for “weapon storage, production, or processing.”

To secure approval, Indian companies submitted End-User Certificates (EUCs), confirming domestic use only. However, industry sources indicate that over 50 permit applications remain pending. One executive noted that the resumption of direct flights between Kolkata and Guangzhou this week will significantly improve logistics and shipping efficiency.

Indian Ministry of External Affairs spokesperson Randhir Jaiswal confirmed that some companies have begun receiving import licenses. However, he cautioned that ongoing U.S.-China trade negotiations could directly impact India’s raw material supply chain and should be closely monitored.

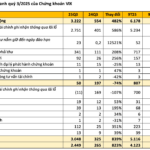

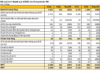

Data from India’s Ministry of Commerce reveals that the country imported 870 tons of rare earth magnets, valued at 306 crore rupees (approximately $36.7 million), in the 2025 fiscal year. With surging demand from electric vehicles and green energy sectors, India is poised as one of Asia’s largest consumers of rare earth components.

Notably, the export resumption comes just days after U.S. President Donald Trump and Chinese President Xi Jinping reached a one-year interim agreement on the supply of critical rare earth materials. Analysts suggest this may have prompted Beijing to process pending orders, including those from Indian firms.

While the restored supply eases pressure on Indian manufacturers, experts warn that the global rare earth supply chain remains highly vulnerable to geopolitical factors, with disruption risks still elevated.

Source: ET

China’s $143 Billion Push to Dominate a Critical Global Sector: Massive Investments Span Europe to Asia, Yet Only 25% of Projects Completed

Chinese electric vehicle and battery conglomerates have invested a staggering $143 billion into overseas projects.

Critical Metal Hits Record High, Global Mining Sector Faces Severe Supply Shortage Crisis

Supply shortages have propelled this metal’s price beyond its previous record high of $11,104 per ton.